- AU QuickBooks Community

- :

- QuickBooks Q & A

- :

- GST and BAS

- :

- Income received March 2020, Refunded income June 2020. How do I make GST amendments to correct the BAS statement for March period?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Income received March 2020, Refunded income June 2020. How do I make GST amendments to correct the BAS statement for March period?

Labels:

3 Comments 3

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Income received March 2020, Refunded income June 2020. How do I make GST amendments to correct the BAS statement for March period?

Hi eo2,

Typically when making changes to a prior BAS period the best way forward would be a Journal Entry. This would not change that account's balance, but would allow the changes to be picked up by the GST centre when you come to prepare your BAS, helping achieve the figures you are looking for.

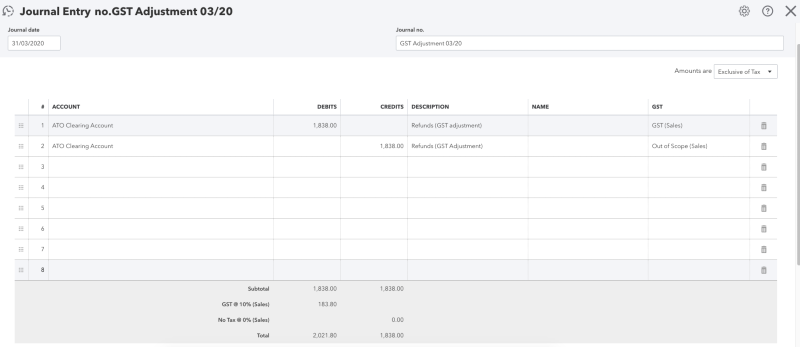

You can see the steps to complete this below:

- Select the + New button and select Journal entry. Enter a date that falls in the BAS period you are preparing.

- On Line 1, enter the account you'll be using for an adjustment (if you have a clearing or adjustment account already set up, you can use this, or create a new one. Speak with your accountant if you are unsure on the account type you should use). Enter the amount you need to make the adjustment by, then select the tax code you need to adjust for. Enter a description for the journal.

- On Line 2, enter the same account used for Line 1. Enter the same amount to balance the journal, and enter the tax code Out of Scope. Enter a description, then select Save.

This journal creates an 'amendment' that will then reflect in the totals of the BAS you are marking as lodged. However before saving, I would encourage you to reach out to your accountant or bookkeeper to ensure this work around supports your books. After completing the journal you can look through GST Exemption Report to find your newly created amendment showing, which can be found with these steps here.

While the journal entry method provided will 'amend' your totals and achieve the goal you are trying to attain, we are unable to advise what is best for your books as we are not accountants.

Thanks,

-Steven

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Income received March 2020, Refunded income June 2020. How do I make GST amendments to correct the BAS statement for March period?

Is this correct? The bottom is calculating the GST on the GST amount or do I need to put the actual amount refunded that results in the GST amount being $1838. see below

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Income received March 2020, Refunded income June 2020. How do I make GST amendments to correct the BAS statement for March period?

Based on the instructions above this is the correct journal as you are balancing out the GST amounts between the bank account and the BAS/GST Liabilities Account. This journal creates an 'amendment' that will then reflect in the totals of the BAS you are marking as lodged. When saved you can run an amendment report which can be found by:

- Select the GST tab

- In the top right, select Run Reports, then select GST Amendments

- This will show you of all the changes as of the present date for past BAS lodgements you have changed.

Once again while the journal entry method provided will 'amend' your totals and achieve the goal you are trying to attain, it would be best to reach out to an accountant or bookkeeper to confirm this is the correct accounting method for your business.

Related Q&A

Featured

Get ready for the end of the Australian financial year on June 30 by

lettin...