Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello there, @kedargraphic.

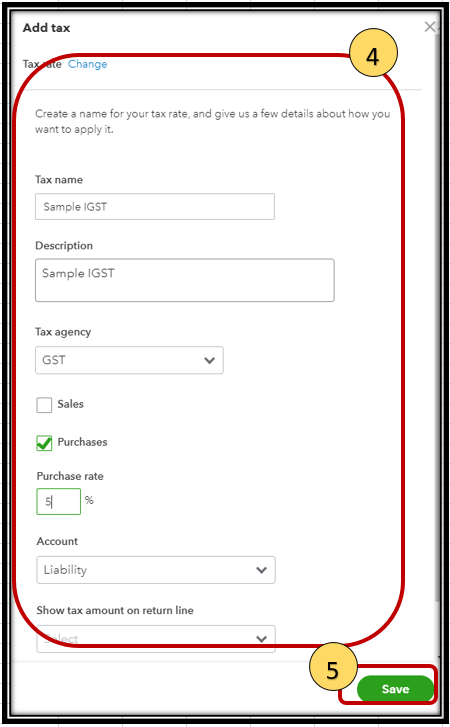

You can create a VAT rate for this specific CGST and IGST. This way, they will show up, and you can select them upon making the bill. I'd be happy to walk you through on how to do that.

Let's starts by adding a new tax rate in the system. You'll need to create two tax rates in this case, one for CGST and one for IGST.

Here's how:

Repeat the same steps until you have the two different VAT rates already.

Once done, you can now generate a bill and utilize the said VAT rates. Make sure to use the rate per line item, so the IGST and CGST will be calculated in the bill.

Please see these sample snips for your visual reference:

To add up, you can also check out this article for more information about how to apply IGST on your sales transactions, in case you need them in the future: Enter IGST rates when creating invoices and sales receipts.

Let me know if you need additional information by clicking the Reply button below. I'm always right here to assist you. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here