Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

We'll have to turn on the VAT function so we can start collecting taxes on sales and purchases, hicham. Also, I'll guide you on how to set up the VAT rates specific for purchases.

We can easily follow the Step 2: Tell QuickBooks where you collect VAT section of this article to activate the feature: Set up and use VAT in QuickBooks Online.

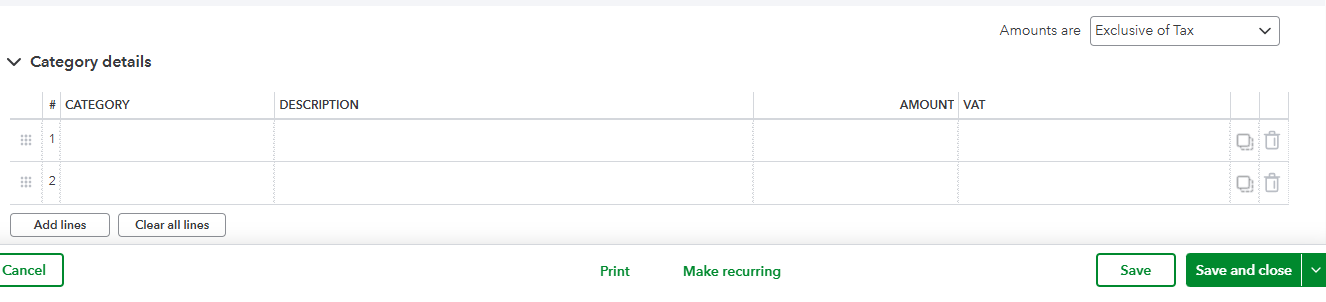

With that, here's how to set up a tax rate specific for purchases:

When we create Expenses, Bills, or Cheques, we will now have the option to collect withholding VAT.

From there, we'll know how much VAT we owe and file the VAT returns.

Let us know if you have additional queries on how to handle your taxes in QuickBooks Online.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here