Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello there, @trevor6.

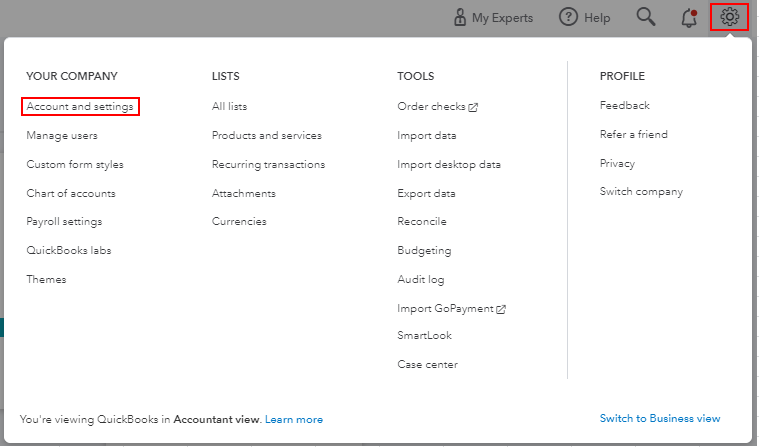

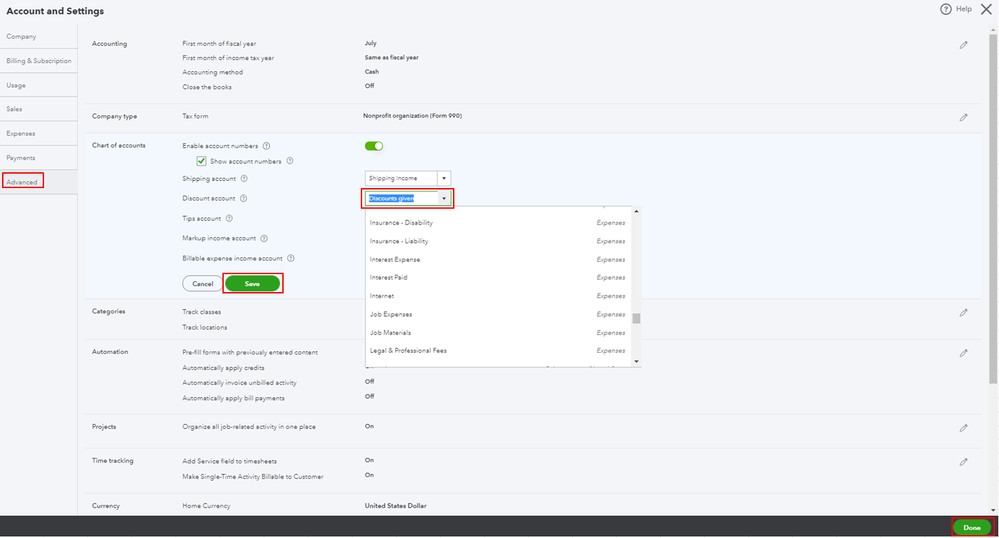

You can go to Account and Settings and change the allocated discount account from there. Let me guide you through the steps.

Once done, the settlement discount will be allocated to an expense account when receiving the payment.

Also, you can record the payment as a normal process in QuickBooks Online. For more guidance, feel free to check out this article: Record invoice payments in QuickBooks Online.

Just in case you want to personalise your sales forms, here's an article you can read for the detailed steps and information: Customise invoices, quotes, and sales receipts in QuickBooks Online.

Please know that you can visit our Community forum again if you have other concerns with QuickBooks Online. I'm always here to help. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here