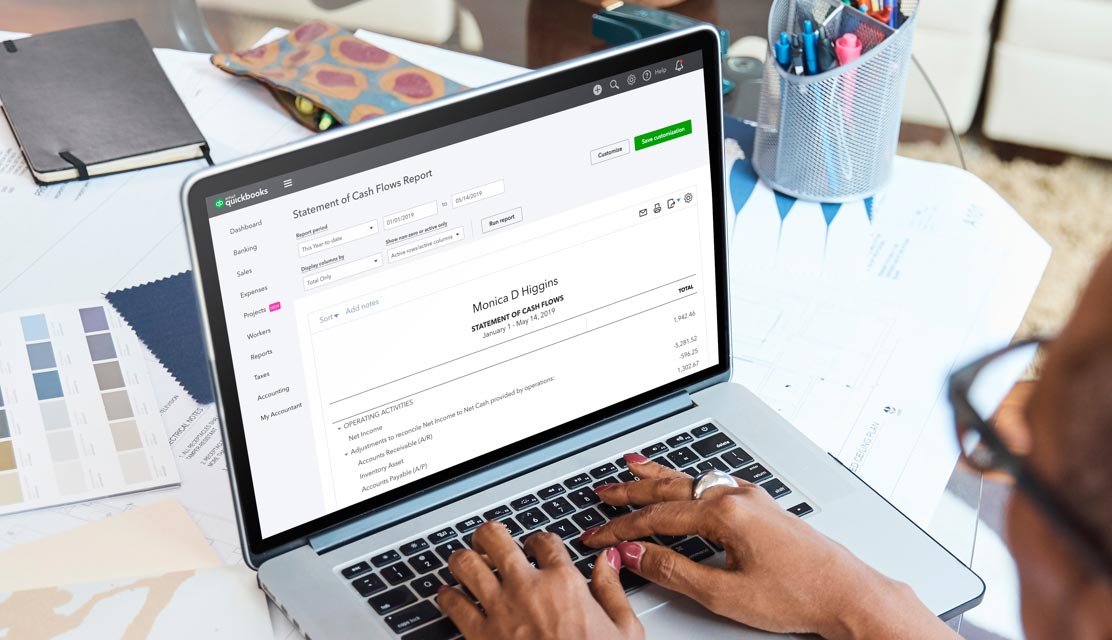

Many small businesses strive to get a better handle on money coming in and going out. This is where cash flow comes into play. QuickBooks tracks and organizes all your accounting data, and can generate your cash flow statement—so you always know how much money you have coming in to cover your bills.

Always know how much cash is on hand

Manage your cash flow

Make better business decisions

Cash is essential to keeping your business financially stable and successful. Quickly generate your cash flow statement with QuickBooks, and you’ll get a clear view of your cash flow for any time period.

Set yourself up for success

The cash flow statement—along with the balance sheet and income statement—is one of the 3 key financial statements used to assess your company’s financial position. QuickBooks can generate all the reports you need to keep your business running smoothly. Even look back in time and predict your future cash flow.

Everything you need to know about your statement of cash flows

How to prepare a cash flow statement

You’ll need to decide whether to use the direct or indirect method of creating a cash flow statement. The difference between the two methods is how you handle your operating activities. Regardless of the method, investing and financing activities are handled in the same manner.

Direct method

This method targets the inflows and outflows from operating activities. This means you subtract the money you spend from the money you received.The direct method, lists the amounts of cash paid and received by your business. In this case, your cash flow statement will include cash received from customers and cash spent on employee salaries, interest, and vendors.

Indirect method

This method starts with your company’s net income (or profit) and factors in depreciation.To use the indirect method, the cash flow statement begins with your company’s net income.Then adjustments are made to convert your accrual net income (income you earned but haven’t yet received) to calculate your operating cash flow.Some common line items you’ll find in an indirect method cash flow statement could include: adding back depreciation expenses, adding an increase in accrued expenses payable, adding the decrease in accounts receivable, and deducting any increase in inventory from net income.Larger U.S. corporations prefer the indirect method when preparing their statement of cash flows because it’s easier to prepare from an accountant’s perspective. It’s also presented in a simpler format.With the direct method, companies have to report all cash receipts and cash payments from operating activities. Under the same method, firms would be required to separately disclose cash receipts and cash payments with detailed subcategories, which can complicate the cash flow statement.With the indirect method, future cash flow projections are simplified due to its consolidated reporting format.

