Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I get your point, @neethal. I’m here to provide the best way to manage your receivables and write off bad debt in QuickBooks Online.

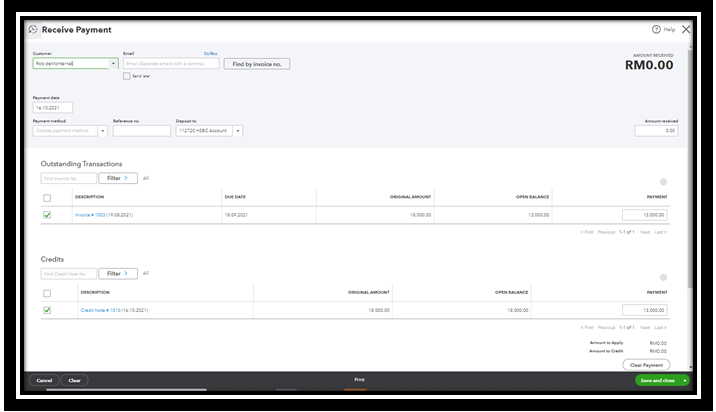

The initial invoice is left unpaid when a customer only pays a portion of the total amount. To settle the balance, you can record the partial payment and write off the bad debt.

Here’s how:

See this article to learn more about receiving invoice payments: Record invoice payments in QuickBooks Online. This includes the steps to edit or delete and to group multiple payments together.

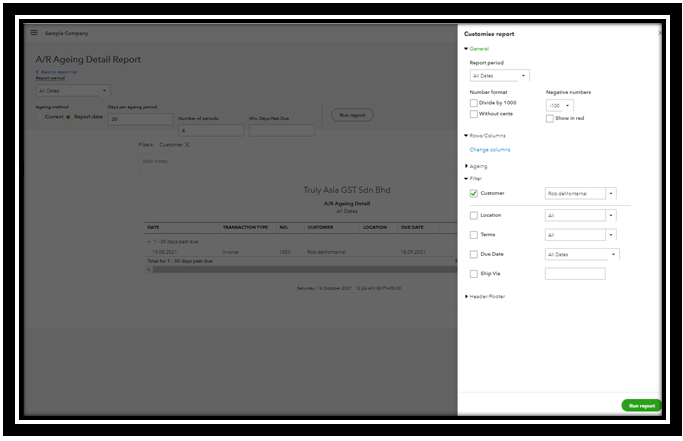

Afterwards, let's launch the Accounts Receivable Ageing Detail report. This will help us track all uncollectible invoices from your customer. I'll show you how:

