Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I would like to get advice on how to handle expenses paid by company credit card.

We do not connect Quickbooks to our bank and will book the entries into QBO manually.

Thank you very much.

Regards,

SY Chan

I got you covered with this expenses concern, @sychan.

If you're referring to recording a company expense that was paid by a company credit card, you can track this as a regular expense. This is because the entry is just an ordinary money out transaction of the company.

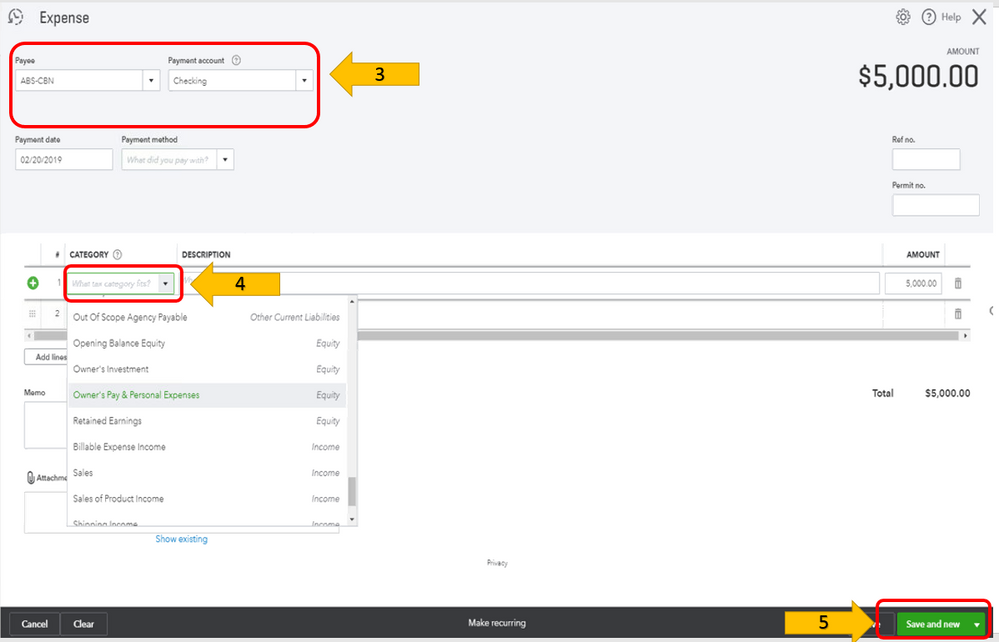

To do that:

Here's a link which contains a short video clip on how to perform this process for your visual reference: Learn how to create, edit, and delete expenses such as cash or check purchases in QuickBooks Online.

However, if you've paid a personal expense using a company's credit card, you must first record the personal expense using the company's account and then reimburse the company afterwards.

Let me guide you how:

Once you record the expense, you must reimburse the company for the amount of the purchase.

To do that:

To learn more about managing paying expense with personal funds, you can always check out this link: Learn how to record business expenses you made with personal funds in QuickBooks Online.

Be sure to let me know how else I can empower you to make QuickBooks work the way your business needs. Thanks for coming to the Community, wishing you continued success.

Thank you @BettyJaneB

Confirm that we are using Company Credit Card to pay Company expenses.

However, when creating new Expense transaction, I cannot exactly following your steps:

Please clarify, thank you.

Also when settle the credit card outstanding from our bank, do we use "Pay down credit card" or "Transfer" funds from Bank to Credit Card?

Please advise.

Thank you very much.

SY Chan

Hi, sychan.

