Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Hi there, @AndySSL.

I'll show you how QuickBooks calculates sales taxes and how we can make changes to it to use the exact rates in the application.

If you notice, there are instances where QuickBooks calculates temporary penny differences. These are usually due to rounding for taxes calculated at exact rates.

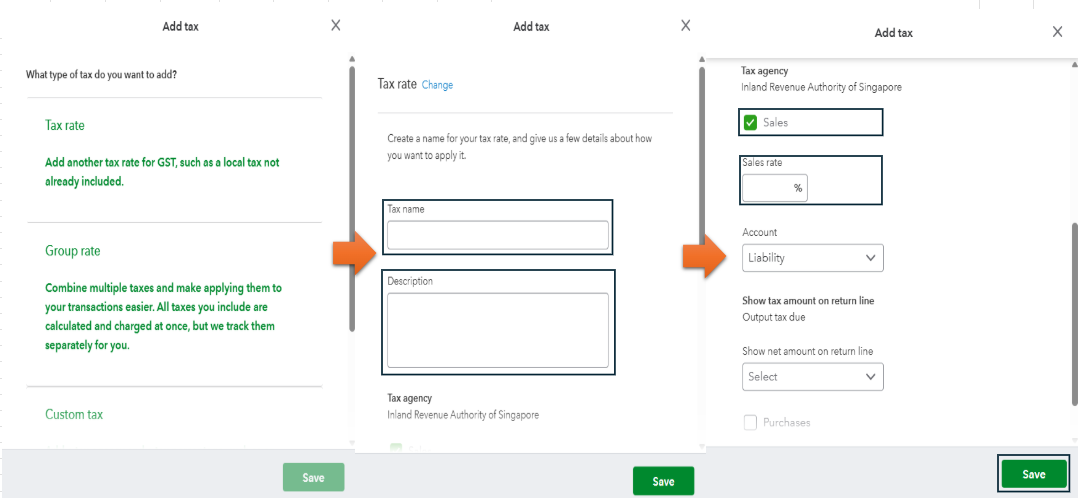

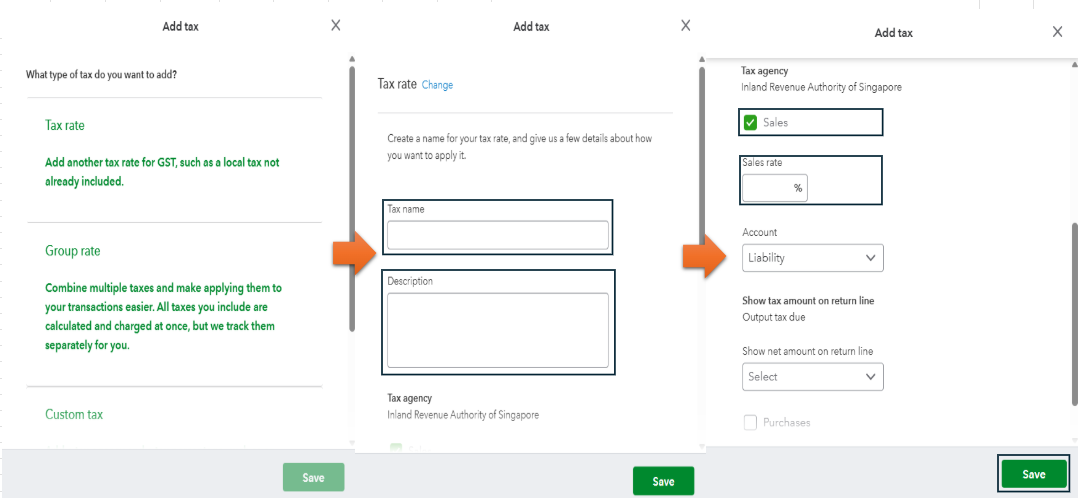

The system automatically creates a set of GST/VAT codes based on the information we receive from your state agency. There are ways we can modify this to achieve the desired amount. The first suggestion I have is to create custom tax rates. This option provides us with the capability to manually add the rates as a percentage based on our calculations.

