Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi, just wondering how to add 30 days end of month to the invoice terms instead of manually changing the due date every time any help would be great thanks

Solved! Go to Solution.

Welcome to the Community, A Black Towing.

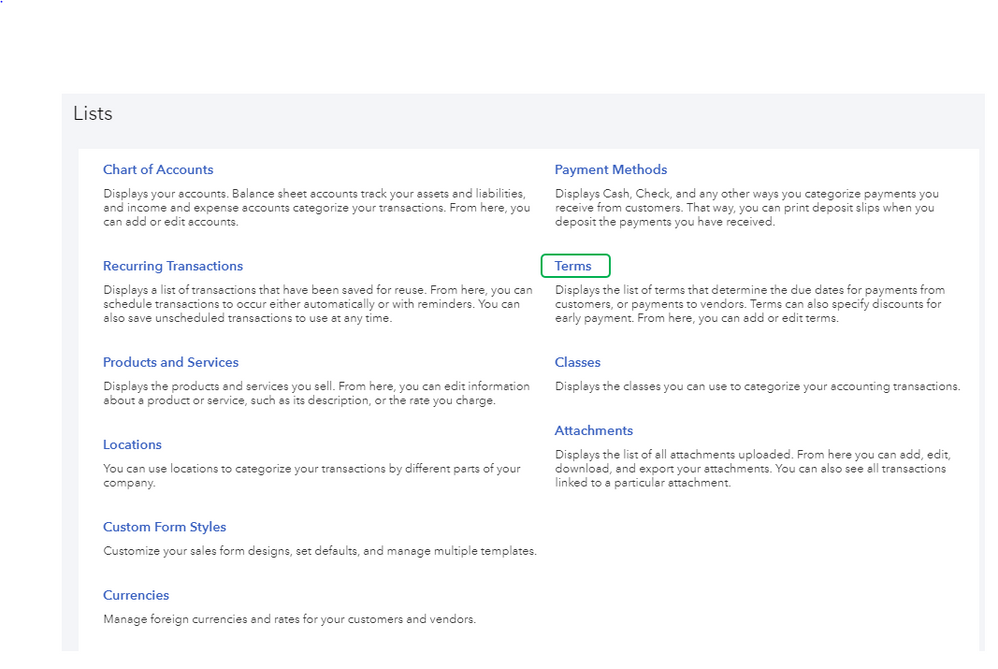

Setting up invoice terms to due every 30 days end of the month can be done by going to the Company settings. Here's how:

For additional information, consider checking out this article: How to Adjust Invoice Payment Terms in QuickBooks Online.

Please let me know if you have any other issues or concerns. I want to make sure everything is taken care of for you. Have a great weekend!

Welcome to the Community, A Black Towing.

Setting up invoice terms to due every 30 days end of the month can be done by going to the Company settings. Here's how:

For additional information, consider checking out this article: How to Adjust Invoice Payment Terms in QuickBooks Online.

Please let me know if you have any other issues or concerns. I want to make sure everything is taken care of for you. Have a great weekend!

FritzF, your solution doesn't seem to work as it puts the due date as 30th of the month in which the invoice is raised and not 30th of the next month i.e. an invoice entered with a date of 25th November 2019 will default to a due date of 30th November 2019 and not 30th December 2019 as it should be.

Keith

Hi Keith45,

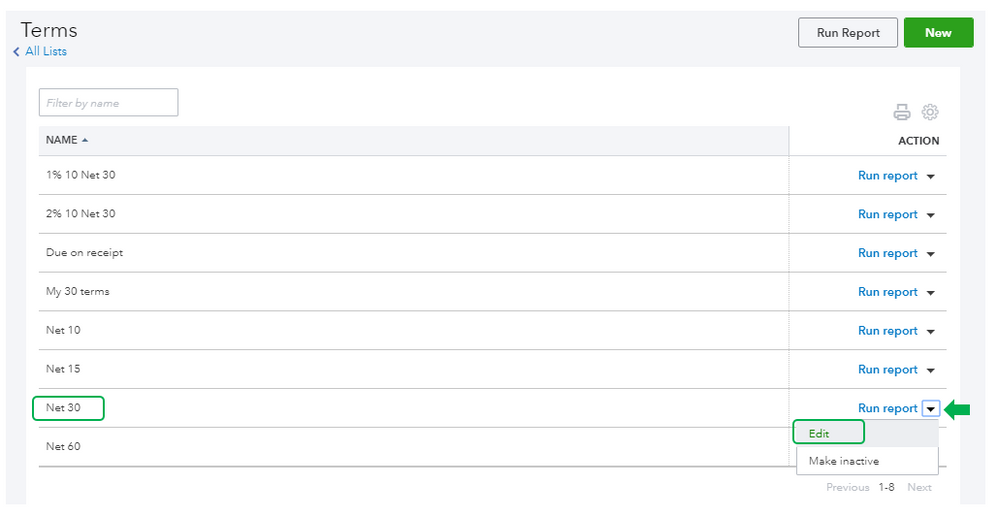

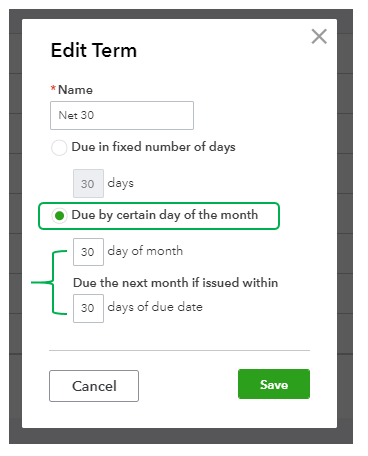

You can edit and adjust the term to due by certain day of the month in QuickBooks Online (QBO).

