Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Welcome to the Community, Tatiana. I'll share information to help you assign bank transactions to Out of scope inside QuickBooks Online (QBO).

To classify a transaction as Out of scope, you'll want to manually select each of the imported transactions in your Bank transaction page, and in the Tax field, choose the correct classification. I'll be happy to outline the steps to get you going:

However, if you don't want to add 0% to the transaction. You'll want to edit those transactions and add No Vat to it. You can also visit this page to learn more on how to manage bank transactions inside QBO: Categorise online bank transactions in QuickBooks Online.

Furthermore, I'm providing this handy article to help you reconcile an account inside the program: Reconcile an account in QuickBooks Online.

We encourage you to post here again if you have any additional questions related to QuickBooks or need assistance managing imported transactions. Our team looks forward to helping you out again. Keep safe, and have a good one.

Thank you. However I do not want to assign a 0% Tax rate as this would include these transactions as taxable in my VAT return. I would like to set these transactions as "Out of scope", no VAT rate assigned to them. Is this possible? Thank you.

Thank you. However I do not want to assign a 0% Tax rate as this would include these transactions as taxable in my VAT return. I would like to set these transactions as "Out of scope", no VAT rate assigned to them. Is this possible? Thank you.

Thanks for getting back to us, @usertatiana-koumidou.

I can see your concern about not wanting to assign a 0% tax rate, which would still include the transactions as taxable in your VAT return. I'm here to help you out.

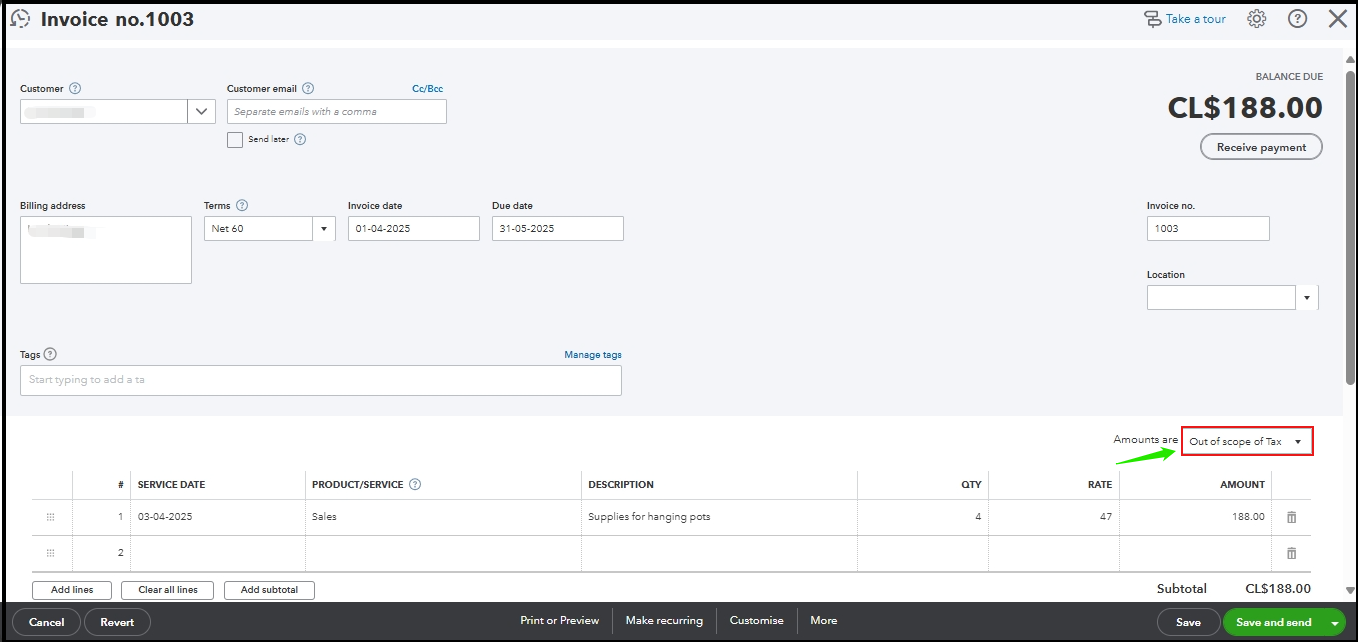

We can select the No VAT option in the Amounts dropdown, you are effectively marking these invoice line items as "Out of Scope" for VAT purposes. This will exclude them from your VAT calculations and reporting, without inadvertently applying a 0% VAT rate.

Here are the steps to select the No VAT option on the Amounts dropdown for the invoice:

See the screenshot below for your reference.

For more insights on how VAT codes work in the system, please see this link: How do I set up sales GST/VAT rates and use them on forms? (International QBO).

Lastly, I'd like to share this reference with you to guide you in utilizing QuickBooks together with its great features: Get started with QuickBooks Online.

I'm just a reply away to assist you if you have any other questions. Take care!

I also need to solve this when IMPORTING (from file) several invoice. I need them imported as "Out of scope of VAT" tax type.

Thanks!

Hi there, Carlos.

