Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I wish you didn’t have to go through all these hurdles, @LHCbz. I'll take it from here and ensure you'll be able to correct the entries to refund your customer.

I understand the importance of having your entries properly recorded in accordance to when they are paid. I also appreciate your effort to search for an article and reach out to our Support Team. Let's work together and clean up those expense and credit on file.

The article you’ve shared above is for the US customers. In this case, the steps you provided above doesn’t apply to your situation. Don’t worry, I’ll help you get back to business with ease.

I also agree that you’ll need to record a refund to your customer using Cheque or Expense, since they want to redeem their remaining credits. This reduces your bank's balance and offsets the customer's open credit, overpayment or prepayment.

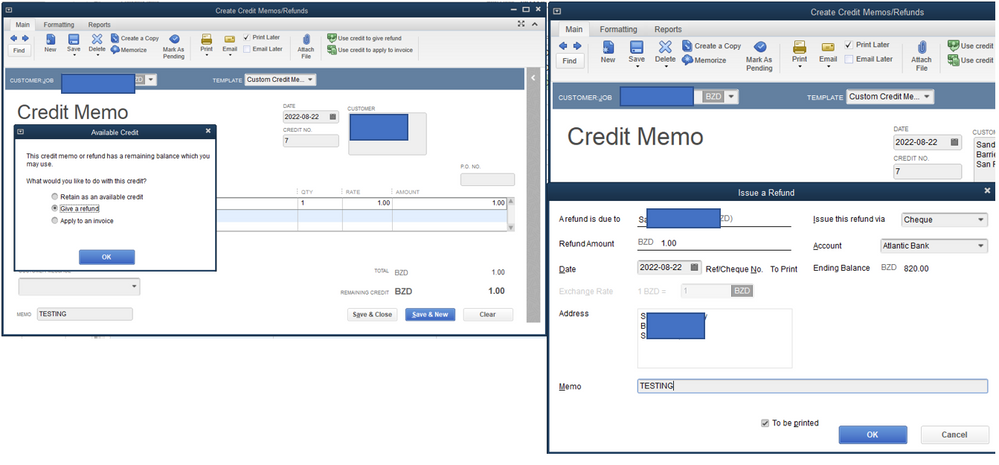

I would also like to clarify that we can link a cheque or expense to the customer’s credit. I’ll show you how:

If you’ll want to review the process outlined above, you can check out the Refund a customer’s overpayment or credit section from this article: Record a customer refund in QuickBooks Online. This will walk you through how to return your customer’s money according to various scenarios.

If you need more help with recording your customer’s refund, please let me know and I'll lend a hand. I'll also hear you out if you have other concerns in managing your invoices and credit note entries in QuickBooks. I'll see you again soon.

Thanks for getting back and providing us screenshots, LHCbz.

To ensure we can link the expense to the customer's credit memo, we'll need to make sure that the Accounts Receivable is being used to your expense transaction.

Here's how:

After that, we can follow the steps above in linking the transactions. See the sample screenshot below:

We can visit the following write-up: Sales and customers. This will provide us with links on how to manage your company income as well as other customer-related concerns.

I'm only a post away if I can be of additional assistance or need more help with QuickBooks. I'm always here to keep helping. Wishing you a wonderful rest of the week, LHCbz.

Hello Rose,

Let me repeat, for your second screenshot, my existing expense for the customer does not show up in the payment screen, nor does the check box that would allow me to select the credit note appear. This function is NOT available to me. The expense does not show up under the client's transaction list either.

I can't do an AR account, we need to refund from a liability as that's where the $ were deposited to initially, the rent in trust.

This is what I see, and none of what you're asking me to do exists.

The only option I have left is to do a reverse payment, ie a negative amount, and apply it to the credit memo. Except the credit memo can't be selected, so I can't do that either.

I have followed the instructions yet due to all of the errors, I literally can not do a refund.

Please see attached what the desktop version does. This is the way I've done it for 20 years, it makes no sense that the QBO doesn't follow the same functionality. Please make a Change Request to your developers to revise the online version to follow what the desktop version has done for many, many years. That this core functionality doesn't exist in online when we both know that this function has already been done, by your company, in the past, is inexcusable.

This isn't the kind of impression that I'd like you to have and we know how much time it can take when something isn’t working the way you need it, LHCbz.

I know how beneficial it is to your business to revise the online version to follow the desktop version in applying credit memo. With this said, I'd recommend sending this request straight to our product engineers through feedback. Sharing features and options that you would like implemented is how our engineers look for new product updates. Here's how:

I appreciate you for the workaround to do a reverse payment and apply it to the credit memo. We can also do a journal entry as the last resort for entering transactions. They let you move money between accounts and force your books to balance in specific ways. Before doing this, it would be best to consult your accountant on what posting accounts you'll need to apply to process payment for the customer credit memo.

In case you need help with other QuickBooks Online-related tasks, feel free to browse this link to go to the page. It has our general QuickBooks topics, video tutorials, and Community answers: View all help for QuickBooks Online.

I can assist you with other tasks and processes in QuickBooks Online. Just leave your questions or concerns here and I'll answer them.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here