Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Thanks for checking in with us, niveditacolorz.

May I know if there's an error message when saving the GSTR 1. This helps me to better isolate the issue. At this time, there's no Tax rate% column when running the HSN-wise summary of outward supplies. However, the rate is available in Section 4 where it will display invoices with line items that have been taxed at 0% GST, IGST and Exempt GST, IGST if a non-zero GST or IGST rate has been applied to another line item included in the same invoice.

The HSN-wise summary of outward supplies includes the total quantity for all the HSN which have been included in transactions of the type Invoice, Sales Receipt and Credit Note. This is for the filing period along with total value (before discount) and taxable value per HSN. If the Product HSN codes are updated in QuickBooks and those products are used in the transaction they will be listed in this report. To learn more about this one, see the Know more about GSTR-1 Summary and Detailed reports in QuickBooks article.

Feel free to visit our Tax page for more insights about managing your taxes in QuickBooks.

I'm just one post away if you need a hand with exporting your reports or any QuickBooks related. I'll be here to ensure your success. Have a great weekend.

There is an error shown while saving rhe GSTR 1. This tax% is a new addition to the GSTR 1 report on the GST website. Other softwares are making this update.

Hi there, @niveditacolorz.

I'll make sure to relay this message to our team in concern here on my end and add your vote for this one. This way, they can add this tax% to the GSTR 1 report. You can also share your thoughts and ideas through your account. Our product development team reviews all the feedback we receive to ensure we’re meeting the needs of our customers.

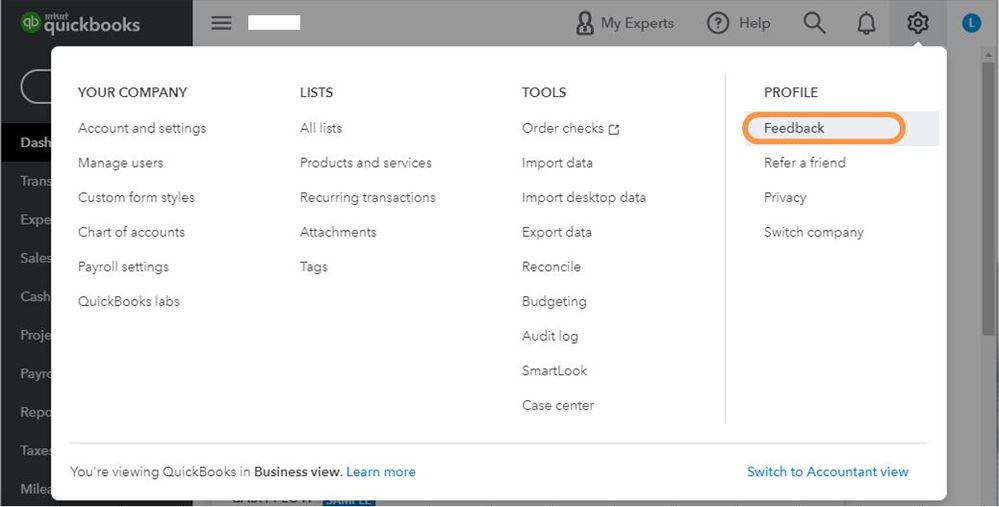

Here's how:

You can also check out our guide for your convenience: How to Submit Feedback.

To learn more about recent improvements, news, and product enhancements, visit the QuickBooks Blog. You’ll also get suggestions on how to grow the business.

If you have any other questions, just let me know and I'll be happy to help. Thanks again for reaching us and have an awesome day!

When will this issue get fixed ... Have been updating manually HSN data in gst portal from past 7-8 months... QUICKBOOK IS NOT GST COMPATABLE NOW>>>> how long will you guys take to update this.... pathetic service.

Being able to add the new requirement of the tax rate in the GSTR 1 HSN is our top priority, Ismailcqc.

For now, we're unable to provide you with a definite time frame on when this will be made available in QuickBooks Online (QBO). You'll want to check out the customer feedback page if this has already been requested or submitted. If not, you can directly submit a request. Also, you'll be able to view some of the recently updated ideas that were being implemented.

I've also added some resources that you can check for more information:

Additionally, you can run different kinds of reports in QBO and customise them to get the information you need. For more details, please check this out: Customise Reports In QuickBooks Online.

Feel free to let me know if you have any concerns about GST/HSN. Remember, I'm here to further assist you.

Any update on this....it's been ages.. you guys yet to add this gst rate % criteria...

Currently, this GST tax rate criteria is still unavailable in the GSTR 1 report. Please know that we're already aware of this new requirement.

To add your vote and help improve your experience in QuickBooks Online, I'd still encourage directly sending feedback to our Product Development. We always track the requests that we receive from our customers and take them into consideration when prioritizing feature development. Here's how:

I'm also adding these articles to learn how to file your GSTR1 and help manage the transactions that make up your GST report:

Don't hesitate to add a comment below if you have any other concerns or follow-up questions. I'll always have your back.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here