I can clear up which tax code to use, Membery Contracting.

For a non-GST registered company, use the Out of Scope tax code for your invoices. This way, sales tax is not calculated on the transactions.

If you have set up the tax, let’s change the Default tax rate section to Out of Scope. This way, you will no longer have to enter the mentioned tax code on the entry. Here’s how:

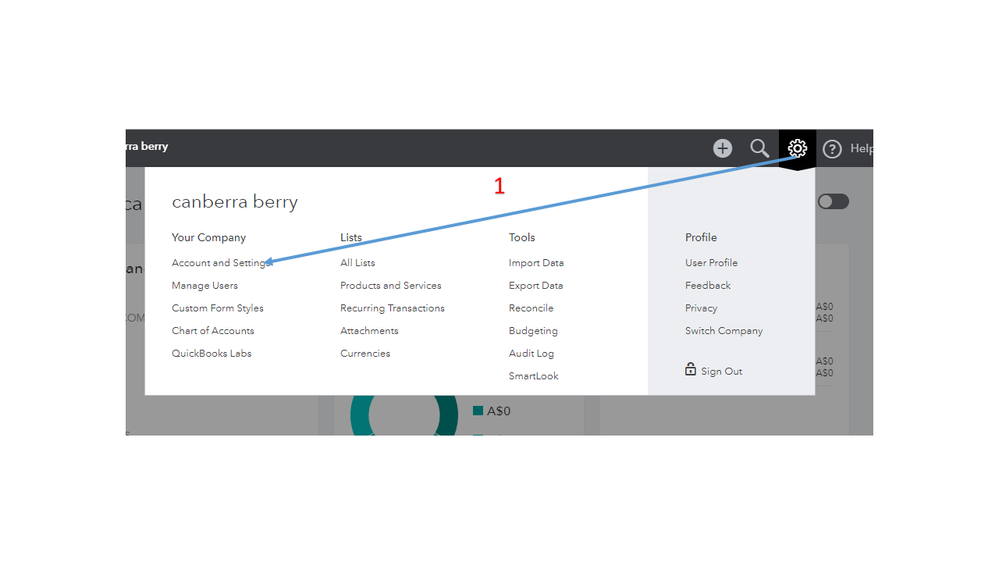

- Go to the Gear icon at the top, under your Company, select Account and Settings.

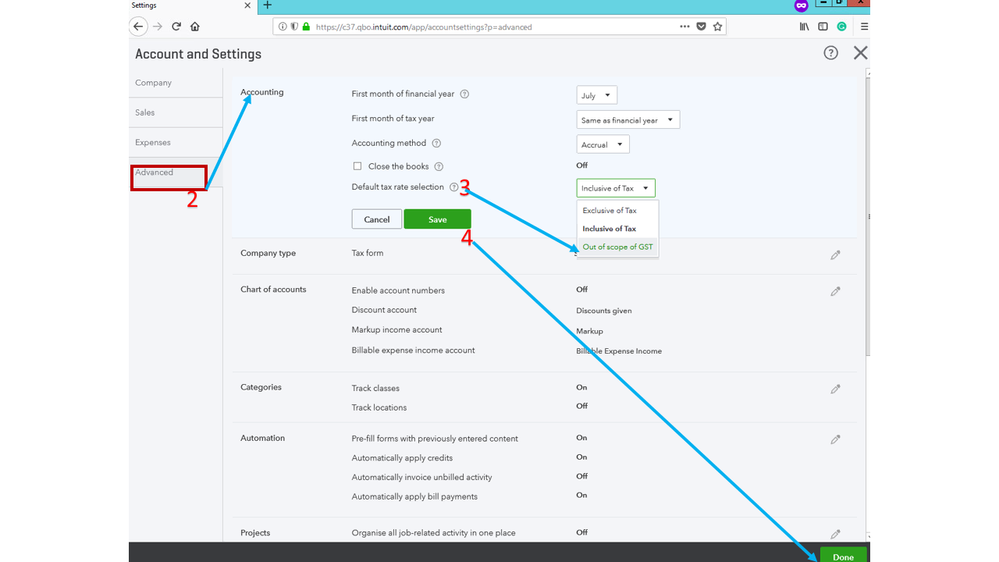

- On the Advanced menu on the left panel, hit the Pencil icon for Accountanting to see the tax rate section.

- In the Default tax rate selection section, click the drop-down to select Out of Scope.

- Choose Save and Done.

For some tips and tricks when using GST in QuickBooks Online, click this link for more information: QuickBooks Resource Centre.

Post a comment below if you any clarifications or questions about QBO. I’m here anytime to answer you. Have a good one.