- AU QuickBooks Community

- :

- QuickBooks Q & A

- :

- Manage customers and income

- :

- Invoicing customers for billable expenses

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Invoicing customers for billable expenses

We incur and pay for some expenses on behalf of customers and then bill them for these on their monthly invoices. We are entering theses expenses at time of incurring them, and then they appear when we do the customer's invoice. But as soon as we add the expense to the invoice, it has no product/service and once we choose the product/service it deletes out the details of the expense and we have to re enter everything manually. This is not sustainable and prone to errors. Why does this happen and how do we stop it from occuring?

Solved! Go to Solution.

Labels:

Best answer August 09, 2020

Solved

Best Answers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Invoicing customers for billable expenses

Good day, alect.

Let me help you with converting billable expenses into an invoice.

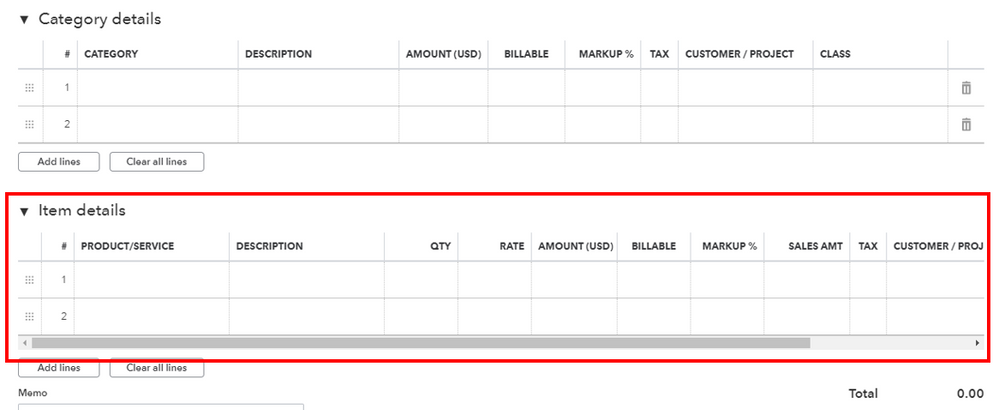

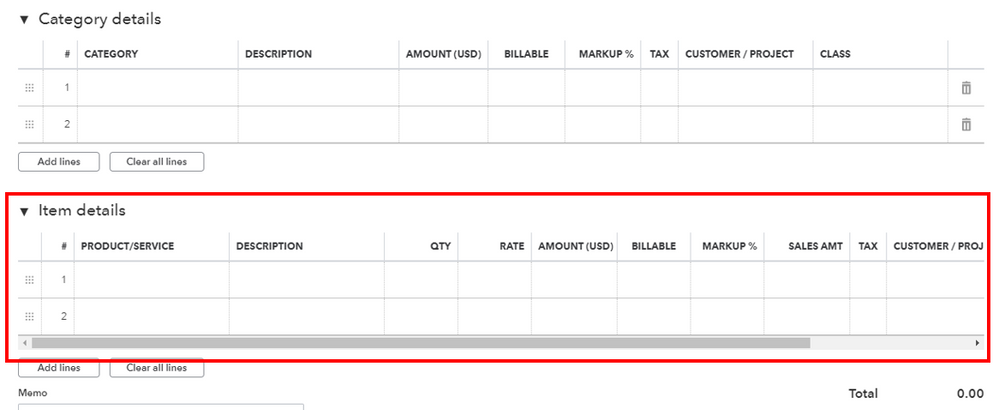

The reason why there's no product or service when you add the expense is that you used the category option. You'll want to open the bill or expense you created and add the details on the Item details section.

If you can't see this section, follow these steps on how to turn it on:

- Go to the Gear icon and select Account and settings.

- From the Expenses tab, select the Bills and expenses.

- Turn on the Show Items table on expense and purchase forms.

- Click Done.

Then, you can redo the expense to correct it and add it back to the invoice. I've added some articles for more details:

I'll be here if you have more questions. Wishing you all the best!

15 Comments 15

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Invoicing customers for billable expenses

Good day, alect.

Let me help you with converting billable expenses into an invoice.

The reason why there's no product or service when you add the expense is that you used the category option. You'll want to open the bill or expense you created and add the details on the Item details section.

If you can't see this section, follow these steps on how to turn it on:

- Go to the Gear icon and select Account and settings.

- From the Expenses tab, select the Bills and expenses.

- Turn on the Show Items table on expense and purchase forms.

- Click Done.

Then, you can redo the expense to correct it and add it back to the invoice. I've added some articles for more details:

I'll be here if you have more questions. Wishing you all the best!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Invoicing customers for billable expenses

Hi there, alect.

You're very welcome. It's glad to know that your issue was resolved. I'm just a few clicks away should you need anything else. Have a lovely day.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Invoicing customers for billable expenses

I have this same issue, and I see how the solution you posted works. It solves the issue presented, but then creates a new on.

If I do as you say, then the product or service shows up on the invoice in that column as desired, but then you lose the ability to categorize the billable expense in the correct expense account, like Cost of Goods Sold: Promotional Items.

Why is QBO set up like this? It is extremely frustrating.

Thanks in advance for your help.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Invoicing customers for billable expenses

I can provide additional information about billable expenses in your invoices, @Sean68.

In QuickBooks Online (QBO), the Category Details refers to a selection of an account from the company chart of accounts to categorize expense type (or non-expense type).

Whereas the Item Details mainly refers to the items from products and services list like the purchase of inventory items by quantity and unit price. It may also help to use for some job costing purposes when job/project cost reports.

For more information about managing Accounts Payable transactions, see this article: Enter bills and record bill payments in QuickBooks Online.

