Set up chart of accounts using the QuickBooks Online template

by Intuit•135• Updated 4 days ago

Your chart of accounts is a complete list of your company's accounts and balances. You can set up your chart of accounts just the way you like it using our Excel template. When you're done, save the file and import it back into QuickBooks Online so you can use and share it with any client.

Before you start

- If you're an accountant, you'll be able to automate the generation of your chart of accounts using our new templates capability.

- The best time to set up your chart of accounts is before you've connected a bank account.

- To see and track GST rates in your chart of accounts, make sure you have GST set up.

This article will run through the following steps and topics:

Step 1: Downloading our Excel template

Step 2: Exploring the template

Step 3: Customising the chart of accounts

Step 4: Setting the account hierarchy

Troubleshooting and resolving import errors

Sample accounts for your new chart of accounts

1. Download the QuickBooks Online template

First, download our Excel template. You can also download this from within the chart of accounts import section in QuickBooks.

- Go to Bookkeeping and select Chart of accounts.

- Using the dropdown arrow next to New, select Import.

- Select Download a sample file.

2. Explore the template

Our template is designed to help reduce errors, improve accuracy, and save you time setting up your chart of accounts. We recommend keeping the current format to make sure your data can be read and backed up into QuickBooks correctly.

Don't worry, we've added tooltips and notes to help you find your way around the template. The dropdown menus offer a range of options and the options available under Detail type depend on the Account type you choose.

3. Customise the account

Next, it's time to customise your chart of accounts! Here are some tips to keep in mind during set-up.

Do:

- Add new accounts

- Rename the template

- Keep the file type as .xlsx or .csv

Don't:

- Change the template's format or file settings

- Change the headers in row 1

- Forget to fill in the required columns marked in green

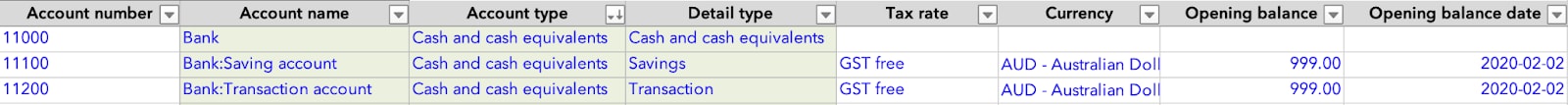

4. Setting the account hierarchy

Finally, keep your accounts in order by arranging them into header and sub accounts. To do this:

- Name the new account — this will be your header.

- In the row below, copy the header name and add a colon (:) at the end.

- In the same row, add the sub account name after the colon.

- Use the same account type for both accounts.

Ready to import your chart of accounts? Take me there.

Troubleshooting and resolving import errors

Import errors are marked in red at step 3 of the import process. Check the column header and refer to our list of possible errors and how to fix them. Try importing again once you’ve found and fixed the errors.

| Error | How to fix |

|---|---|

| Account number | Use a unique number for this account. |

| Account name | Use a unique name for this account. |

| Account type | Choose an option from the preset list to ensure this account is set up correctly. |

| Detail type | Choose an option from the preset list to ensure this account is set up correctly. |

| Tax rate | Choose an option from the preset list to ensure this account is set up correctly. |

| Currency | Choose an option from the preset list to ensure this account is set up correctly. |

| Opening balance | Use a number value for this field, or leave blank if no balance is needed. |

| Date | We don’t recognise that date format. Double-check the details and try again. |

Sample accounts for your new chart of accounts

We’ve added our most commonly used accounts to get you started.

| Account name | Account type | Detail type |

|---|---|---|

| Accounting and bookkeeping | Expenses | Legal and professional fees |

| Advertising and marketing | Expenses | Advertising/Promotional |

| Bank charges and fees | Expenses | Bank charges |

| BAS Roundoff Gain or Loss | Other Expense | BAS roundoff gain or loss |

| Billable Expense Income | Income | Service/Fee income |

| Contractor Expenses (non salary) | Expenses | External services |

| FBT Liabilities | Current liabilities | BAS payable |

| Freight & Delivery - COS | Cost of Sales | Shipping, Freight and Delivery - COS |

| Fuel & oils | Expenses | Auto |

| Gas and electricity | Expenses | Utilities |

| Gifts and donations | Expenses | Charitable contributions |

| GST Liabilities Payable | Current liabilities | BAS payable |

| Insurance | Expenses | Insurance |

| Interest expense | Expenses | Interest paid |

| Interest income | Other income | Interest earned |

| Inventory | Current assets | Inventory |

| Loan | Non-current liabilities | Long term borrowings |

| Luxury Car Tax Liabilities | Current liabilities | BAS payable |

| Meals and entertainment | Expenses | Meals and entertainment |

| Motor vehicle expenses | Expenses | Auto |

| Motor vehicles at cost | Fixed assets | Vehicles |

| Office expenses | Expenses | Office/General administrative expenses |

| Office furniture and equipment at cost | Fixed assets | Other fixed assets |

| Opening balance equity | Owner's equity | Opening balance equity |

| Owners drawings | Owner's equity | Owner's equity |

| PAYG Instalment Liabilities | Current liabilities | BAS payable |

| PAYG instalments payable | Current liabilities | Current liabilities |

| PAYG Withholdings Payable | Current liabilities | Payroll liabilities |

| Payroll clearing | Current liabilities | Payroll liabilities |

| Postage & shipping | Expenses | Office/General administrative expenses |

| Printing, stationery & supplies | Expenses | Office/General administrative expenses |

| Registration and insurance | Expenses | Auto |

| Repairs and maintenance | Expenses | Repair and maintenance |

| Retained earnings | Owner's equity | Retained earnings |

| Salary and wages - staff | Expenses | Payroll Expenses |

| Services | Income | Service/Fee income |

| Shipping, Freight, and Delivery Postage & Handling | Expenses | Shipping, Freight and Delivery - COS |

| Staff amenities | Expenses | Office/General Administrative Expenses |

| Subscriptions | Expenses | Dues and Subscriptions |

| Superannuation - staff | Current liabilities | Payroll liabilities |

| Superannuation payable | Current liabilities | Payroll liabilities |

| Telephone & internet expenses | Expenses | Utilities |

| Travel expenses | Expenses | Travel |

| Uncategorised Asset | Current assets | Other current assets |

| Uncategorised Expense | Expenses | Other miscellaneous service cost |

| Uncategorised Income | Income | Service/Fee income |

| Undeposited funds | Current assets | Undeposited funds |

| WET Liabilities | Current liabilities | BAS payable |

| Workcover expenses | Expenses | Payroll Expenses |

More like this