Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

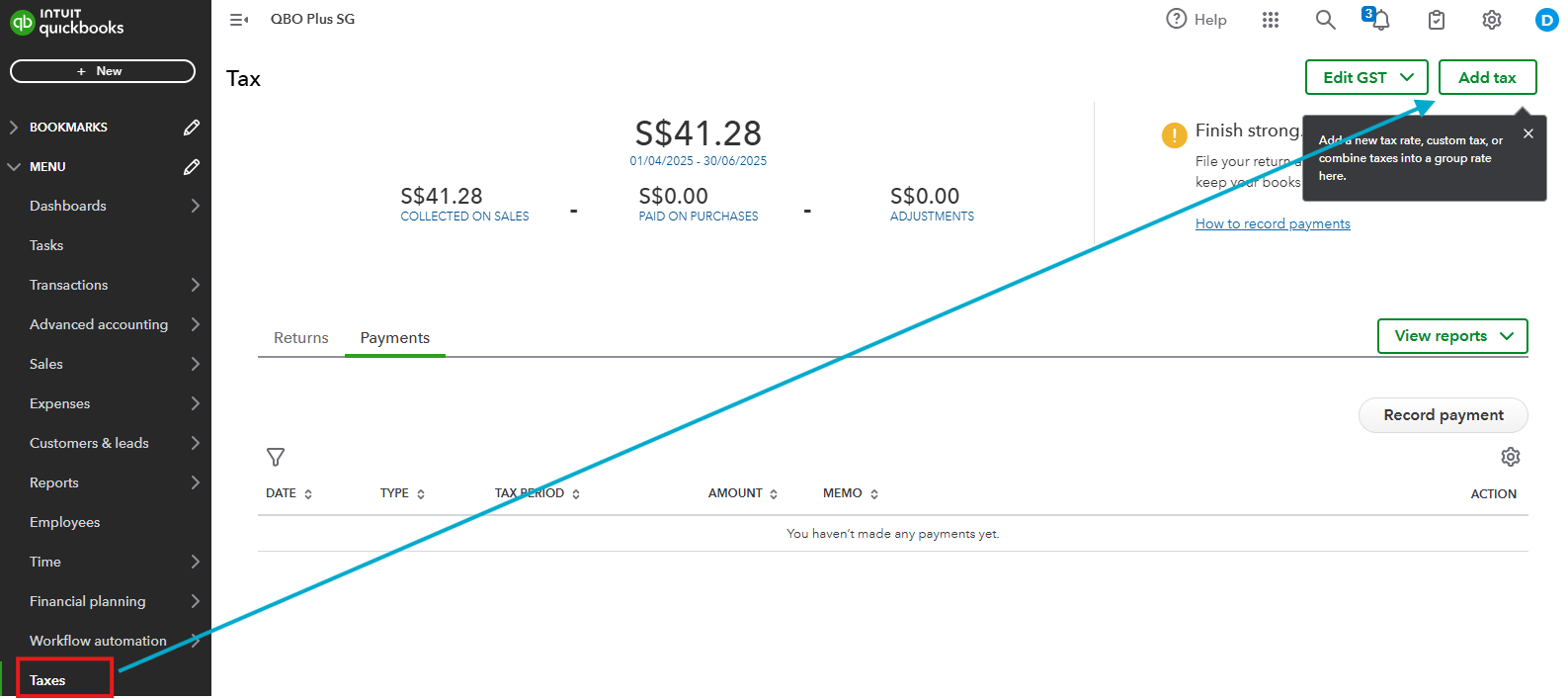

The taxes collected on sales and paid on purchases will only show up once you have properly configured taxes in Taxes Centre, Elaine-Daisley.

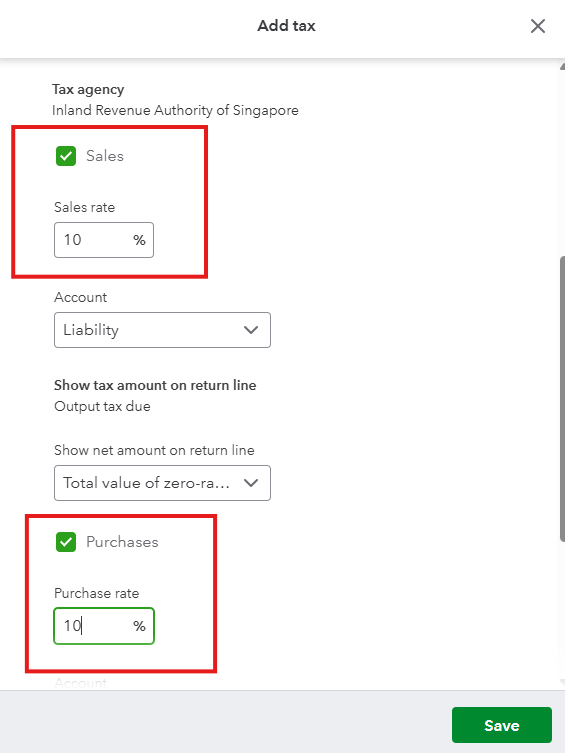

You'll have to make sure that the tax is being added and applicable rates for sales and purchases are configured correctly for the taxes to appear. To do so, follow the steps outlined below:

It is also worth noting that when you mark a return as filed, the amount in the Collected on Sales and Paid on Purchases will zero out because the system interprets the filing as an indication that these amounts have been paid.

You may want to run the Transaction Detail by Tax Code to confirm whether taxes are being calculated correctly. This helps identify issues with transactions that may not be pulling to the Tax Centre.

By keeping track of both tax collected on Sales and Paid on Purchase, this ensures you have a clear visibility into your tax obligations and easier to file your taxes accurately on time. Please get back to us if you need further assistance in anything with your taxes. We'll always be around to help you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here