Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I'll make sure you're able to reconcile your supplier transactions in QuickBooks Online (QBO), @userlgolimpi. This way, you can keep your financial data and books updated.

Since the goods are returned in July, you'll have to enter a Supplier credit in QBO. Then, match it to the credit that reflects on your bank statement before you reconcile your account. With this, you're able to resolve the difference between your bank record and in QuickBooks.

You can enter a supplier credit depending on how you record your purchases. Given that you enter bills to track your expenses, you need to make sure the credit hits the expense account you use for the supplier.

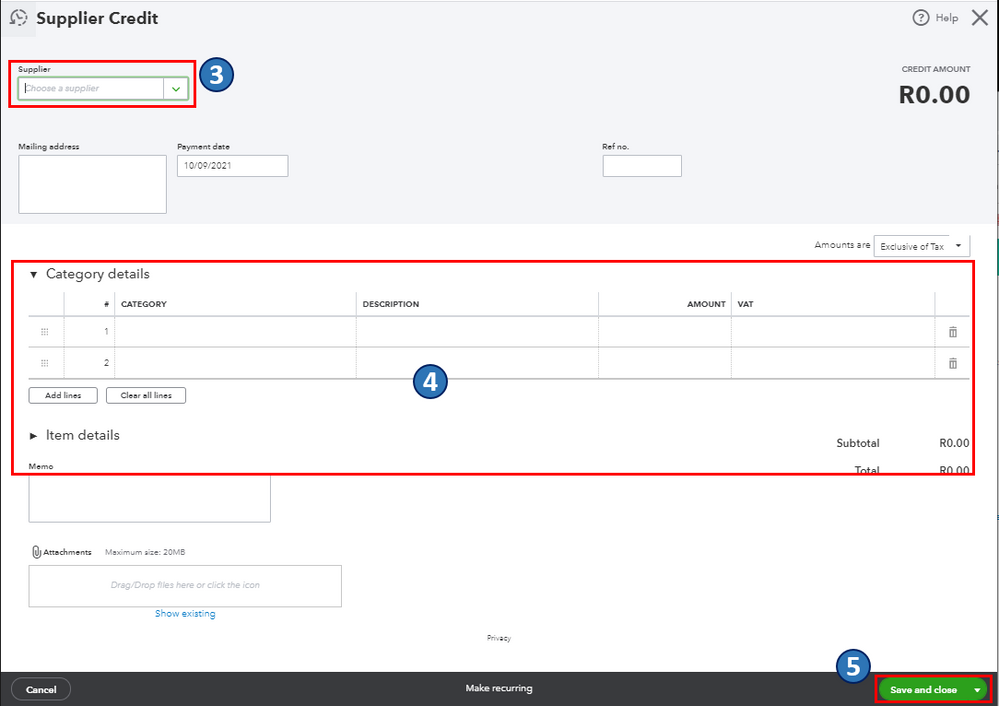

To do this, you'll first have to create a supplier credit by following these steps:

Then, apply the supplier credit to the bill. Here's how:

In case you'll want to enter expenses or write cheques to enter supplier credits, you can check out this article to learn more about this: Enter a credit from a supplier.

Once you're done, match the Supplier credit to the credit that reflects on your statement. For the step-by-step guide, you can refer to this article: Categorise and match online bank transactions in QuickBooks Online.

Then, you're now set to reconcile your account. I'd recommend performing this process every month. This will help monitor your expenses and detect any possible errors accordingly. For the complete guide, check out this article: Reconcile an account in QuickBooks Online.

Also, I'm adding this article to guide you anytime you need help doing or fixing a reconciliation in QBO: Learn the reconcile workflow in QuickBooks.

Let me know how it goes in the comments below. If you have other reconciliation concerns and questions about managing supplier transactions in QBO, I'm always around to help. Take care, and I wish you continued success, @userlgolimpi.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here