As a business owner, you need to know where your business is headed, and you must make assumptions about sales, production, and costs. Pro forma financial statements are a great way to assess the financial impact of the assumptions you make.

Pro forma financial statements

What does pro forma mean?

The definition of pro forma is “as a matter of form”, or “for the sale of form”. This Latin term is also used to define a type of financial information.

Inc defines pro forma financial statements as “the process of presenting financial projections for a specific time period in a standardized format.” Pro forma statements are used in a business plan to present the best case, expected case, and worst-case scenario for a proposed transaction.

What are pro forma financial statements?

For business owners, the term pro forma means “what if”. Owners create a set of projected financial statements, including the balance sheet, income statement, and cash flow statement, based on a set of assumptions.

Every small business should create a budget, and the budgeted financial results are pro forma statements. The budget makes assumptions about sales, production, and pricing. An owner may create pro forma reports to assess the profitability of a product, or to determine if a business expansion makes financial sense.

What is the purpose of pro forma financial statements?

A pro forma projection can be used in a variety of scenarios:

- Business loan: A commercial lender will need financial statements for prior years, and pro forma financial reports for future years. Pro forma earnings, for example, project net income, and the ability of the borrower to repay the loan.

- Capital investment: A company’s capital structure may include some combination of debt and equity. Potential investors need a pro forma income statement to assess a firm’s ability to generate increasing sales and profits.

- Financial modeling: Pro forma statements are used to analyze the financial impact of a major business decision. If you’re considering adding a product line, opening a new location, or closing a company department, pro forma reports will project the outcome of your decision.

Pro forma financial reports do not comply with Singapore Financial Reporting Standards (SFRS). Reports must be clearly labeled as “pro forma’. You must distinguish between pro forma and actual financial statements.

What are the benefits of pro forma financial statements?

Pro forma financial statements help owners identify growth opportunities, and limit risk.

Assume, for example, that a retailer creates a pro forma income statement for the upcoming year. The income statement includes these categories:

- Sales

- Cost of goods sold: Direct material and labor costs incurred

- Gross profit: Sales less cost of goods sold

- Operating expenses: Overhead costs

- Net income: Gross profit less operating expenses

Each of the line items can be changed to create different scenarios. For example, sales might be presented as 15% higher (best case), 5% higher (expected), 20% lower (worst case). If material costs increase sharply, or there is a shortage of labor, the cost of sales will increase.

An owner can create pro forma financial statements and consider these questions:

- If I take on a new customer to increase sales by 15%, what is the cash flow impact if the customer pays in 30 days? What if the accounts receivable balance isn’t paid for 45 days?

- If I start buying materials from a new supplier, what is the impact on production if the supplier ships materials 20 days later than promised?

- To add a new product line that my customers want, I need to borrow from my line of credit. How much in total liabilities can I take on, and still make the required principal and interest payments?

Pro forma financial statements are a great tool to evaluate alternatives. Every business has limited resources, and pro forma reports can help you make better decisions regarding limited resources.

How do you create pro forma financial statements?

