Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have received some inward remittance. However in the whole process the bank has deducted around $20 as bank charges. Now I am just not been able to match the transaction with the relevant bill. How do I resolve this issue. Kindly be as detailed as possible.

Thanks for checking in with us, SFW_2021.

If you received less than the due amount on the invoice due bank charges, ,we can create an expense account for Bank Fees (if you don't have one already). Then, resolve the difference when matching the transaction from your Banking page. Here's how to create an expense account:

Once you have an expense account for bank fees, you can resolve the difference between the invoice and the payment when matching transactions from your Bank Feed. Here's how:

Your transaction is now matched off against the invoice and the bank fees are accounted for. Feel free to visit our Banking page for more insights about managing your bank transactions.

I'd like to know how you get on after trying the steps, as I want to ensure this is resolved for you. Just reply to this post and I'll get back to you. Take care always.

Welcome back to the Community, SFW_2021.

I can help answer any questions you may have about QuickBooks. However, I need more information about the issue.

Were you able to try the solution shared by my colleague above? May I know the result and which part of the steps you’re having a problem with? Any details shared will guide me on the steps will have to perform to fix the issue.

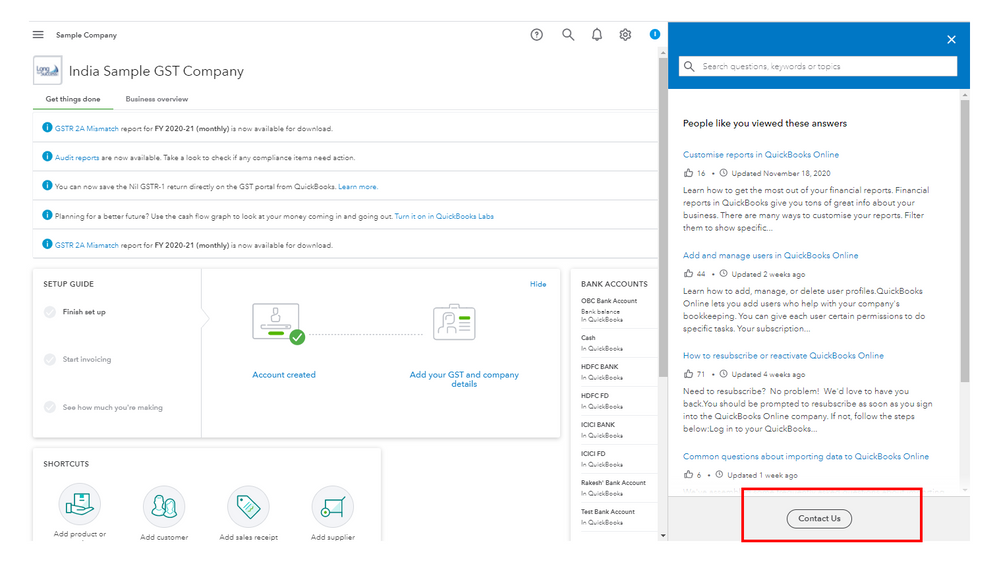

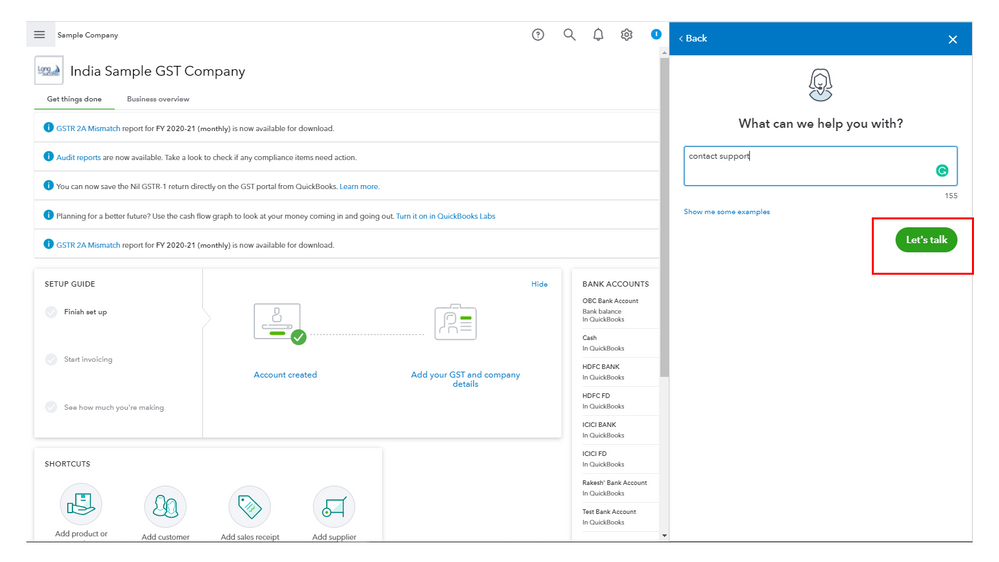

If you still wish to connect with our QBO Care Team, let’s go to the Help section of the company to get the contact details.

Here’s how:

I’m adding a link that shows the complete list of our self-help articles. These resources contain topics about taxes, banking, reporting, data management, suppliers, customers, etc. From there, you’ll find the steps on how to perform each task in QBO: Get started.

If you still need help with QBO, feel free to post a comment below. I’ll get back to help and make sure you’re taken care of. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here