Spend less time crunching the numbers and more time on the things that matter. QuickBooks tracks and organizes all of your business’s accounting data, making it easy to access your balance sheet and other financial statements.

Balance Sheet Software & Template

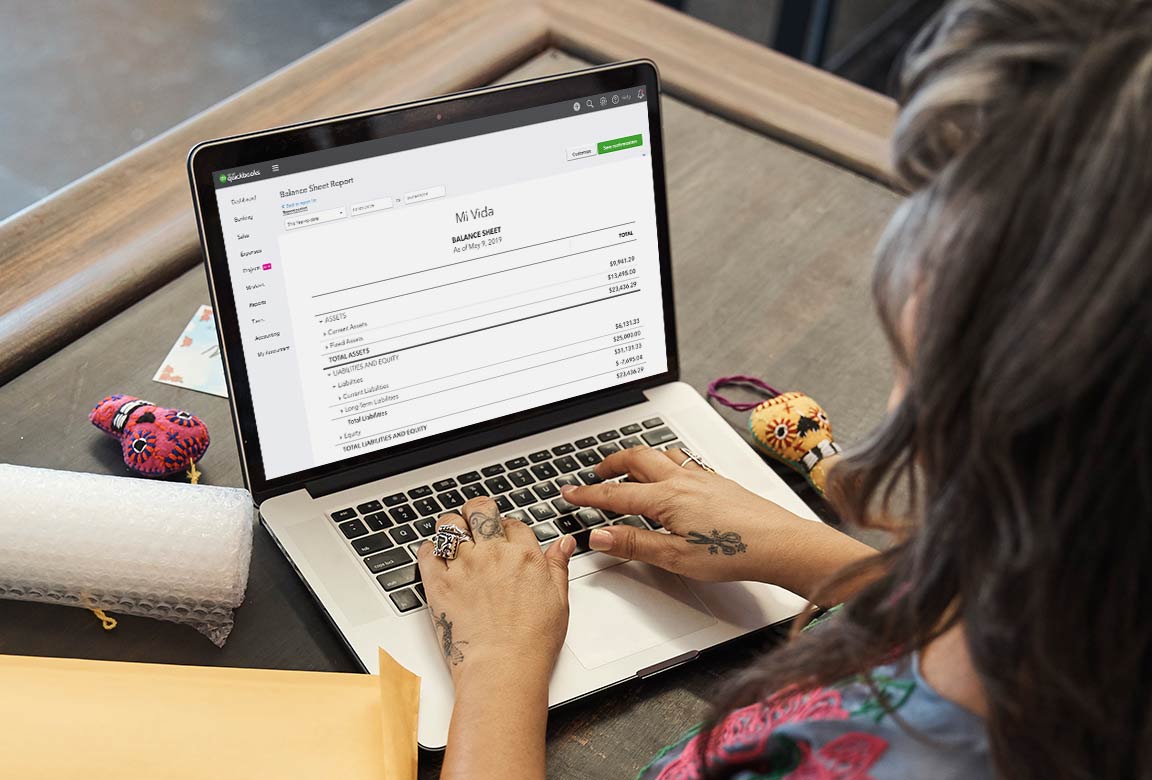

QuickBooks Online calculates and creates the balance sheet for you

Know the ins and outs of your business

No more manual entry

Make better business decisions

The balance sheet provides insights on what the business owns (its assets), what the business owes (its liabilities), and how much the business is worth. It helps you spot the strengths and weaknesses in your business, helping you make smart decisions about how to invest and grow in the future.

Custom financial statements

Access and customize over 50 accounting reports and financial statements. It’s easy to share reports with your business partners, investors, or colleagues. You can even schedule them to be automatically generated and sent daily, weekly, or monthly.

A balance sheet puts all your financial data at your fingertips

The balance sheet shows what a business owns, the assets, what it owes, the liabilities, and its net worth at a specific point in time. The three parts of a balance sheet are assets, liabilities and equity. It has two sections that must balance, hence the name balance sheet. The balance sheet, together with the income and cash flow, is the main report for any business.

The QuickBooks Online balance sheet template makes it easy

QuickBooks Online allows you to access and generate over 65 financial reports and statements in minutes. The main categories of assets are listed first in the balance sheet, followed by the liabilities. The difference between assets and liabilities is displayed at the bottom as the equity or net worth of the business. Simply choose Reports > Balance Sheet in QuickBooks Online and the pre-installed template is populated with your data in seconds.

Balance sheets can help you identify and analyze trends in your business, especially for accounts receivable and accounts payable. Are your customers paying on time? Can you collect overdue invoices more effectively? Do you have any "bad debts" - debt that you can't collect? The balance sheet provides you with the financial information you need to effectively manage the business's financial health.

Balance sheets: everything you need to know

By Kathryn Pomroy

Every business owner has a finite amount of time, and a successful manager uses their time wisely to carve out a better financial position for their company. Understanding the ins and outs of your company’s balance sheet can help you make more informed short-term and long-term decisions for your business.

If you can analyze how the balance sheet connects to other financial statements, and how terms like current assets, accounts payable, current liabilities, and long-term liabilities affect your company’s bottom line, then you can increase your cash flow and profitability.

Take a look at these tips to get a clear understanding of the balance sheet.

Why does a balance sheet matter?

