Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I see you've already entered the Start date and Filing frequency correctly. To make sure your VAT setup works perfectly, let's quickly double-check a few more things, Ziad.

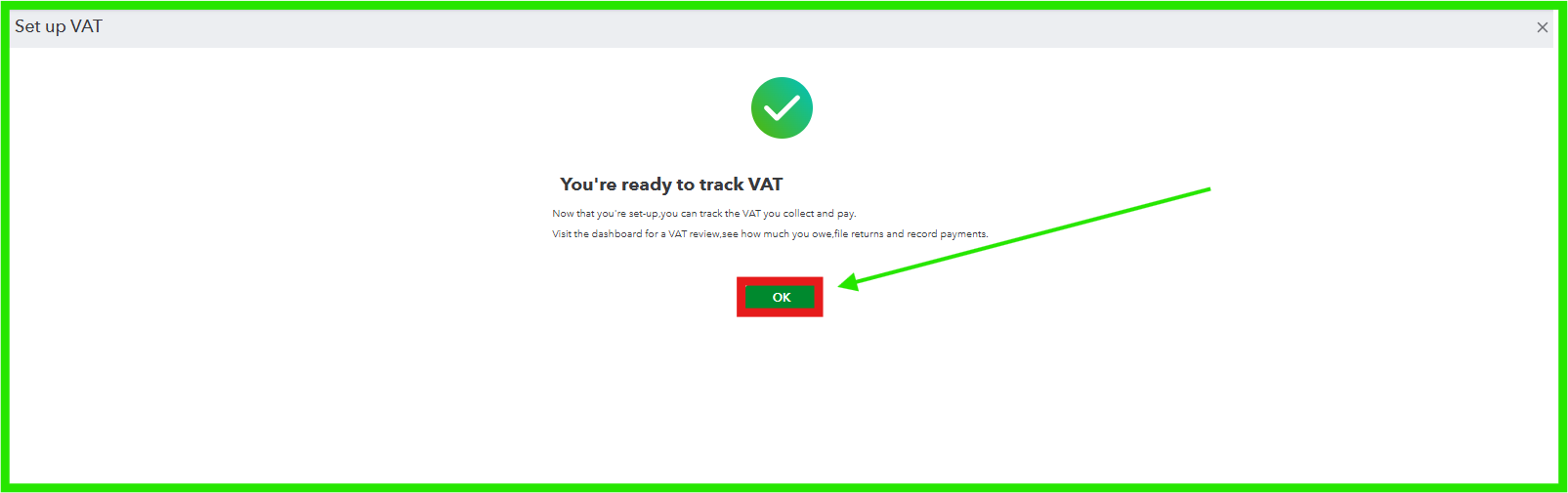

After entering the Start of Tax Period, Filing Frequency, Reporting Method, and Tax Registration Number (TRN), please click "OK" under the message that says "You're ready to track VAT." This action will successfully enable the VAT feature in QuickBooks Online (QBO).

Take a look at the image below for a visual guide:

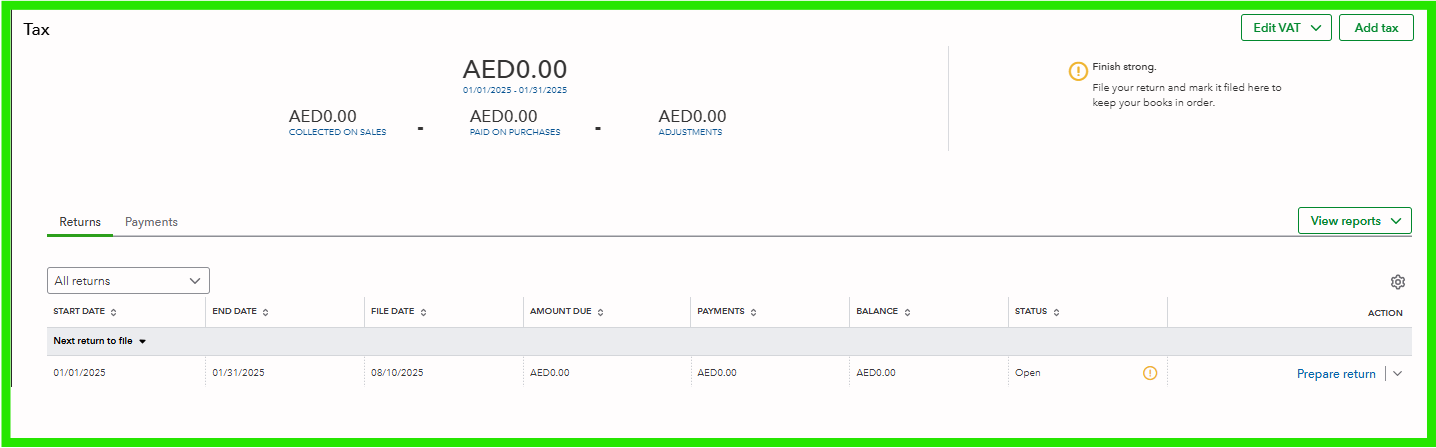

Once you have click OK, you will be routed on this page where you can file your tax return.

When you add a Tax Registration Number (TRN) to your company details in QuickBooks, the system performs a quick validation check. If the TRN cannot be validated or is determined to be incorrect, there's no need to worry. QuickBooks will automatically send you an email notifying you that the TRN has been removed from your details, allowing you to update it accordingly.

You can check this article for detailed information about the VAT feature in QBO: VAT Feature Update FAQ

If you have further questions, please respond below. The Community team is always here to assist.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here