I'm always here if you have questions about your account. Let me know in the Reply section below. Take care and have a wonderful day!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Invoicing customers for billable expenses

Thanks for your help.

I have found that QBO just cannot do what I want correctly.

I have graphic designer work and dropship print jobs, neither of which are inventory, but both are billable expenses.

I need to categorize these as COGS and can only do so in the Category section where I can specify the expense account.

Doing that leaves the Product/service column empty on my invoices and also leaves me unable to run a report for a client showing them what they spent on printing, graphic design, video production, or anything else. I do not have inventory, yet what I sell are indeed products and services.

Quickbooks just seems designed to not allow naming a COGS item as a product or service. Very frustrating and I think I am moving to a different financial accounting product.

Thank you for trying to help me.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Invoicing customers for billable expenses

Hi, I was trying to do exactly the same. However, if I go into the Expenses tab in the settings it only allows me to change the Default bill payment terms and I do not see any other option. I guess this is not part of my subscription?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Invoicing customers for billable expenses

Thanks for joining us here, north_75.

The Billable Expenses feature is available in QuickBooks Online Plus.

If you're using Simple Start or Essentials, let me help you upgrade your account to get this subscription. Here's how:

- Go back to the Gear or Settings ⚙ and select Account and settings.

- Proceed to the Billing & Subscription tab.

- Make sure your payment info is up-to-date.

- Go to the QuickBooks Online section, then clickUpgrade your plan.

- Look for QuickBooks Online Plus, then select Choose plan.

- Follow the on-screen steps to upgrade your plan.

Once done, proceed to the Expenses tab and activate the Billable Expenses feature. You can use this article as a guide: Enter Billable Expenses.

Let me also share a couple more articles for additional guidance and reference when using this feature:

Don't hesitate to reach out to us again if you need anything else. I'd b happy to get back here and help you again.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Invoicing customers for billable expenses

When in create an invoice for billable activities, the description field on the invoice is blank. I've checked all these settings and they seem to be fine. I can select a different item once the invoice is created, and the description appears. I can then switch back to the original item and the description appears. How can I set it up so when I create an invoice from billable items the description appears automatically? I did a chat with a support person, and they had no suggestion.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Invoicing customers for billable expenses

I’ve got you covered, @lmwill33. I’m here to provide details about the Description field within invoices.

This feature is currently unavailable in QuickBooks Online (QBO). However, by providing us with feedback, this will help us enhance our product.

Here’s how:

- Go to the Gear section.

- Select Feedback

- Enter your feedback and suggestions for us.

- Click Next.

- Choose Feedback for the Category.

- Click Send Message.

Your recommendation will be sent straight to our developers, who will take it into account when developing future QuickBooks features.

You can also use this link to offer your suggestion: Customer Feedback for QuickBooks Online.

In addition, I added an article that can serve as your guide to enter billable expenses.

You can always reach us for more concerns and clarification on QuickBooks. Have a fantastic week!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Invoicing customers for billable expenses

Once an item has been added to an invoice (ie. a receipt that is getting expensed back to the customer) how would i then go and see the receipt attached and uploaded in the receipt management system? I am thinking of a scenario in a few months when i need to look at the receipts associated/attached to a certain invoice.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Invoicing customers for billable expenses

Hello, @SR31T.

I can see that you just joined an Australian thread, and as you've mentioned, you are using QuickBooks Desktop, so I would assume that this is under the QuickBooks Online region.

To upload receipts to QuickBooks Desktop, you can use either the QuickBooks Desktop mobile app or a computer. If you have a Pro Plus, Premier Plus, or Enterprise subscription, QuickBooks will automatically match the information from your receipts with an existing transaction. After that, you can review and approve the match.

If you have refunded a customer, you can match the refund with the uploaded receipt in the receipt management section. However, if you still need to issue a refund, you can create a new transaction by reviewing the receipt in the Receipt Management.

To create a refund, you can follow these simple steps:

- From the Customers menu, select Refunds.

- In the Customer: Job drop-down, choose your customer.

- Enter the items you're giving credit for, then select Save & Close.

After creating a refund, you can review, edit, and match receipts to transactions. Once you upload the expense receipts in QuickBooks Desktop, they'll show up in the For Review tab.

- Go to Vendor, then select Receipt Management.

- From the For Review tab, select the Refresh icon to see your receipts.

- From the receipt, select the small arrow, then select Review.

- If the receipt matches the transaction, select Attach.

- Note: If the match is incorrect, select Remove match, then create a new transaction.

- Select OK.

After you have completed the steps, you can add the invoice as an attachment receipt, and you have to do it manually. Remember that you will attach it through a file.

For future reference, you can learn how to reconcile your accounts so they match your bank and credit card statements: Reconcile an account in QuickBooks Desktop.

If you have further questions about anything related to QBDT. You can comment below, and we'll respond to you as soon as possible.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Invoicing customers for billable expenses

Hi,

Thanks for the info but it doesn't answer my question exactly. Lets say i have created an invoice and added a receipt to that invoice from the "Add Time/Cost">"Expenses" button (Here i find receipts for reimbursable expenses i have incurred being billed back to the owner and pulled from the Receipt Management System).

So the expense cost is now on the invoice and i want to now go look at the receipt associated with that expense from the invoice screen. For Example: In the future I want to give the owner copies of the receipts. I'd like to pull these directly from the invoice.

Please let me know if this is clear or not.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Invoicing customers for billable expenses

Hi SR31T,

Thank you for getting back to us. Since you are using the QuickBooks Desktop version in Australia, I would recommend contacting the support desk for QuickBooks Desktop which is handled by Reckon. They'll be the best support that can provide more information about the billable expense concern for your account.

Contact Reckon support through: https://www.reckon.com/au/contact-us/

Post again in the Community if you have further concerns about QuickBooks Online version.

Related Q&A