Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I understand the importance of the categorization of a bank transaction for a loan given to others, kannan. . It's my priority to ensure that transactions are accurately recorded in QuickBooks Online (QBO).

We can create and set up a liability account so you can record the loan.

I recommend consulting your account to ensure that your specific category is accurate.|

Now you have an account with the full loan amount. Whenever you need to make a payment toward the loan, you can record it against this account.

Then, we can issue a check for the loan. To do so, I'll show you how:

I recommend consulting your account to ensure that your specific category is accurate.

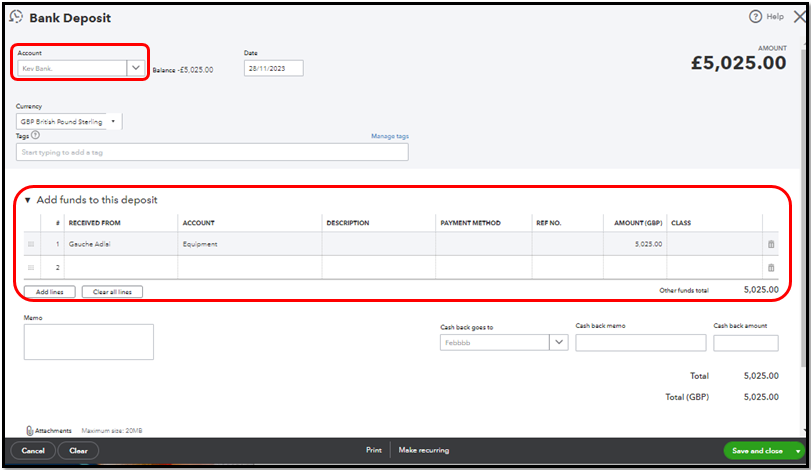

Then, create a bank deposit for the same amount that went back into your bank account.

Additionally, I'm sharing this article to assist you in recording the loan and its payments: Set up a loan in QuickBooks Online.

Moreover, utilizing specific account reports can provide detailed insights into various aspects of your business.

Feel free to reach out in the Community for further assistance recording your stolen vehicle in QBO. We're always here to help. Take care!

How loan given to others become expenses? I am not sure if you understand my question correctly. I have given loan to company X and want to record properly either account receivable or something which should show in report.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here