The basics of a cash flow statement

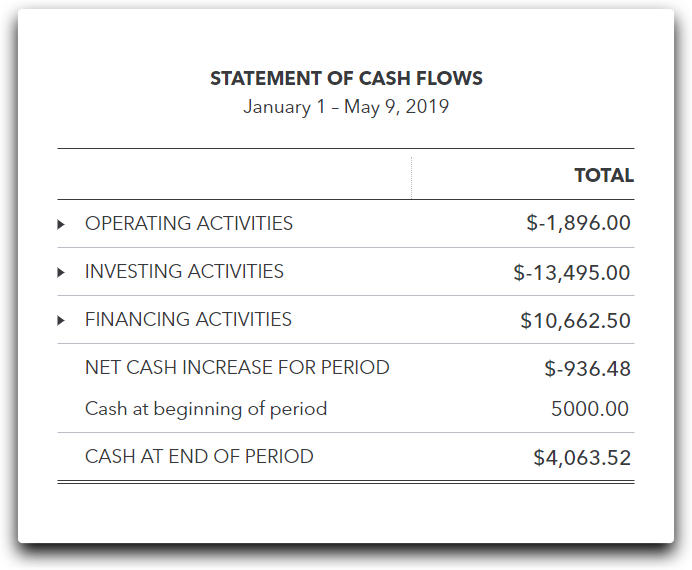

A cash flow statement is broken down into 6 fundamental elements. We’ll examine all 6 to help you understand how each element plays a significant role in managing your business cash flow.

Reviewing and projecting cash flows

Reviewing historical financial statements is useful for identifying trends and learning from previous business decisions. Historical and current data allows you to make future projections — in the coming quarters or years — to meet both short- and long-term obligations.Cash flow projections helps to keep you informed so that you can make better decisions, whether it’s making a big purchase to improve operational efficiency, reducing expenses, or seeking new financing as you grow.Now that you know more about what’s involved in creating, preparing, reading, and analyzing a cash flow statement, you can make more informed decisions and practice proper cash flow practices.With all these tools, resources, and information QuickBooks can make it easier for you to manage your cash flow as a small business owner.

Developing a cash flow statement is essential to understanding your business’ liquidity, which is how well you can cover your current liabilities using your current assets.

Think of a cash flow statement as a snapshot of your company’s cash on hand. Since cash flow statements are widely used among small businesses, it’s a good idea to keep the format consistent.

Why use a cash flow statement?

A cash flow statement tracks money in and money out of your business. It shows how much cash your business has on hand at any given time and how it has increased or decreased over time.

Not understanding cash flow and poor cash flow management are some of the biggest reasons businesses fail. Understanding your business’ cash flow is critical to managing cash effectively and sustaining a positive cash position. It’s important to understand the key cash drivers for your business’ operations as well as how the current period compares to the prior period.

A cash flow statement provides insights into:

- Cash shortages and surpluses

- Business expenses and income over time

- How business changes impact your cash flow, for example hiring an employee

- Areas of wastage or costs that can be reduced

If you’re looking to take out a business line of credit or loan, a cash flow statement can also demonstrate to lenders your ability to repay on time.

What to include in a cash flow statement

Every business is different, so the exact information you’ll need to include in your cash flow statement depends on where your cash is coming from and costs you need to account for. As a general guide, however, a cash flow statement is broken down into three sections:

Beginning cash on hand

This is the amount of money you have available at a particular period.

Cash receipts

This covers all the money coming into your business, including:

- Cash sales

- Collections from customer credit accounts

- Loans or other cash injection

- Interest income

- Income tax refunds

- Miscellaneous cash receipts

Cash payments

This includes all the expenses associated with running your business, such as:

Cost of goods sold:

- Direct product/service costs

- Salaries

- Payroll taxes and benefits

- Supplies

Operating expenses:

- Advertising and marketing

- Automobile/transportation

- Bank service charges

- Business licenses and permits

- Charitable contributions

- Computer and internet

- Continuing education

- Dues and subscriptions

- Insurance

- Meals and entertainment

- Merchant account fees

- Office supplies

- Payroll processing

- Postage and delivery

- Printing and reproduction

- Professional services – legal, accounting etc.

- Occupancy

- Rental payments

- Subcontractors

- Telephone

- Travel

- Utilities

- Website development

Other expense payments:

- Interest expense

- Income tax expense

- Cash disbursements to owners

Free cash flow statement template

We’ve created a free cash flow statement template that you can start using today. This template provides an overview of your cash position and is designed to help you compare changes over time and review the income and expenses that are impacting your cash flow.

While Excel templates can be useful for a new business, they eventually become too time-consuming to use when you’re dealing with a lot more business activity. As your business grows, you might consider switching to accounting software to help you handle most of the work and give you back more time to focus on what’s important.