To import multiple invoices with the Out of Scope of VAT tax type in QuickBooks Online (QBO), start by preparing your invoice data in an organized spreadsheet. Let me explain further below.

Before importing your invoices, ensure that every line item includes an invoice number, customer name, invoice date, due date, item amount, and, the item tax code. Please review the requirements for importing invoices or download this sample spreadsheet.

Furthermore, QBO will prompt you to map the fields from your file to the corresponding fields in QBO. If you have invoices classified as Out of Scope of VAT, simply add the relevant tax rate to your spreadsheet. During the import process, you can match your designated tax labels to the appropriate QuickBooks tax codes, such as Out of Scope.

Please ensure to validate the data before and after importing to maintain accurate financial records.

Moreover, I'm sharing this article to help you pull an Invoice List report in QBO to review outstanding invoices, track unpaid customer balances, manage cash flow effectively, and ensure timely follow-up on receivables: Run a report in QuickBooks Online.

Feel free to reach out if you have any more questions or need additional assistance with managing your invoices marked as Out of Scope of VAT in QuickBooks Online (QBO). Wishing you a safe weekend ahead!

Thanks for the feedback. However, at least in my case, the "Out of scope of Tax" is not a tax code, but is an option that you choose when you "do not want to have tax code". Is a system option, rather than a tax created by us on our Quickbooks.

I am showing you a picture below: We have some tax codes, but the option of "Out of tax scope" is the one we choose when we don't want to use any existing tax code.

If you see below, when creating invoices, you have three (3) options: "tax included", "tax not included", and "out of the scope of taxes". When you chose the last one, then you DO NOT need to select any tax code on the line details of the invoives.

HOWEVER, when you were importing invoices, at least until last week, the tax type (*ItemTaxCode field ) was a mandatory field, and among the options, was not "out of tax code". That was the problem that triggered my message to you.

Now, it seems you have changed the file back to exclude that field as mandatory (or not even there). So, at least for us, the issue has been resolved. But would be nice to know what happend.

Thanks!

Hello. The problem seems to have returned!!

Now, the import file has a mandatory tax code (*ItemTaxCode). This generates problems for us as we create all our invoice with "out of tax scope" taxes. When you are maping the file (please see image attached) you only get two options: "Tax no included" and "Tax included" and YOU ARE MISING the option of "Out of tax scope".

You need to fix this as this is something you just implemented, and it was bad implemented.

Thanks!

Thank you for reaching out and sharing your concerns with us. I recognize how crucial it is for your invoicing process to include the Out of Tax Scope option, especially to comply with your specific tax handling requirements.

The update was designed to streamline tax-related functionalities. We greatly appreciate your feedback and understand how crucial it is for the software to function correctly to match invoicing needs.

We encourage you to provide feedback to our development team, emphasizing the importance of enabling the Out of Tax Scope option in the mapping choice. Your input is vital as we continuously seek to improve our user experience.

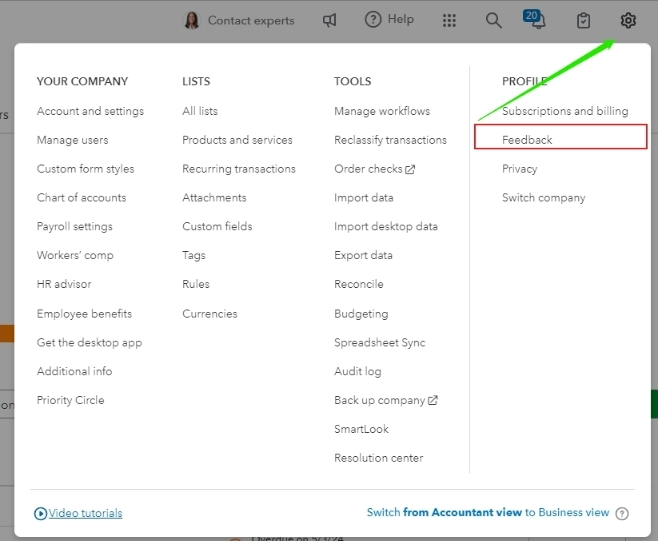

To share your suggestions, please follow these steps:

In the meantime, please set the invoices to Exclusive of tax. After the import process, we can manually adjust them to Out of Scope of Tax as an interim solution.

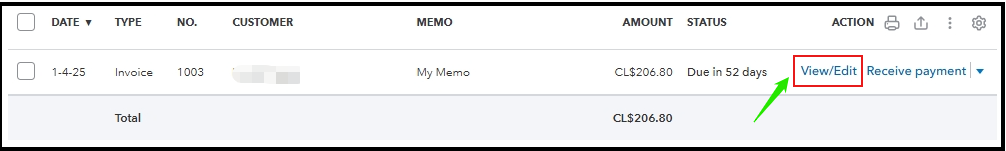

Here’s how:

Furthermore, I recommend reviewing the following articles to assist in managing transactions after receiving payments from your customers:

Thank you for your patience and understanding as we work through this matter. If you have any more questions or if there is anything else we can assist you with, please do not hesitate to reach out.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here