Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have set up a deduction for an employee to salary sacrifice $250 to their Super fund. Have done it under the Deductions. However it has resulted in the Company's Superannuation contribution dropping from 11.5% down to 10.5%. Seems to be calculating the company superannuation guarantee as the Gross less the $250. Have I done something wrong in the set up ?

Yes, Sarah, there may have been issues in the setup of the salary sacrifice deduction in QuickBooks Online (QBO). Let's double-check the setup process and ensure everything is accurate.

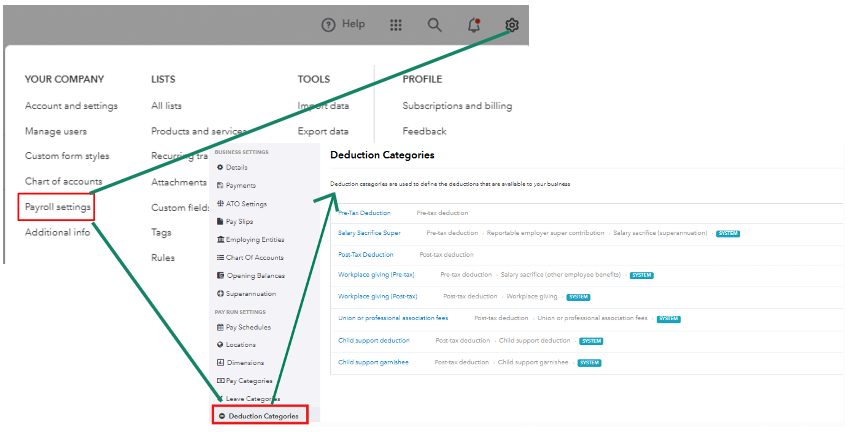

Based on the information you've provided, it seems that the deduction is affecting the calculation of the company's superannuation contribution. To fix this, we can review the settings for the deduction category in your payroll settings. This is to ensure it correctly categorizes the $250 salary sacrifice and does not reduce the gross salary used to calculate the employer's superannuation contribution. Also, verify that the deduction category payment options are set appropriately.

See the screenshot below for your reference on where you can review your setup.

Please know that important updates have been made to the setup of pre-tax deduction categories for contributions to super funds reported as RESC, such as salary sacrifice super. These changes aim to prevent incorrect setup and reporting of RESC deductions.

Payment options for deduction categories with the RESC deduction type will be restricted, with different rules for existing versus newly created categories. These changes apply to both pay run inclusions and manual additions to a pay run.

If an employee has a recurring deduction set up as a pay run inclusion using the Salary Sacrifice Super or an updated RESC deduction category with the payment option 'paid manually/bank account, the user must update the payment option to "paid to a super fund".

On the other hand, if an employee has a pre-tax deduction (non-RESC) already set up as a pay run inclusion and paid to a super fund, no further action is needed. These deductions will stay the same but will be labeled as a pre-tax deduction paid to a super fund, rather than the new RESC label.

By ensuring that the deduction categories in QBO are set up correctly and adhering to updated rules, you can avoid issues such as incorrect calculations of employer contributions to superannuation, maintain compliance with SG requirements, and ensure accurate payroll processing.

You can refer to this article for more information about SG changes: Superannuation Guarantee changes in QuickBooks Online.

Moreover, I've included these articles that can help you manage your employees in QuickBooks:

If you have more questions about setting up deduction categories or other QuickBooks concerns, leave them down below. The Community team is always ready o back you up.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here