Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

You'll want to enter the interest for an early payment in QuickBooks Online (QBO) so it'll be in your account. We'll outline the entire process to ensure your inquiry gets addressed.

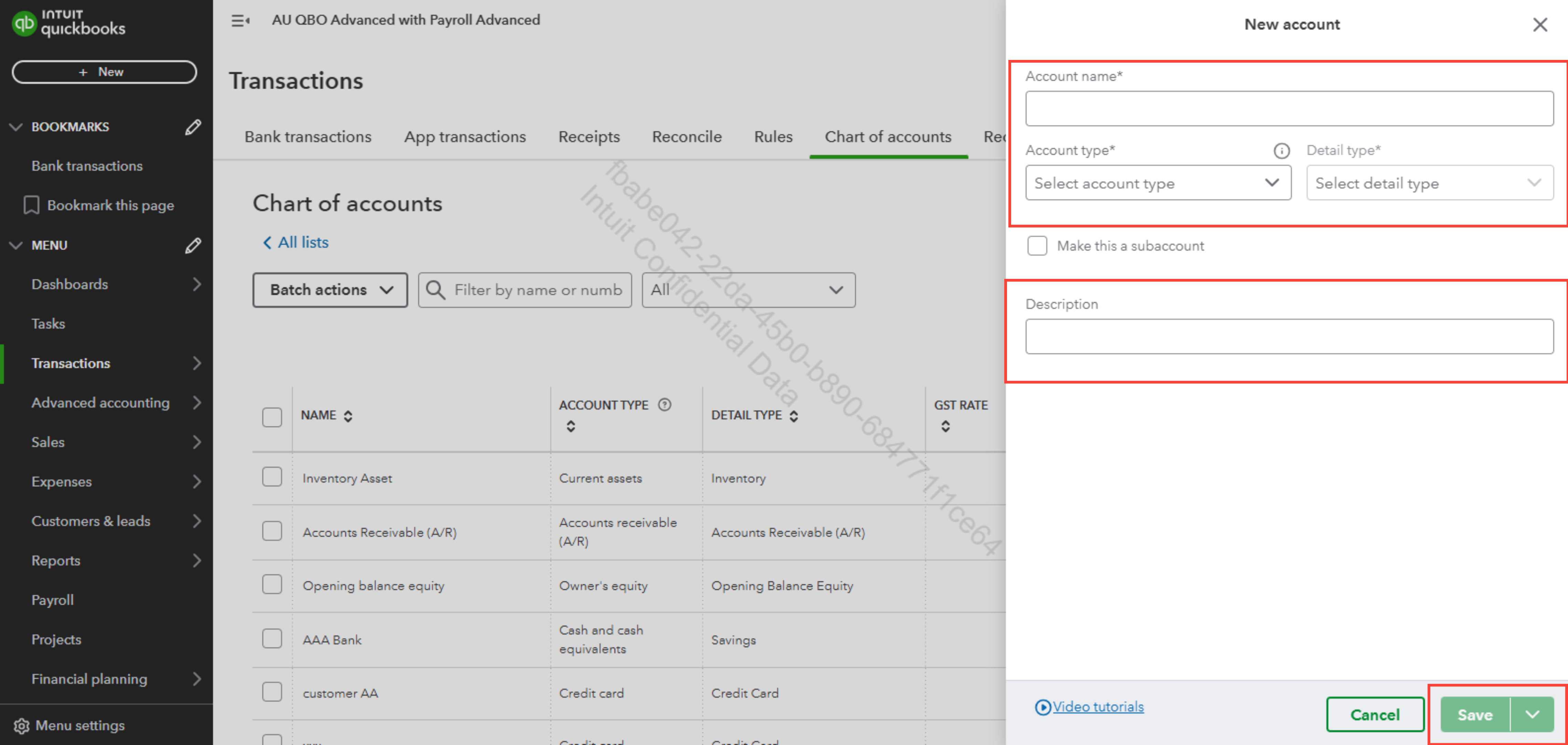

Before anything else, it's essential to create an account in your COA specifically for the interest that you received for an early payment. These are the steps:

For visual reference, see the image below.

After creating the account where you'll allocate the interest you've received for an early payment, you can proceed to record the credit in the program. Refer to this article for more details: Record and make bank deposits in QuickBooks Online.

Once done, proceed to enter the tax payment in QuickBooks. Here's an article to guide you further: Recording a GST payment (BAS Payment) in QuickBooks Online.

If you're unsure which accounts to use when recording, you can work with an accountant. They can assist you in completing this task and ensure everything is accurate. If you don't have an accountant, I can help you find one. Feel free to visit this page: Find a QuickBooks ProAdvisor.

You can also run a profit and loss report to ensure it's accounted for accurately under income and check your balance sheet to verify if the payment appears on point.

The Community space is available around the clock to address your questions. Feel free to use the comment section below so we can respond quickly to help resolve any issues.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here