Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Explore all newly-added features in QuickBooks Online at a glance!

June 2020

Things to remember

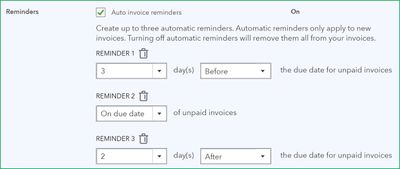

1. The reminder is triggered twice during the day. 6 am IST and 6 pm IST.

2. Only one reminder is sent per invoice per day. So even if Reminders 1, 2, and 3 say on the due date, QuickBooks will send a single reminder e-mail.

3. There is no cap on the number of invoice reminders sent per day per company file. Earlier this was 7.

TDS thresholds and deduction rates have been updated for all existing TDS sections in QuickBooks for FY 2020-21. The updates include the TDS rate changes (25% reduction) announced by the Ministry of Finance as part of the COVID19 economic stimulus.

Please note that no new sections have been added and calculations happen only for purchase bills and expenses.

May 2020

1. Use your Gmail address to send invoices

QuickBooks now permits sending invoices directly from a Gmail account.

Enabling this will activate a widget on the dashboard showing a graph of Money In and Money Out transactions in connected bank accounts.

March 2020

1. Payment enabled invoices—Razorpay

QuickBooks now lets you receive online payments on your invoices using Razorpay, a leading Indian electronic payments processor.

February 2020

1. GSTR3B now includes Debit Note transactions

The GSTR3B has been updated to pick Debit Notes, i.e. Supplier Credit. The sections which will show Debit Notes are Sections 4A1, 4A2, 4A3, 4A5, and Section 5A Inter-State Supplies. The conditions for a Debit Note being picked up are the same as for other transactions being picked up in these sections.

January 2020

1. New improvements in the GSTR 2A reconciliation report

You can now import purchase bills in batches to QuickBooks Online.

December 2019

1. New options available in Profit and Loss Reports

Two new options are now available in the Profit and Loss report for comparison purposes.

2. Changes to the left navigation bar, + menu and color scheme

3. Pay down credit card

A new transaction type named Credit Card Payment (Pay down credit card) has been added to QuickBooks. The purpose of this form is to provide an easy flow for users to move money from a Bank account to a Credit Card account. It is essentially a more limited Transfer form. This feature is still being tested and hence hasn't been made available to all users.

4. GSTR-1 Save

QuickBooks now lets users save their GST related data (tax liability) directly on the GST portal. This feature aims at simplifying GST filing for the users.

November 2019

QuickBooks Online Accountant launched in India. Helping CAs take their practice to the next level, QBOA comes with the following features:

✔ Real-time document exchange

✔ Higher team productivity

✔ Automatic bank updates

✔ Dedicated training and support

✔ Anytime, anywhere access

October 2019

1. Barcode Scanning in QuickBooks

Barcodes are widely used to capture and identify inventory data. With this new feature release in QuickBooks, you can now read barcodes and simplify your inventory management.

September 2019

1. Direct Feeds in QuickBooks: ICICI Bank

QuickBooks now connects to ICICI Bank Business using a direct connection to simplify access to your accounts. It is faster and more reliable. This means fewer sync errors and your account transactions stay up to date in QuickBooks. All you have to do is permit your financial institution, and your bank sends us a token that we use to access your account. This establishes an authenticated and secure connection between your QuickBooks company file and your bank.

August 2019

1. QuickBooks now has an option to let businesses based in Kerala handle the Kerala Flood Cess that went into effect from August 1, 2019. This has been levied to support the reconstruction of the state after the devastating floods in 2018.

QuickBooks is now available for FY 2018-19. Yippee!

June 2019

1. GSTR 2A reconciliation in QuickBooks introduced to provide you an Excel report that lets you reconcile and compare your purchases in QuickBooks with your supplier’s invoices (GSTR 2A) uploaded on the GST portal.

2. The GSTR 9 report in QuickBooks introduced to give you all the tables filled in based on the books of accounts. It will also highlight the input tax credit reconciliation difference to be reported in GSTR 9 return.

May 2019

1. Share invoices with WhatsApp Web. You will now be able to send invoices via WhatsApp Web to your customers. A new option called Save & Share (WhatsApp) is now available within invoice transactions in the Save button drop-down.

2. We have now added support for GST 6% rate in all transactions. You’ll be able to see this tax rate in the Tax drop-down in purchase and sales transactions.

April 2019

1. QuickBooks now goes beyond 90 days when fetching data from a newly added bank account! Add a new account and choose from a date range starting Today, This month, This year or a Custom date that allows you to go back up to 24 months subject to availability of data at the bank's website.

Here's some more information on the default selections that QuickBooks will make for you if you do not choose a starting date.

March 2019

Thanks for bringing such features.

However I would request you to bring below features on high priority :

1. Having option for TDS while importing bulk invoices via EXCEL

2. Digital Signature for Invoices

3. Having option to attach Invoices at the time of importing Bulk invoices via Excel.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here