Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi there, and thank you for contacting us about taking away the tax rate when making a bank deposit, user70795.

You're unable to track tax on accounts of types Accounts Receivable on the Banking page.

Also, you're unable to turn off the tax rate field on the Banking page. You'll need to select another category for the income so you can save the deposit.

If you need more help in categorising bank transactions, you can refer to this article: Categorise and match online bank transactions in QuickBooks Online.

Please get back to me if you have additional questions about the tax rate on the Banking page. I'm always right here to help you.

I can't choose another category to add customer income, because in any case I need to choose a tax rate that I don't have. How else can I add income?

Thanks for getting back, @Mariana4. Let me share some information about categorizing your transactions to the right account.

If you want to utilize multiple accounts when categorizing bank accounts, you can split the transactions for easier tracking and spread transactions across numerous accounts.

Here’s how:

To open the Split transaction window.

As of now, in bank deposit screens, you can set it to Out of Scope so you won’t have to select the tax.

Let me walk you through:

For future reference, you can check out this article categorise and match online bank transactions in QuickBooks Online.

Feel free to leave a comment below if you need further assistance with banking transactions. I’m just one post away from assisting you. Stay safe!

I turned off the tax in my account and settings, but everything remained the same. I can't add a transaction because I need to choose a tax rate. I am attaching a screenshot. Is it possible to completely exclude the tax?

I appreciate all the work you've done to keep the tax out of the transaction, @Mariana.

I want to stop this from happening to you. I have other troubleshooting steps that will certainly exclude the tax rate in QuickBooks Online.

Yes, we can exclude tax on the Match page by selecting a tax rate of 0%. Choosing 0% does not calculate any tax amount. Doing this eliminates the tax, and you can save the transactions seamlessly.

If you don't have a 0% rate, I'd recommend creating a custom tax rate specific for these transactions. For the complete steps, check out this link: Create custom tax rate.

In addition, don't forget to deposit the funds and reconcile your account to make sure they match your bank statements.

Discover these articles below on how to troubleshoot specific bank errors and manage your chart of accounts in QuickBooks:

Leave a line if you have follow-up questions about matching transactions. I'm happy to answer any questions you may have. Remain safe, Mariana.

I created a 0% tax rate and chose when I added a payment, but that doesn't allow me to choose the right income category. I choose Accounts Receivable (A / R) and it gives me a mistake. If I choose another category, it will be an incorrect payment. Please help disable this tax.

Let me guide you on how you can disable the sales tax rate that you've created, Mariana4.

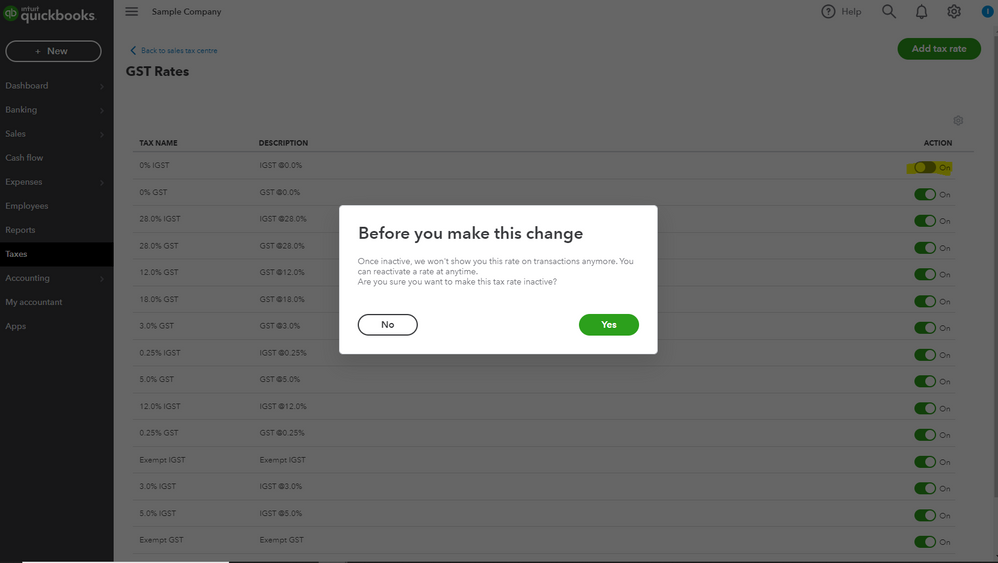

QuickBooks Online (QBO) lets you disable the tax rate that you no longer need. To do this, you can follow the steps below:

Once it is set to inactive, this won't show the rate on your transactions. However, you can always reactivate the rate anytime if you change your mind. Additionally, to run reports for your sales tax liabilities, record or edit sales tax payments, and see your payment for different time periods, learn from this article for your guide: Manage Sales Tax Payments in QuickBooks Online.

Reach out to us if you have any concerns about sales tax. The Community is always right here to help you anytime.

Thanks for the help! I have already done so, but to no avail. It still doesn't allow me to properly add cash flow from the client. Is it possible to turn off the tax center? Logically, if you can add a tax rate, you can turn it off completely.

I appreciate all the efforts you've exerted to resolve your issue, @Mariana4.

I want to make sure this issue is taken care of, and I'd like to redirect you to the best support group available to get this address right away.

The option to turn off the tax center isn't possible. You'll have to set the Default tax rate to Out of scope to ensure the taxes won't calculate. However, since it doesn't work, I recommend reaching out to our QuickBooks Support Team. This way, they can further check on this matter and help you remove the tax field on the banking page or when creating a deposit. Here's how to reach them:

You might want to learn more about managing sales tax payments. This article will help you record, adjust and delete sales tax payments in the sales tax center: Manage sales tax payments in QuickBooks Online.

Please know that I'm just a reply away if you need further assistance with this. Wishing you all the best, @Mariana4.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here