- ZA QuickBooks Community

- :

- QuickBooks Q & A

- :

- VAT

- :

- Newly VAT registered (South Africa)

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Newly VAT registered (South Africa)

Hi

I’ve been trading now for 10 months and using QBO during this time. I am now VAT registered. Can i just turn on the tax function and start using it from the date i became VAT registered?

Or do i need to do something special/different to compartmentalise the pre-VAT period i was trading from the post-VAT period? I just don’t want to cause any problems with the system setup.

Any guidance would be gratefully appreciated.

Solved! Go to Solution.

Labels:

Best answer July 01, 2020

Solved

Best Answers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Newly VAT registered (South Africa)

Hello there, @JeremyAdv.

You've got me here to share some details on how you can utilize the VAT feature in QuickBooks Online.

Once you've become a VAT registered, you'll need to set up VAT in the system. After that, you may enter the Registration Number, so it will reflect on your invoice.

To set this up, please take these steps below:

- On the left panel, click on VAT.

- Select on Set up VAT.

- From the Set up VAT page, choose the Start of VAT period (the date that you became a VAT registered), Filing frequency, Reporting method, and your VAT Registration No..

- Hit on Next.

- Press on Got it.

To enter the VAT Registration Number:

- Select the Gear icon.

- Press on Account and Settings.

- Tick on Company name.

- Enter your VAT Registration Number in the VAT# field.

- Hit on Save.

I'm also adding these help articles below to give you more insights about adding VAT rates in the system and all the things that you need to know once you're registered:

Lastly, if you need assistance with filing and paying your taxes, this link will get you covered: Learn how to file and pay the Tax/GST you owe using QuickBooks Online International version.

Let me know if there's anything else that you need about this or with QuickBooks. I'll be around to lend a helping hand. Have a good one!

6 Comments 6

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Newly VAT registered (South Africa)

Hello there, @JeremyAdv.

You've got me here to share some details on how you can utilize the VAT feature in QuickBooks Online.

Once you've become a VAT registered, you'll need to set up VAT in the system. After that, you may enter the Registration Number, so it will reflect on your invoice.

To set this up, please take these steps below:

- On the left panel, click on VAT.

- Select on Set up VAT.

- From the Set up VAT page, choose the Start of VAT period (the date that you became a VAT registered), Filing frequency, Reporting method, and your VAT Registration No..

- Hit on Next.

- Press on Got it.

To enter the VAT Registration Number:

- Select the Gear icon.

- Press on Account and Settings.

- Tick on Company name.

- Enter your VAT Registration Number in the VAT# field.

- Hit on Save.

I'm also adding these help articles below to give you more insights about adding VAT rates in the system and all the things that you need to know once you're registered:

Lastly, if you need assistance with filing and paying your taxes, this link will get you covered: Learn how to file and pay the Tax/GST you owe using QuickBooks Online International version.

Let me know if there's anything else that you need about this or with QuickBooks. I'll be around to lend a helping hand. Have a good one!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Newly VAT registered (South Africa)

Hi @JeremyAdv

You are only VAT liable from the date of registration as on your "Confirmation of VAT Registration" letter that was issued to you by SARS. There is nothing special/ different to do. Once the VAT is turned on, QBO will start to track the VAT on the sales and purchases you tell it to.

The steps etc. to turn the VAT on are explained nicely by @BettyJaneB

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Newly VAT registered (South Africa)

I cannot get QuickBooks 2019 Premier to reflect the vat amount on each line item.

it just shows the vat code and percentage. at the bottom it shows the combined VAT amount of all the line items

together.

Please help

Thanks

Keith

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Newly VAT registered (South Africa)

Welcome to the Community space, @Keith5488.

Let me provide you with steps for adding the VAT amount on every line item in your invoice in QuickBooks Desktop (QBDT).

To add a VAT amount to each item, consider customizing your template and adding a VAT column, then manually calculate and enter the VAT amount. Let me guide you through the steps.