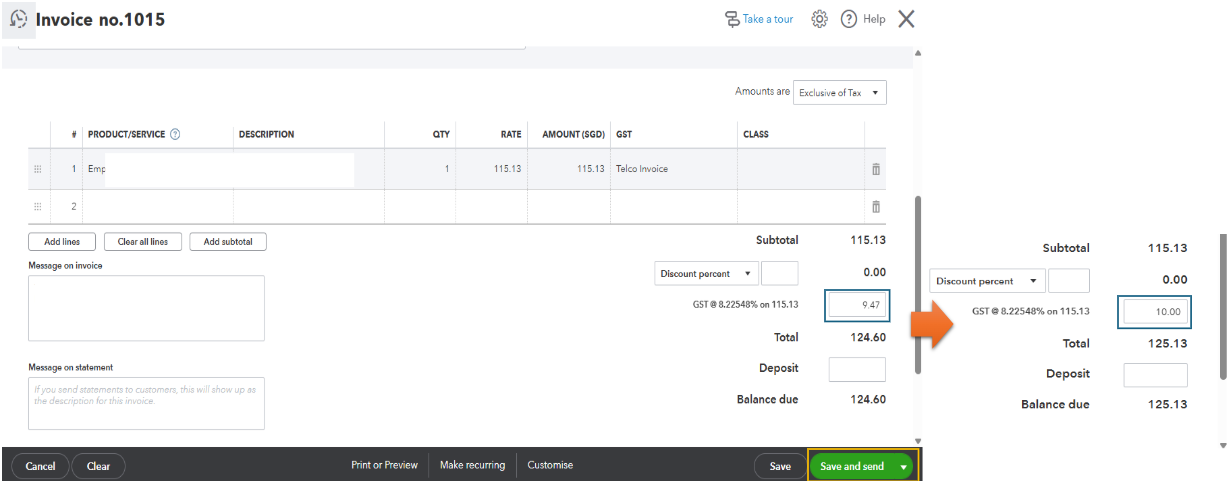

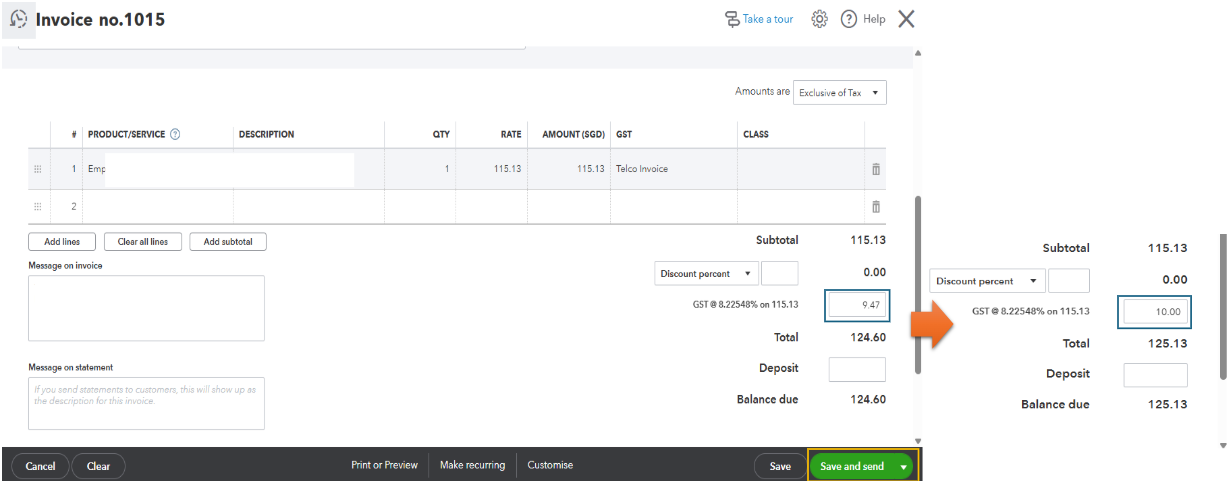

Let me share this example for reference: Your desired GST amount is $9.47 and the invoice amount is $115.13. To get the percentage value we need for your tax rate, we'll need to get that from the amounts mentioned. We'll need to multiply the quotient of $9.47 over $115.13 to 100. Hence, the function will look like this, ($9.47/$115.13) x 100 = 8.22548423521%. It's also best to work with your accountant for other ways to calculate tax rates.