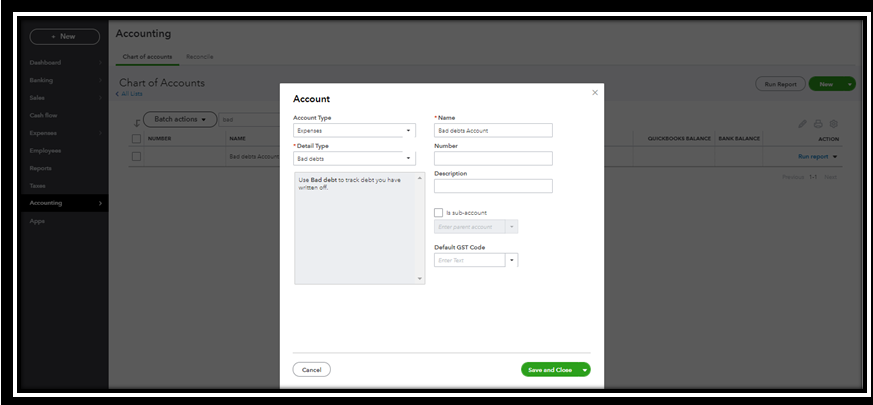

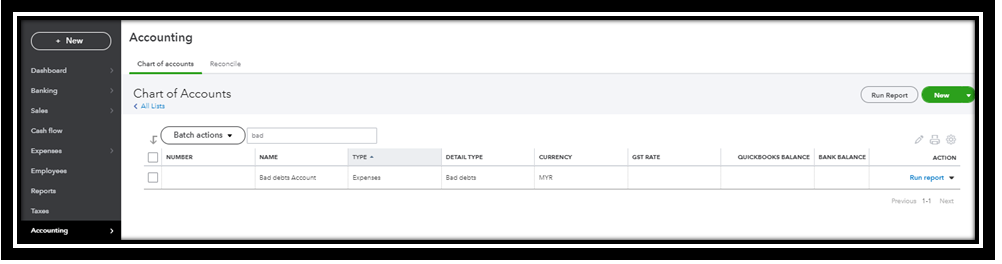

Next, let's set up a bad debt expense account by following these steps:

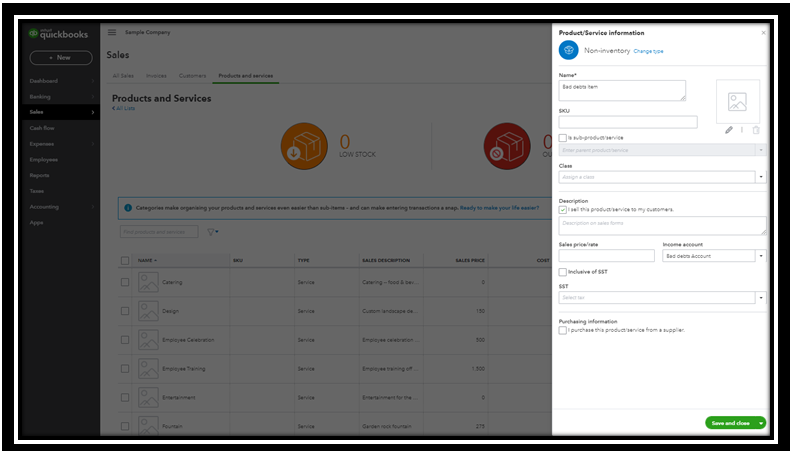

Then, you'll need to create a non-inventory item to balance the accounting. Let me show you how:

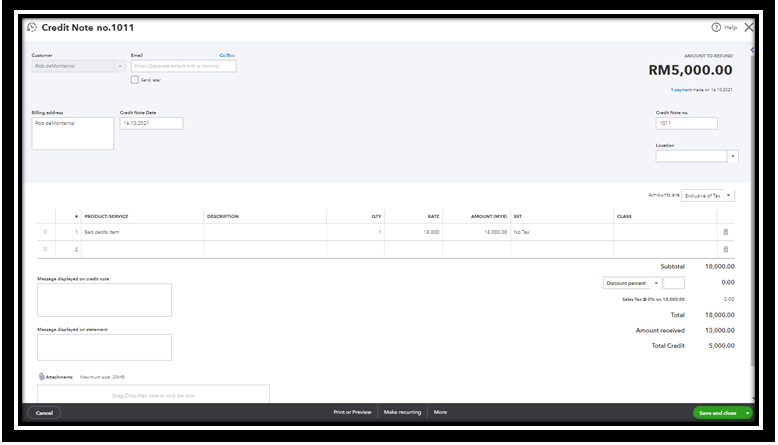

Once done, create a credit note to write off the transactions. Follow the instructions below:

To proceed with linking the credit note to the unpaid portion of your invoice, go to Step 5: Apply the credit note to the invoice section in this guide: Write off bad debt in QuickBooks Online. Lastly, you can continue to Step 6: Run a bad debts report on all the receivables you tagged as uncollectible. I've added snippets below:

I've also attached some resources that will walk you through personalising your sales forms and reports in the program:

Please know that you're always welcome to post a reply in this thread if you have any other questions about recording invoices. I want to make sure that this concern is taken care of. Stay safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here