Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

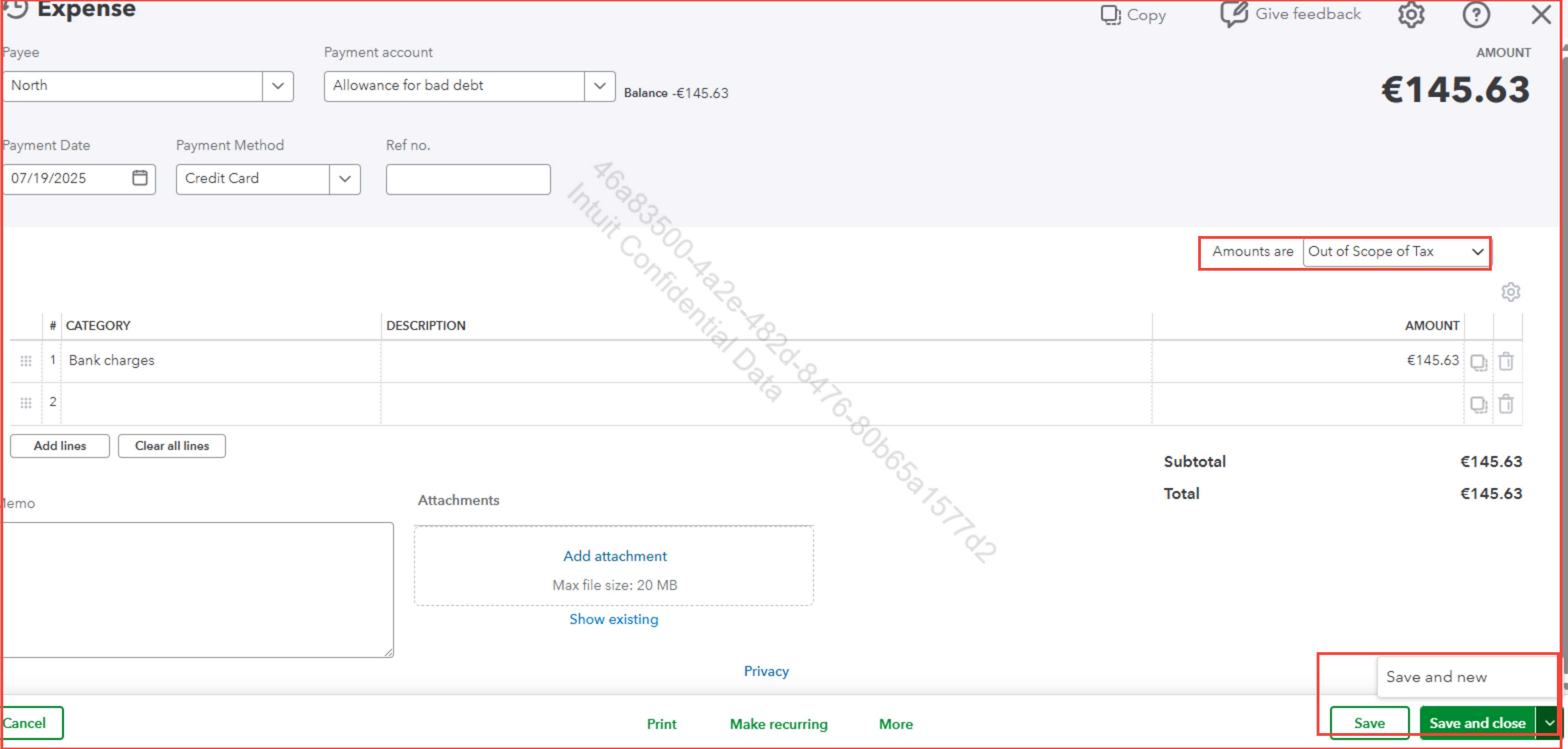

Once VAT is enabled, you’ll need to select the 0% VAT option for transactions, Laura. However, if you prefer not to include VAT on certain transactions, I suggest choosing the Out of Scope of Tax option instead.

Here’s how:

To ensure your transactions are accurate, I recommend consulting your accountant or tax advisor to determine the correct rates and their applicability.

Additionally, you can refer to this article for guidance on selecting and setting up commonly-used VAT/GST/GCT/IVA/ITBIS/TOT rates: How do I set up sales GST/VAT rates and use them on forms? (International QBO)

If you have further questions about VAT, feel free to reach out to the Community for assistance.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here