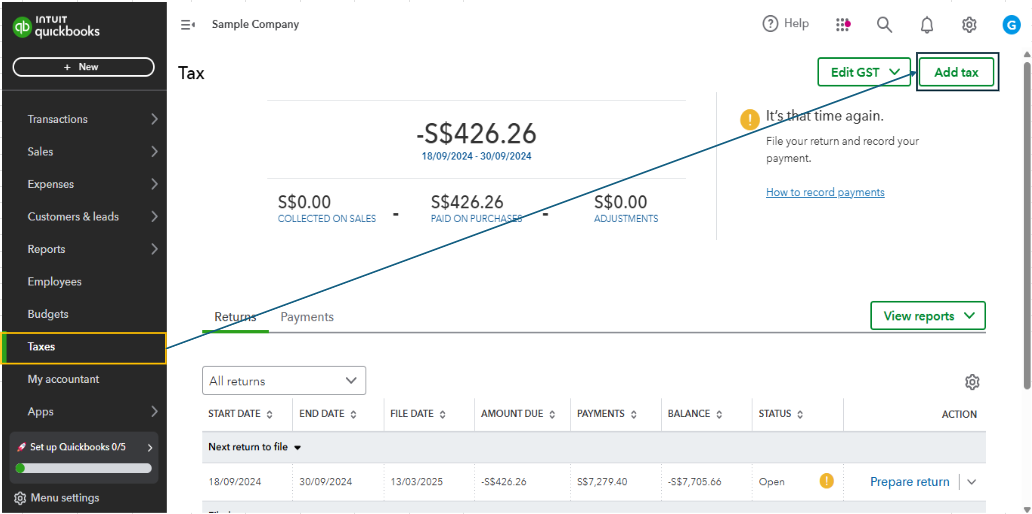

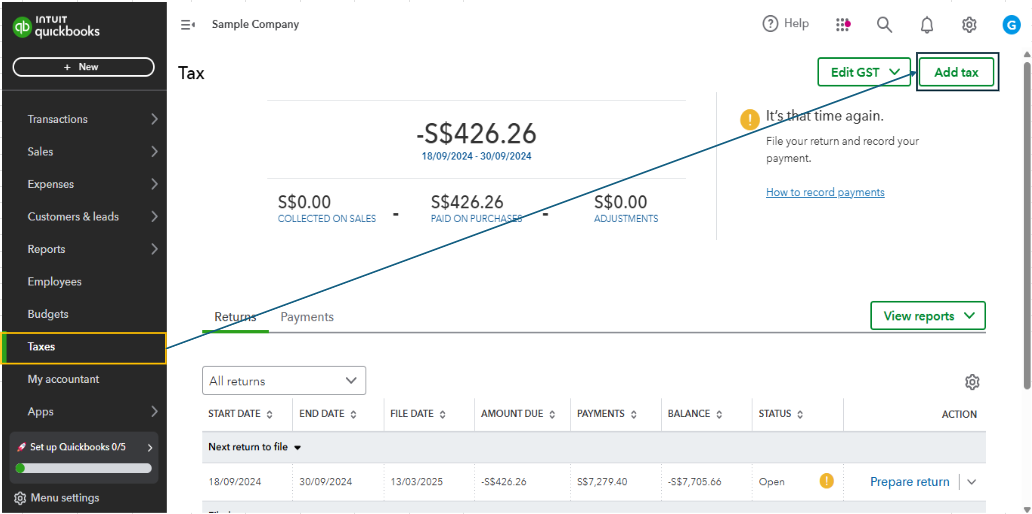

To add a tax rate, you can follow these steps:

The other option is to manually change the rates upon creating your invoice. I added a screenshot for your reference:

Furthermore, check out this article once your client decides to pay the transaction. Doing so will keep your records accurate and balanced: Record invoice payments in QuickBooks Online.

Additionally, learn to manage your GST payments to ensure you adhere to legal requirements and avoid penalties and fines.

I'll be around the corner if you require additional help managing your tax rates, @AndySSL. I'm just a few clicks away. Stay safe!

Hi there, @AndySSL.

I'll show you how QuickBooks calculates sales taxes and how we can make changes to it to use the exact rates in the application.

If you notice, there are instances where QuickBooks calculates temporary penny differences. These are usually due to rounding for taxes calculated at exact rates.

The system automatically creates a set of GST/VAT codes based on the information we receive from your state agency. There are ways we can modify this to achieve the desired amount. The first suggestion I have is to create custom tax rates. This option provides us with the capability to manually add the rates as a percentage based on our calculations.

Let me share this example for reference: Your desired GST amount is $9.47 and the invoice amount is $115.13. To get the percentage value we need for your tax rate, we'll need to get that from the amounts mentioned. We'll need to multiply the quotient of $9.47 over $115.13 to 100. Hence, the function will look like this, ($9.47/$115.13) x 100 = 8.22548423521%. It's also best to work with your accountant for other ways to calculate tax rates.

To add a tax rate, you can follow these steps:

The other option is to manually change the rates upon creating your invoice. I added a screenshot for your reference:

Furthermore, check out this article once your client decides to pay the transaction. Doing so will keep your records accurate and balanced: Record invoice payments in QuickBooks Online.

Additionally, learn to manage your GST payments to ensure you adhere to legal requirements and avoid penalties and fines.

I'll be around the corner if you require additional help managing your tax rates, @AndySSL. I'm just a few clicks away. Stay safe!

I made a mistake.....the subtotal was actually $ 105.13 (not $ 115.13).

Anyway, I followed your "create a new tax rate" method and it worked like a charm!

Problem solved! Thank you!

Thanks for getting back to this thread, Andy.

We're glad to hear that the recommendation to add a new tax rate was able to resolve your concern. It's our utmost priority to help every user fix every problem or provide insights for each concern.

I've also attached some articles you might find handy once you need to submit your GST return and record its payments or manage GST adjustments:

Don't hesitate to drop by again in this thread once you have more queries regarding your GST calculations in QuickBooks. We're always delighted to help. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here