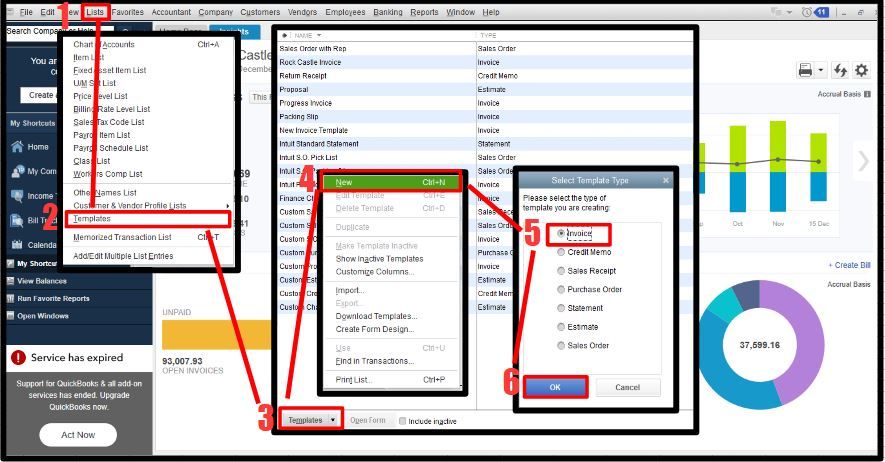

- Go to Lists, and select Templates.

- Click the Templates at the lower left part of your screen.

- Select New to create a new template, then choose Invoice, and click OK.

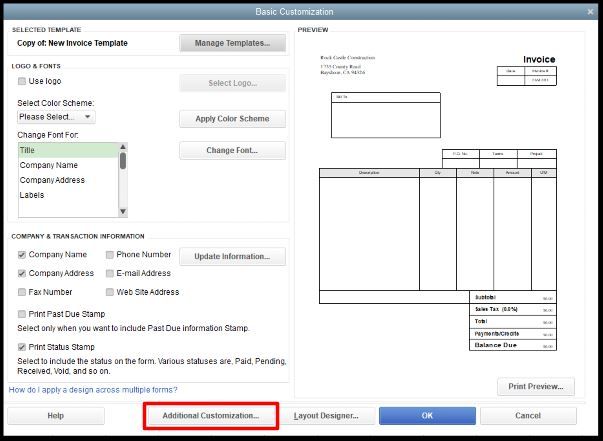

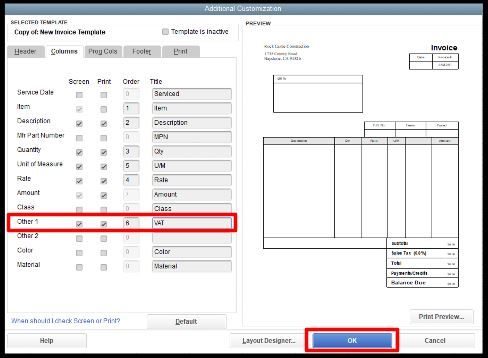

- Click Additional Customization and choose the Columns tab.

- Tick on the Other 1 checkbox and enter a name such as VAT.

- Make other changes if needed.

- Once done, click OK.

Now, you can use this template when creating an invoice and manually calculate the tax amount, then enter it in this column of your invoice. Here's how:

1. Go to Customers and click Create Invoices.

2. Choose an item, then at the upper-right corner of your screen click the dropdown arrow beside the Template.

3. Select the template that you created.

4. Manually calculate the VAT, then enter it on the VAT column of your invoice.

5. Once done, click Save & Close.

Moreover, I'm adding this US article that can be applied in your country as your reference in fixing issues that you encounter when using customized templates in QBDT: Fix common issues when you use and customize templates.

I'm always here to provide further guidance if you have more concerns about adding VAT amount on your invoices in QBDT.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Newly VAT registered (South Africa)

QB does not open the field : start of vat period. Please help

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Newly VAT registered (South Africa)

The reason why this Start of VAT period field doesn't open is caused by a browser-related issue. Let's work together and troubleshoot this so you can complete your VAT setup and start tracking your sales taxes, Magriet.

QuickBooks uses the browser's cache to run faster. You'll have to clear or remove outdated ones to prevent potential viewing and performance issues with QBO.

Start troubleshooting by pulling up your account using a private browser (incognito). Here's how:

- Press Ctrl + Shift + N (Google Chrome)

- Ctrl + Shift + P (Firefox)

- Control + Option + P (Safari)

Once signed in, go to the VAT menu to set up and use the VAT feature in QBO.

If you're able to do so, return to your default browser and clear its cache. After that, restart your browser and log back into your QBO account to refresh the system.

However, if this matter continues, I'd recommend clicking the browser's Refresh icon (please see the screenshot below) or using other supported browsers.

Also, QuickBooks automatically tracks VAT when you make a sale after you set up. To get a detailed look at the taxes you owe, run the VAT Liability report before filing your return and recording your payment.

Keep me posted in the comments if you have other VAT concerns or questions about managing sales taxes in QBO. I'll gladly help.

Related Q&A