You can never have 100% certainty when running a business, but with the new cash flow planner, you get customised, data-driven financial insights to help you make informed business decisions. Generate an overview of your cash flow, and plan the future for your business by projecting future expense and income scenarios — without editing your actual financial records.

Effortlessly manage your business operating cash flow right in QuickBooks

Take control of your cash flow

Connect your bank to start getting cash flow insights. Discover ways to improve your cash flow, like chasing overdue invoices, and review which recurring expenses are unnecessary and can be trimmed away.

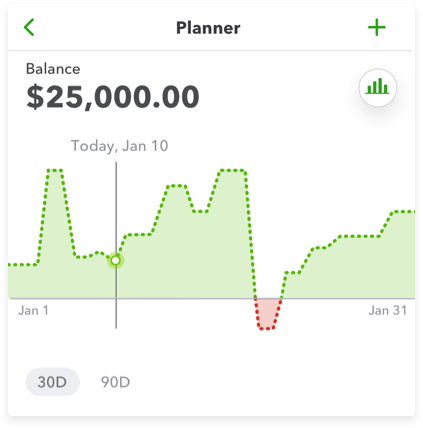

See the future of your cash flow

See how your cash flow might look in the next 90 days, by keying in potential purchases, investments and income scenarios — without editing your actual records.

See your cash flow projection

Stay prepared by forecasting cash transactions over 30 and 90 days. Your data is imported and synced automatically for accurate cash flow analysis, without multiple spreadsheets.

- Look at your future cash flow using the 90-day cash flow planner.

- Run and export reports including profit and loss statements, and balance sheets.

- Share a summary of your cash flow projection data with your accountant.

What is the cash flow planner?

The Cash Flow Planner is an interactive tool that forecasts cash flow, which is the in-and-out of your money over the next 90 days. It looks at your financial history to forecast future money in and money out events. You can also add and adjust future events to see how certain changes affect your cash flow without impacting your actual books.

You also have a Cash Flow Overview to get a picture of your cash flow position and take actions to improve it including:

- Money in – Overdue invoices, open invoices, quotes

- Money out – Overdue bills, open bills and other recurring expenses.

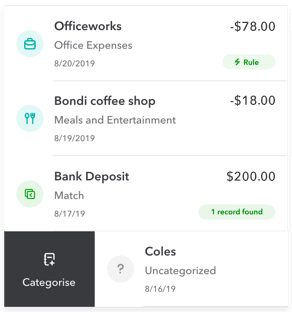

To view the Cash Flow Planner and Cash Flow Overview, go to the Cash Flow left menu item on your dashboard:

How does the forecast work? What data is included?

The Cash Flow Planner chart uses historical data from your bank accounts connected to QuickBooks Online to forecast future recurring income and expenses. This includes categorised and uncategorised transactions. You can also manually include data to forecast cash flow by adding events that may occur in the future.

The Cash Flow Planner chart does not include:

- Credit card transactions

- Transactions you’ve entered manually into QuickBooks

- Multi-currency enabled files

How do I add events for possible money in or money out?

You can manually add events for potential income and expenses. For example, if you have a big sale coming up, add it as an event so it will be a part of the forecast.

Important: Events aren’t actual transactions and won’t affect your finances in QuickBooks.

- Select the Add Event button.

- Select Money in if the event is income, or Money out if it’s an expense.

- Name the event and enter an amount, then select Continue.

- Select the date when the event will occur.

- When you’re done, select Save.

To edit or delete an event:

- Select and open an event.

- Select the Date, Name, or Amount field, or change whether it’s Money in or Money out.

- When you’re done, select Save.

Frequently asked questions

At its core, cash flow represents the amount of money coming in and going out of a business at any time. Cash is king, and good, healthy cash flow allows a small business to have money on hand to spend on necessary items.

But what is considered good cash flow? And what are the characteristics of a strong statement of cash flows? These are questions many small business owners in Singapore ask when they first start tracking cash flow and preparing cash flow statements.

What a good cash flow statement looks like

The amount of cash you should have available can vary significantly depending on the type of business you own and your operations.

With this in mind, there’s no ‘perfect’ cash flow statement that applies to every business – however, there are three general indicators that your cash flow is in a healthy position:

- You record positive cash flow from operating activities: The first requirement of a healthy business is its ability to generate more cash than it spends. As such, your business’s core operations should consistently grow your net cash flow over time.

