Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have changed my sales area and created entries for the sales tax agencies I deal with. However, I still get see the other sales tax agencies I no longer deal with on my Sales Tax Liability report.

I have made those other agencies inactive, but they still display with all zeros. I even inactivated the sales tax item lines associated with those agencies. I am reluctant to delete them since I may need to provide reports for an audit someday.

How can I set an indicator on the old tax agencies so they are not displayed on my Sales Tax Liability Report?

Solved! Go to Solution.

Hi there, FairfieldPhoto.

Thank you for posting here in QuickBooks Community. I appreciate you for sharing detailed information about your concern. With this, I'll be sharing details on how sales tax agency works in QuickBooks. Then, to ensure you're able to remove those agencies on the report.

Some customers are required to deduct tax from their invoice payment and then pay that tax to the government. Thus, the inactive sales tax agency will still show on your reports as long as there are transactions associated with it. QuickBooks only removes the tax rate or agency from the Taxes page. This helps keep your data intact and accurate.

However, you still have the option to remove those sales tax agencies on the Sales Tax Liability Report. To do this, you'll have to click all the transactions connected to the specific agency that appears on the report. Then, change the tax agency to another one. This way, the particular transaction will remove and be added to another agency that is activated.

I suggest consulting an accountant before performing the process. They can provide suggestions on how to properly handle Sales Tax Liability concerns.

Lastly, please refer to this article to view different details on how the Sales Tax Liability report in QuickBooks Online provides information on how much sales tax you owe: Check how much sales tax you owe in QuickBooks Online.

Post a reply below if you have other concerns or questions about taxes in your QBO account. I’m more than happy to help you out again. Have a good day ahead.

I don't believe this solution will work - I have hundreds of completed transactions associated with the old transactions and going through them to change the tax agency will take a very long time and I feel "breaks" the proof that I have paid tax to those agencies. All these transactions are closed/completed, so there is $0 showing for the tax liability for these legacy tax agencies.

I would prefer to not go back and change hundreds of transactions, but rather, flag a legacy tax agency as "inactive" and no longer see it on the Sales Tax Liability report. Ideally, the only agency I should see on my Tax Liability report is the current/active tax agency.

I have attached a Sales Tax Liability report screen shot. The ones that are flagged "Hide/Don't Display This Tax Agency" haven't had any taxes collected for them for years. I know I can click the twistie to collapse the list of tax elements, but I want those tax agencies to not even show up on the Sales Tax Liability report.

Hi @FairfieldPhoto,

I have some information about removing the inactive sales tax agency from your reports. Currently, we're unable to filter the report that way. Another workaround is to export the report to Excel. From there, you can delete or remove the rows for inactive accounts.

To export:

An Excel Spreadsheet will open, from there you can remove the rows for inactive accounts. Learn more about exporting in this article: Export your reports to Excel from QuickBooks Online.

In case you need help managing your sales tax, check out this link to go to the page: Tax.

Don't hesitate to reply anytime if you still have questions or concerns with sales tax. I'll be around for you. Take care and have a great day ahead.

Thank you for the follow-up.

I would appreciate adding an enhancement request for a future version of QB that will allow me to filter based on tax agency being "inactive" so this report can be more useful reflecting currently active tax agencies.

Thank you!

-Mike

Your voice matters to us, FairfieldPhoto,

I can see how the functionality to filter the Sales Tax Liability report based on tax agency would be beneficial to your business. With this, I'd recommend sending a feature request directly to our Product Development team. This helps us improves your experience with the program.

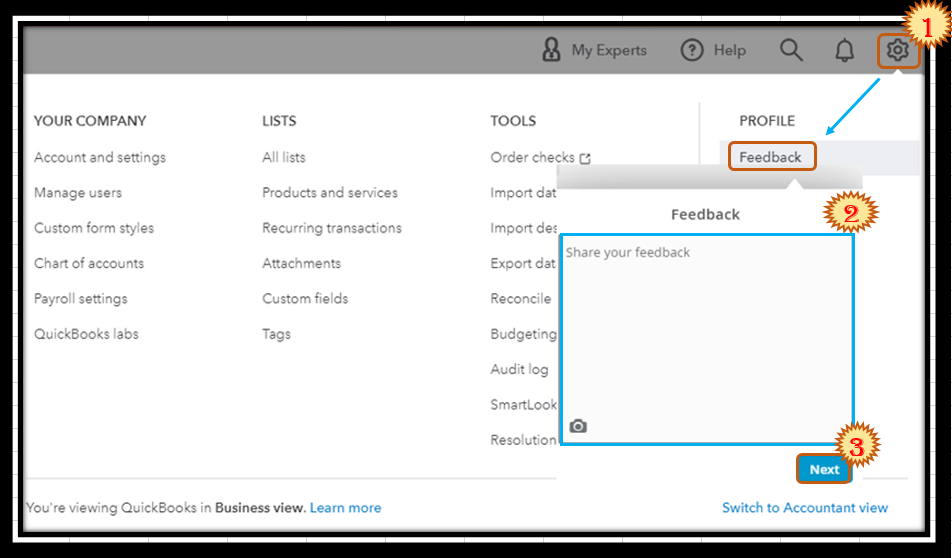

Here's how:

Also, you can track your feature request through the Customer Feedback for QuickBooks Online website.

Additionally, I've added these articles that'll help you learn more about running and customizing reports in QuickBooks Online.

I'm only a post away if you need more assistance personalizing reports in QuickBooks, FairfieldPhoto. It's always my pleasure to help you out again.

Done. Thank you!

-M

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here