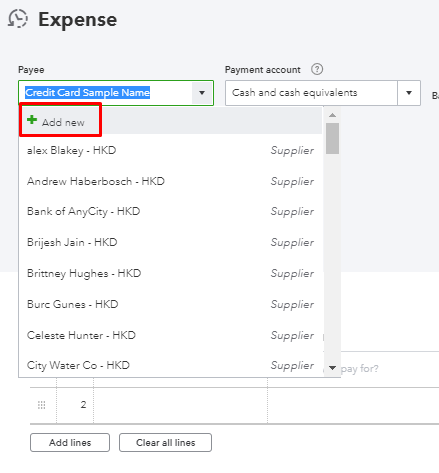

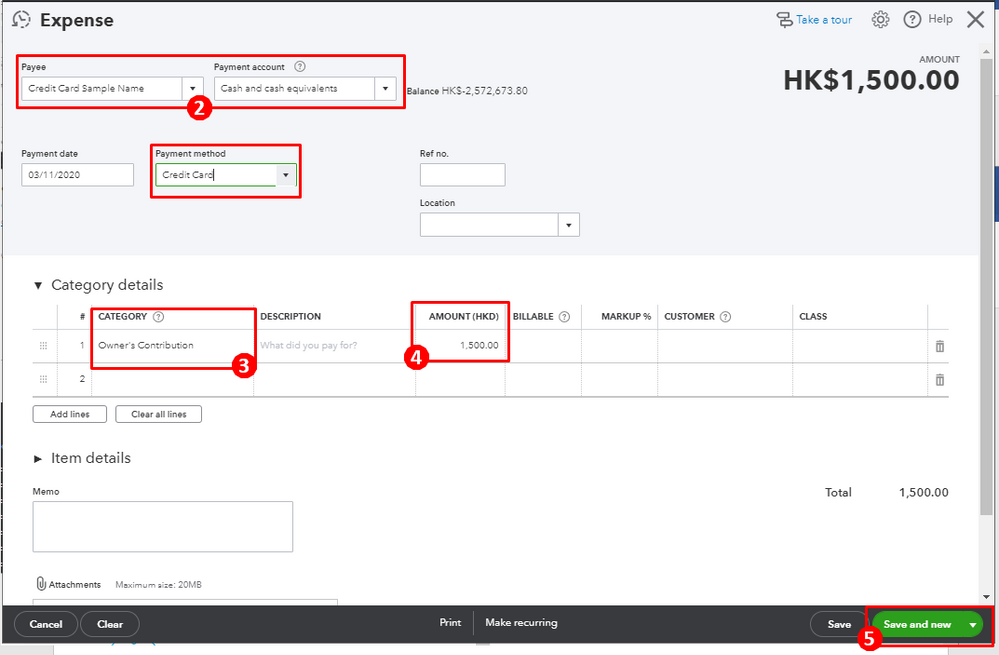

Allow me to step in and clarify the steps for you. I'll be attaching screenshots as well to serve as your visual reference.

The Pay down credit card option is the main way of recording credit card payments in QuickBooks Online. For other ways of recording your card payments, you can go through this article for the detailed steps: Record your payments to credit cards.

You can always come back to our forum for other questions or clarifications. I'm here to help. Have a nice day!

thanks @Rose-A @BettyJaneB

I am confused by your further explanations.

Please refer to my screen capture. Thankyou.

SY Chan

I appreciate the screenshot that you gave, @sychan.

It's my priority to help you track your expense in QuickBooks Online. Let me provide further clarifications in this matter so you can get back to business.

When creating the expense, enter the name of the supplier where you pay the expense in the Payee box. Then from the Payment Account, select the name of your company's credit card used. Please see the screenshot attached for your reference:

Moreover, you can directly select the expense account on what the expense is intended for. Based on the screenshot that you've shared, you can choose the Utilities: Website & Hosting account for the Category. There's no need for you to select the owner's equity since the expense is for the company and the credit card is company-owned.

Know that the instructions given where you need to select the owner's equity account is only applicable if you're paying an expense using your personal account.

To add up, in case you're paying a service for your supplier, you may utilize the Item details field on the expense transaction and select the item from there. Here's a sample snip on how it will look like:

Lastly, I'd like to share this great reference that you can use to help you in recording payments you make to your credit cards in QuickBooks Online: Record your payments to credit cards.

I'll be right here to help if you have any questions about this or need anything else, SY Chan. Keep safe!

thanks @BettyJaneB

Your approach makes sense. thanks a lot I understand now. I will update my entries accordingly.

SY Chan

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here