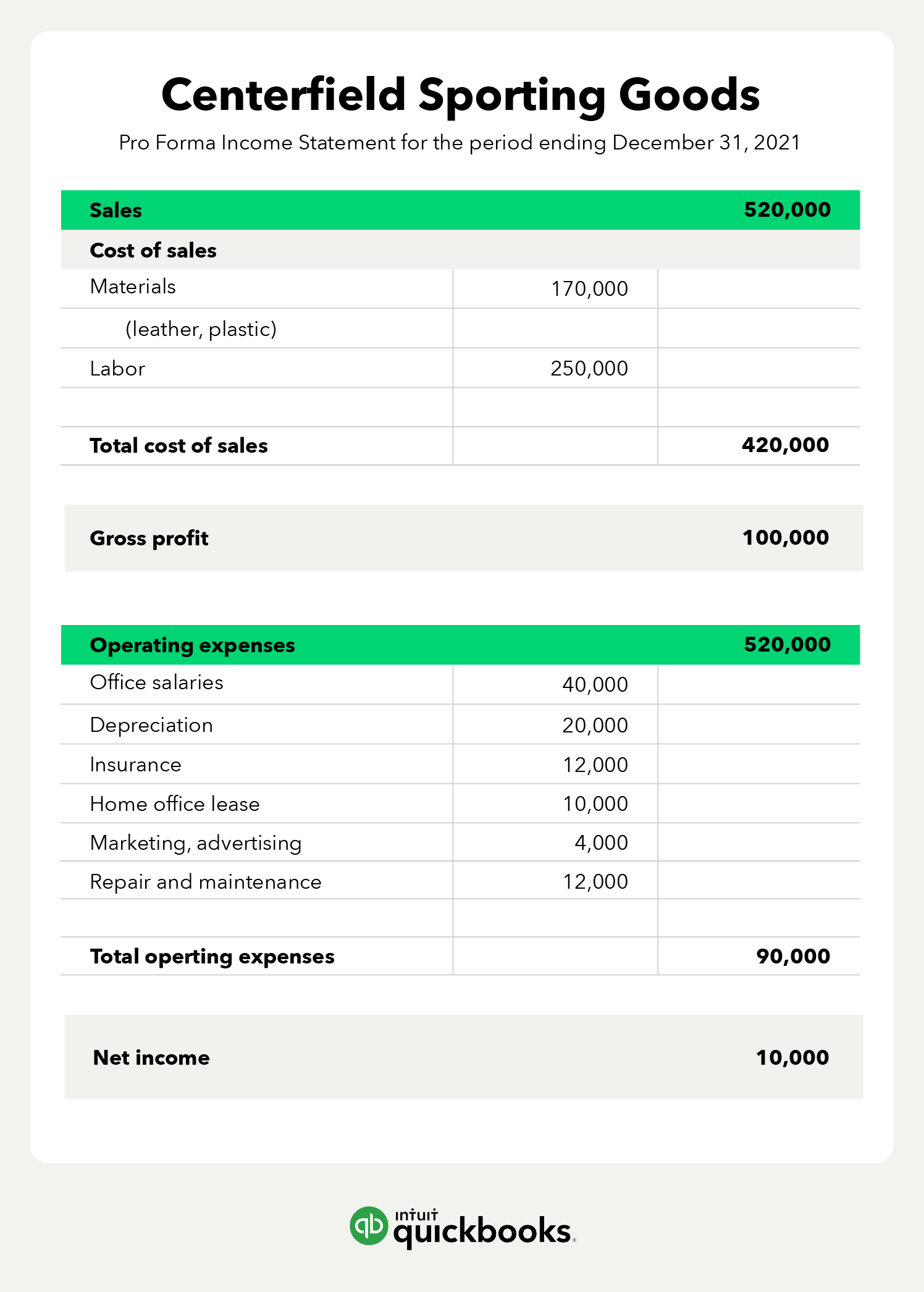

To illustrate the process of creating pro forma financial statements, meet Sally, the owner of Centerfield Sporting Goods. Centerfield is a small firm that manufactures baseball gloves, and Sally is creating pro forma reports for the 2020 fiscal year.

The process starts with the income statement.

How to create a pro forma income statement

Sally estimates the number of gloves sold in 2020, uses that total to calculate sales, which is the first line item in the income statement below:

She then projects costs for leather and other raw materials, and the hourly rate she must pay for labor. Material and labor costs make up the cost of goods sold. Finally, Sally estimates overhead expenses, including office salaries and depreciation.

Sally’s business is only a few years old, and she projects a small profit of $10,000 for the year.

