Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Welcome to the Community, @Afi123.

I've come to provide some clarifications on how the reconciliation works in QuickBooks Online.

Currently, you only use the Reconcile feature to reconcile bank and credit card accounts in QuickBooks. It doesn't apply to reports. You mainly perform the process to match with the statements coming from your financial institution.

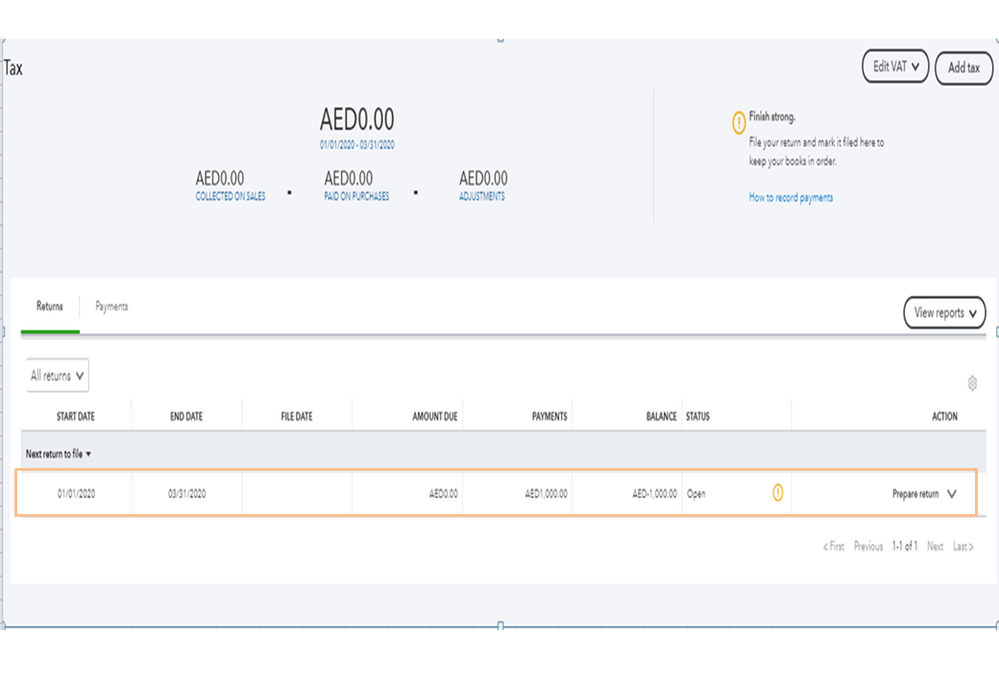

If you're referring to reconciling the VAT payments, you'll need to make sure that the payments have been matched, categorised, and added into the register. Here's a link that you can visit to guide you in doing this process: Learn how to review bank and credit card transactions after you download them into QuickBooks Online...

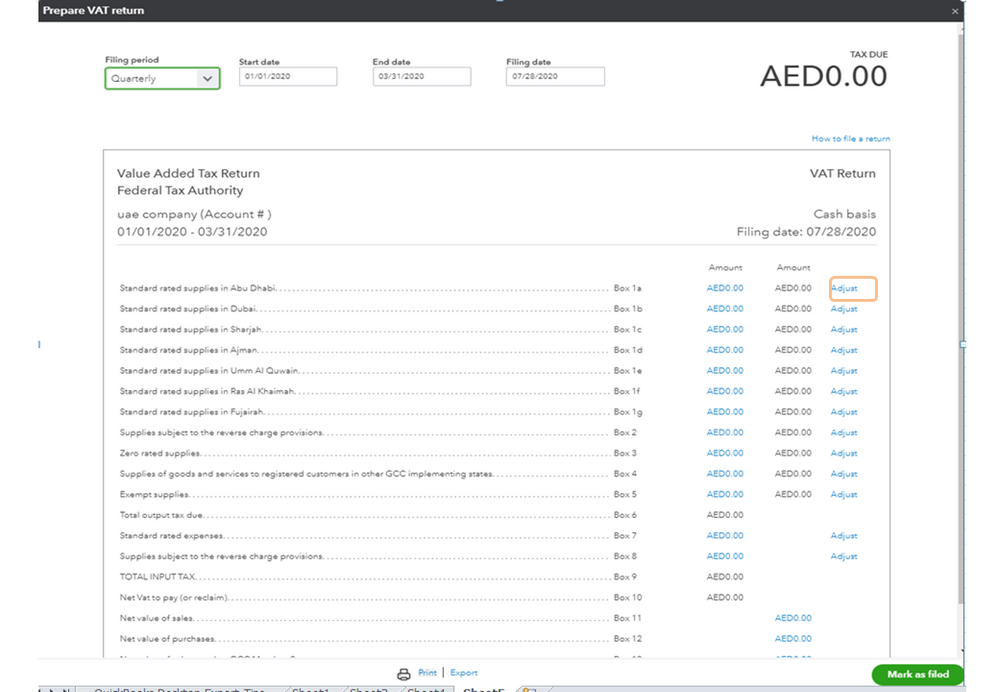

However, if you've found any discrepancy on your VAT report and you want to correct it, here's how you can do that:

Lastly, you can always scan through this link attached to give you complete details on how to smoothly reconcile an account in QBO: Learn how to reconcile your accounts so they match your bank and credit card statements.

If you're referring to something else or if you have any other concerns, let me know. I'll be right here to help. Have a wonderful day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here