Let me show you how:

Then, open the invoice and toggle the Terms drop down to reflect the changes.

Let me share this article for future reference: How to edit an invoice.

Please keep me posted if you have any follow-ups or further questions. I'm always glad to help. Have a good day.

JaneD, thank you for your reply. After I posted my query I did manage to set up a Payment Term as you have described. This will work across most months of the year but doesn't seem to work for dates in January and February.

As far as Quickbooks is concerned, 30 Days after the end of January 2020 is 1st March 2020 (February 2020 is a leap year) and 30 Days after the end of February 2020 is 1st April.

It would be better if Quickbooks could handle the payment terms with reference to the Calendar rather than specific dates.

You’re welcome, @Keith45! It’s our pleasure to help.

You can always create a new term to make it due on the 29th day of February. When creating a New Term, choose Due by certain day of the month and set 29 on the day of month box.

Here's how:

It’s also a great idea to have a term that is set to refer to a calendar date which is the end of the month. I'll be sure to take note of it. For now, you can visit the QuickBooks Blog to check for new updates and features that we have.

Let me know if there’s anything that I can help with your account by leaving a comment below. I’m always here to assist. Take care and have a wonderful week!

Hey Team.

We have customer accounts set to invoice terms Month End.

However this appears to return random dates, not always actually selecting the last day of the month, or better still last working day of the month.

Is there a way this can be actioned to return the correct & true 'Month End' date each time an invoice is created?

Do we really have to manually fix individual invoices to the date?

It seems strange that QB appears unable to provide fixes within a reasonable time frame, here the previous client requested in November 2019... six months ago yet no update to fix the issue has been provided.

Month End with reference to a calendar is not a 'good idea'... it is essential and should work on a programme that earns it's developers big bucks!

We're taking notes of your feedback and suggestions, @AlanH.

At this time, we can only set terms base on a certain day of the month. You'll have to modify the terms from the invoice date manually.

Please know that our product engineers are considering all suggestions based on the number of requests and their impacts on the user interface before they're rolled out.

I can see how beneficial it is for you and your company to set terms base on the end of the month. But I want to let know that your voice matters and I'm submitting feedback directly to our engineers for consideration.

For now, you can visit our blog site so you'll be able to get the latest news about QuickBooks and what our Product Care Team is working on.

Please keep in touch if there's anything else I can do to help you succeed with QuickBooks. I've got your back. Have a great day and be safe.

Hi JaneD,

I'm trying to add 1% 10 / Net 30 EOM terms in QBO. I noticed in your screenshot that this is in your list of terms as well. Is there a way to add early payment discounts in QBO so that the 1% 10 day discount will apply? Or does the discount need to be added manually when paying each individual bill?

Thanks

Let me provide you more information about this, charterbooks.

You can set up invoice terms to apply early payment discounts to your customers. However, discount amounts are not automatically calculated. You'll have to update the invoice and include the discount.

Here's how:

Go to the Sales menu at the left pane, then choose the Invoices tab.

Locate the invoice that was already paid but with a remaining balance.

On the lower left of the invoice, click Discount Percent, and change it to Discount value.

Enter the early payment discount amount, then click Save and Close.

To give you more information about recording invoice payments, please visit this article: Record Invoice payments in QuickBooks Online (QBO).

Please touch base with us if you need anything else. I'll be right here to help.

Hi MariaSoledadG,

Thanks for your response, but I'm asking about setting up invoice terms for vendors. That is, I'm the customer and one of my vendors sent me an invoice with "1% 10 / Net 30 EOM" as the terms. I've figured out how to add new invoice terms under Settings > All Lists > Terms, but I'm trying to add 1% 10 / Net 30 EOM and there doesn't seem to be a way to set it up.

Thank you!

Hi charterbooks,

At this time, automatic discount terms and/or price levels are a feature only available in some QuickBooks US products. While it is not featured in QuickBooks Online Australia, you would need to add the discount manually when recording the invoice, bill or so on.

I would be more than happy to pass this on as a product enhancement insight to be considered in a future update and would also encourage you to submit your feedback in-product by accessing your Settings > Feedback. All feedback is considered as we are constantly working towards improving your experience using QuickBooks Online. I also encourage you to visit our QuickBooks blog which will keep you updated with new features and updates.

-Kass

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here