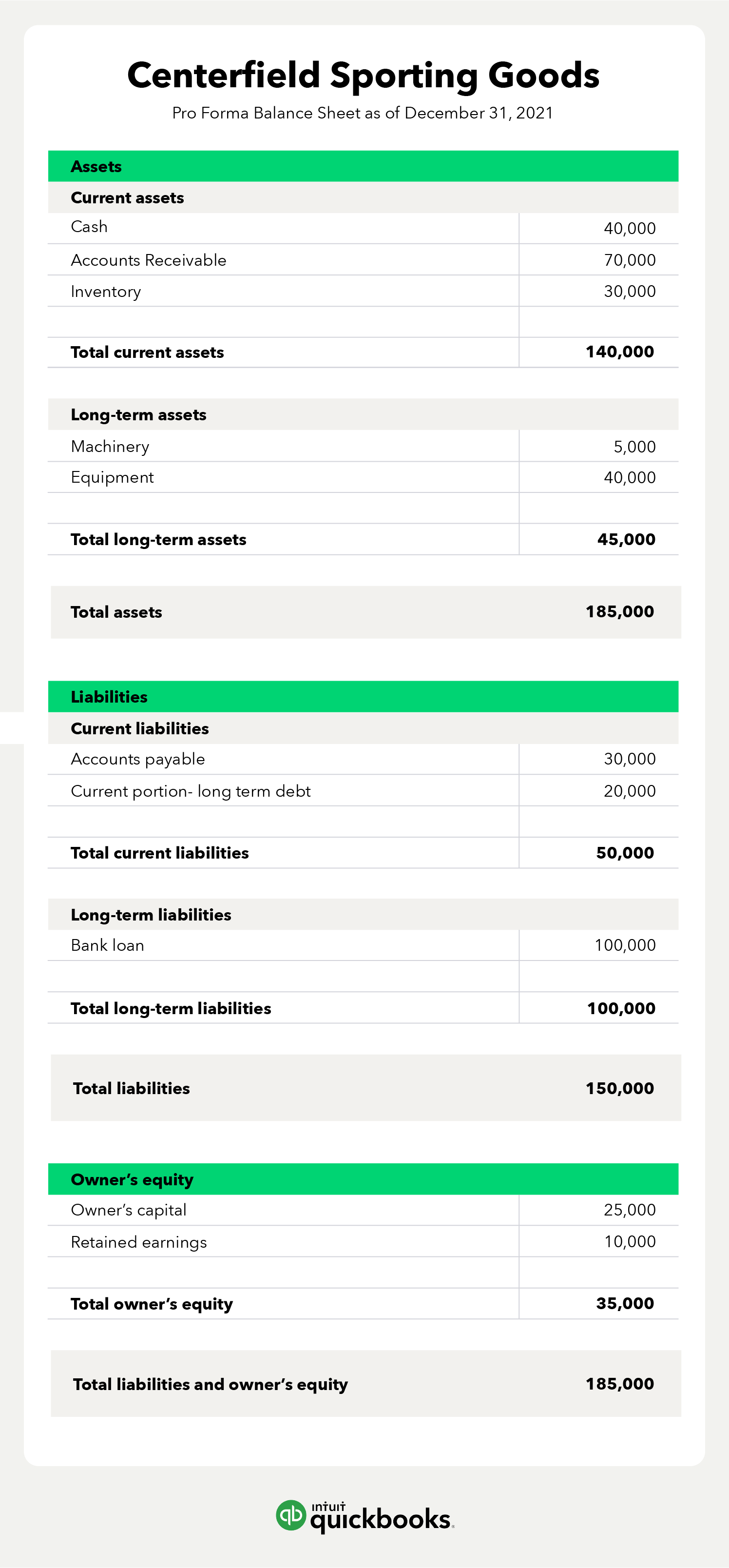

Next, use the income statement to create the balance sheet.

How to create pro forma balance sheets

Sally uses her sales estimate to estimate the dollar amount of inventory at the end of 2020. The sales total and customer payment history helps the firm determine the accounts receivable balance. Both balances are listed below.

Centerfield will carry a $100,000 bank loan, and her $10,000 in net income is posted to retained earnings in the balance sheet. 2020 will be the first year of profit for the company.

Finally, the income statement, balance sheet, and other data is used to create the statement of cash flows.

How to create a pro forma statement of cash flows

Cash flow from operations includes cash inflows from customer payments, and cash outflow for material purchases and payroll costs.

Sally budgets for a $10,000 equipment purchase in 2020, and for the repayment of $15,000 in loan payments. The ending balance in the cash flow statement ($40,000), corresponds with the cash balance in the balance sheet.

Make pro forma statements work for you

Pro forma financial statements are a great tool to assess your financial position in the current year, and for any future time period. If you’re considering a major decision, such as a business combination (merger), or a new product launch, creating pro forma reports is important.

You can also use pro forma statements to generate financial ratios. If, for example, you want to calculate the impact on the debt to equity ratio in future years, you can use the data from pro forma reports.

QuickBooks accounting software allows you to create financial reports, and make changes as needed. Use these statements to find opportunities, reduce risk, and to increase profits.