Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

What are the definitions of the various Tax Types in QB?

Hello there, Fatima.

When entering a bill for a supplier who is not registered for VAT in QuickBooks Online, you should select Out of Scope of Tax. This choice ensures that VAT is not applied to transactions with these suppliers, as they are not registered under VAT regulations and cannot charge VAT on their goods or services.

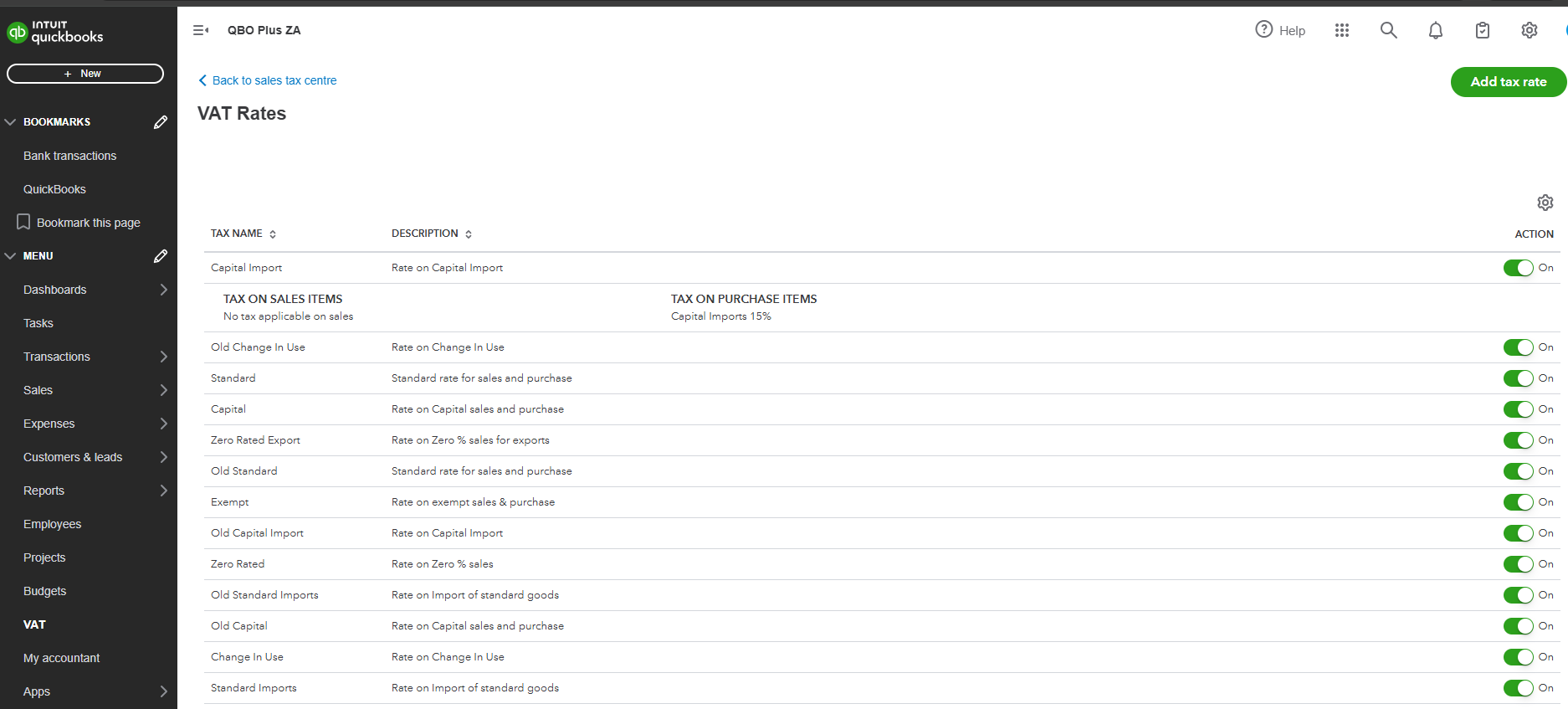

Here's a brief overview of the Tax Types in QBO:

You can choose to view descriptions of various tax types in QuickBooks, rather than just their definitions along with the corresponding rates that are set.

Here’s how:

It's always a good idea to confirm with your accountant if you're unsure about which Tax Type is correct for a particular transaction to ensure compliance with the local VAT regulations.

Please let us know if you have further questions. The Community is always here to respond.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here