Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

By following these instructions, the withheld tax amount will be fixed! @userjamalshah-mapl.

There are several processes to handle customer's withholding in QuickBooks Online. You’ll want to set up a withholding tax expense account first to track the charges.

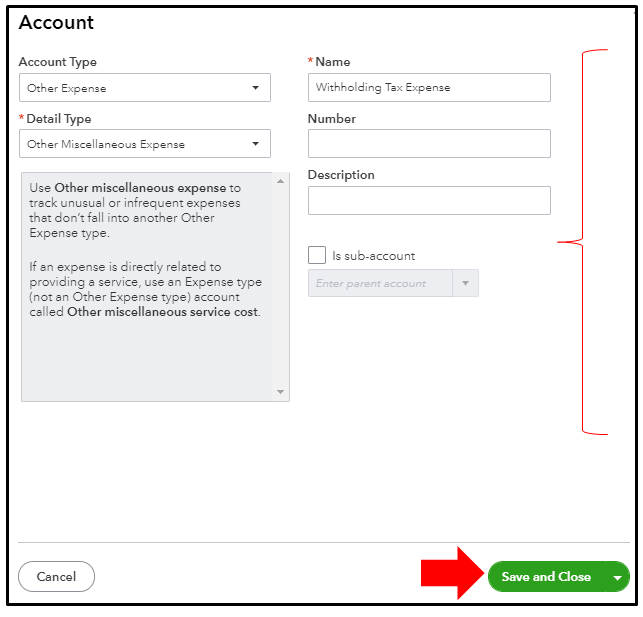

Step 1: Set up a withholding tax expense account:

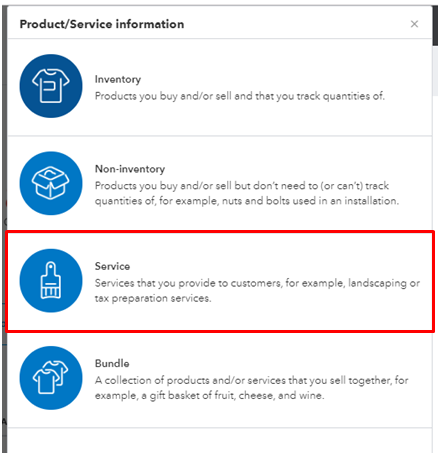

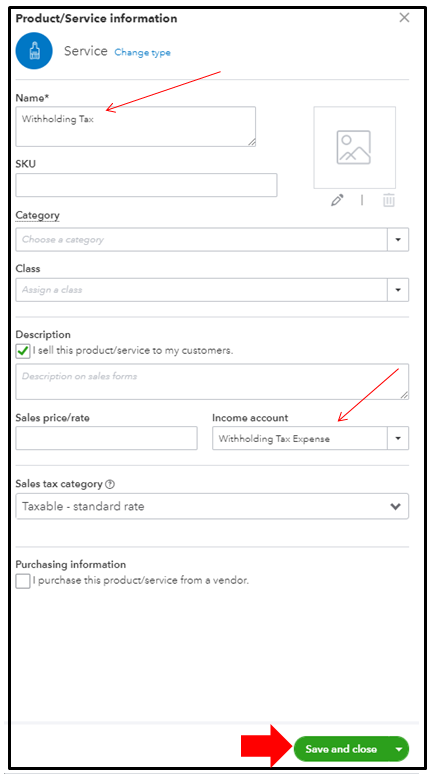

Step 2: Set up a withholding tax expense item:

Once done, please proceed to Step 3 and 4 found in this article to create a credit note so we can apply it to the invoice payment.

Check out this reference for more insights on how to record multiple, partial, and joint invoice payments in QuickBooks.

I'm always here to help and provide you additional assistance if you have follow-up questions about the payment. Stay safe and have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here