- Your customers’ payments are prompt: In 2020, the Singapore Business Federation reported that 7 in 10 businesses are facing cash flow issues due to late payments. Late payments frequently contribute to an unhealthy cash flow, as business owners are forced to bear unnecessary expenses such as overdraft fees and credit card interest, in order to tide through periods without cash on hand. Proper cash flow management includes timely chasing of invoices, either manually or via automated payment reminders with an accounting software like QuickBooks.

- Your investments are funded by cash, not financing: Although having positive net cash flow from financing activities may be necessary to expand your business, it should be the exception rather than the rule. Using cash to expand suggests the company is managing its operating activities well and profitably, and does not need to take out new loans. Simply put, it reassures investors that the fundamentals of the business are strong enough and that it can pay for its own growth, instead of relying on borrowing, selling its assets or raising funds.

Quick ways to optimise cash flow and avoid problems

- Streamline your invoicing process: No matter how you track payments, it’s important to be able to see what you’re owed and know how to collect unpaid invoices. QuickBooks makes it easy to manage invoices from end-to-end. You can create, send, track and send reminders to customers, all in one place.

- Reduce outgoing expenses: Look for areas in which you can reduce recurring monthly, quarterly and annual expenses. Can you reduce the cost of utilities, rent, payroll, subscriptions or other unnecessary expenses? Can you split up any large payments so that your monthly cash flow is lower and more predictable? For example, when purchasing machinery, consider paying it off in monthly 0% instalment payments where possible, instead of one lump sum.

- Increase income: Consider how you can increase revenue by exploring new sales channels, expanding your offerings or selling off assets you no longer need for a quick cash injection.

- Expand your payment options: There are plenty of reasons why invoices go unpaid—and a lack of payment options is one of them. It’s a good idea to be flexible about taking payments. Accepting cheques and PayNow payments is a good place to start, as well as accepting credit and debit card payments.

- Consider your borrowing options: Injecting money into your business by borrowing is another way to boost your cash flow. Ask your current financial service provider what they can offer to help you bridge the gap in the case of cash shortfalls. Remember to calculate interest costs carefully to make sure that it is within your business budget!

- Negotiate accounts payable: Negotiating payment terms with suppliers or other payees can help you spread your cash flow more evenly. With more working capital available, you can prioritise your most important expenses and prevent minor cash flow problems from becoming major issues.

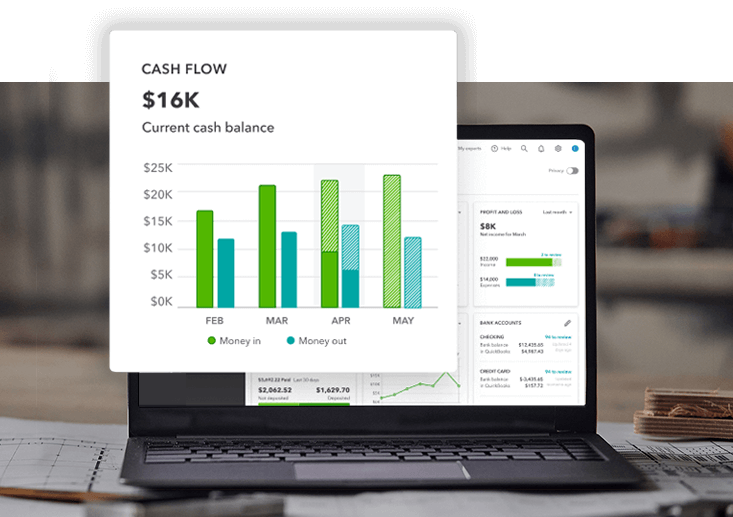

- Customise and automate your financial reports: There are a handful of accounting reports that business owners should be familiar with. Profit and loss statements along with the balance sheet are two examples of reports that need to be checked and understood frequently to understand your cash position.

Perhaps the greatest advantage that accounting software has over Excel spreadsheets, is the ability to customise and automate these reports, so you’ll always have a clear picture of your overall finances, including cash flow.

Tips for managing cash flow effectively

Whether you’re running a heartland nail salon, or a business listed on SGX, managing cash flow effectively is critical to long-term success.

But why does cash flow matter?

Many business owners think profitability is the only crucial metric for success. However, for small businesses, survival comes before success. Without positive cash flow, small business owners will have to resort to borrowing, which creates even more expenses in terms of borrowing costs.

In other words, cash flow indicates whether you can pay for essential expenses like inventory, employees, rent and other operating expenses, with your cash available in the bank. Poor cash flow management is one of the biggest reasons businesses fail. Without access to sufficient cash, a business simply can’t afford to stay afloat.

So, what can you do to ensure your cash flow is healthy? We’ve created a handy infographic with tips for managing your cash flow effectively to help you get started.