Many small businesses routinely look at their income statement and cash flow statement, but most don’t realize the importance of the balance sheet. The balance sheet is an essential financial statement that all companies should review regularly, as it fluctuates with every transaction.

As an example, let’s look at Reliable Plumbing, a commercial plumbing company that generates $12 million in annual sales. As the owner of Reliable Plumbing, Joe’s balance sheet is an important aspect of his business, but managing a growing company requires a lot of Joe’s time. His gut tells him that unless he spends more time analyzing his financial results, he’s going to make some poor business decisions.

Joe’s current method of financial analysis is pretty basic. At the end of each month, he generates an income statement and takes a look at his net income or profit. He also scans other financial responsibilities like tangible and intangible assets, shareholders equity, total liabilities, total assets, and long-term debt.

Joe divides net income by sales to calculate the company’s profit margin. Profit margin reports the amount of profit earned on each dollar of sales. His analysis gives him a sense of each month’s level of profit.

After reviewing profitability, Joe takes a look at his cash balance by generating a balance sheet. To get an accurate look at cash, he reconciles the bank account and compares the cash balance to his average cash balances for the past 12 months.

If the cash balance seems low, he checks accounts receivable to see if any large receivable balances are outstanding.

Joe doesn’t perform any other analysis. Unfortunately, without further scrutiny into his balance sheet, Joe isn’t able to monitor his overall financial health at any given time. Just by taking a little time to delve into his balance sheet, Joe could solve many problems long before they damage his business — making this one of the best ways that Joe could use his time.

Return on time invested

Joe’s limited review is typical for many business owners that only view profitability and available cash as the most important metrics to track. However, all business owners need to understand the components of the balance sheet, and how the balance sheet is connected to the income statement and the cash flow statement.

If Joe is willing to invest the time and use a balance sheet template, he can make more informed business decisions and achieve a better financial position for his company.

The components of a balance sheet

A balance sheet is important because it provides business owners with a snapshot of what they own, the balances they owe, and how much their business is worth.

While profit and cash are necessary, other pieces of financial information are just as important. When you start to use a balance sheet template to track your finances, you are better able to find hidden costs, reduce expenses, and maximize profits.

How is a balance sheet related to an income statement and cash flow statement?

As a business owner, it’s important to understand the connection between a balance sheet, income statement, and cash flow statement.

First, consider how the income statement and the balance sheet work together in Joe’s business. Reliable Plumbing earned a 15% profit margin on $12 million in sales or $1.8 million in net income. Net income from the income statement increases the owner’s equity balance in the balance sheet. When Joe prints his month-end balance sheet, the $4,500,000 equity balance includes the month’s $1.8 million in profit.

The cash balance on the balance sheet is the ending balance in the statement of cash flows. The cash flow statement essentially takes the company checkbook and assigns cash inflows and outflows into these categories:

- Cash activity from financing: A company raises money to operate the business and pays it back. Issuing common stock is a cash inflow and repaying a loan is a cash outflow.

- Cash activity from investing: Investing refers to buying and selling a company’s assets. If Reliable pays cash for a truck, that’s a cash outflow, and if the company sells some equipment for cash, that’s a cash inflow.

- Cash activity from operations: Every cash transaction that is not related to financing or investing is posted here. This includes activities like paying employees and collecting money from customers.

The formula for the cash flow statement is:

Beginning cash balance + cash inflows – cash outflows = ending cash balance

The ending cash balance is also the cash balance on the balance sheet.

Using financial analysis to increase cash flow

For many business owners, the most important metric for their business or their statement of financial position is the amount of cash they need to operate each month. This may be more important than profit since no company can operate without sufficient cash.

Think about it this way: If Reliable Plumbing generates a 15% profit on every dollar sold, then 85% of every dollar sold is an expense. When the monthly sales equal $12 million, Reliable incurs $10.2 million in expenses. Those expenses have to be paid in cash, either this month or sometime down the road.

A business can generate more cash by reducing the balance in two accounts that tie up cash:

- Accounts receivable

- Inventory balance

Accounts receivable represents money owed by customers, while inventory balance is the dollar amount of items that you have on hand for resale.

Reliable Plumbing can take several steps to increase cash flow. They can offer discounts to customers who pay quickly or insist that customers pay a 20% deposit before any work is performed. The company could also have a formal process for collections. These steps will reduce the accounts receivable balance and increase cash.

QuickBooks Online can help businesses track unpaid invoices, remind customers that a balance is due and take payments via credit card and bank transfer.

Reliable Plumbing could also take a look at the dollar amount of inventory on hand. If Joe’s suppliers can ship inventory items faster, the company can reduce the inventory levels and still meet customer needs. If a supplier can get orders to Reliable in five days rather than ten days, the plumbing company can carry less inventory.

Balance sheet analysis pays off

Taking steps to reduce accounts receivable and inventory levels increases available cash and makes it easier for your company to manage day-to-day business operations each month. Similarly, taking a look at a balance sheet example to understand where and how your company’s equity (net worth), long-term assets, and current portion of long-term debt line-up can paint a picture of where you are compared to where you want to be.

Don’t forget to download our balance sheet template, which will give you a better understanding of your company’s financial standing at any point in time. And we’ve got you covered when you need to track and organize all of your accounting data.

Download the free balance sheet template

The balance sheet plays a vital role in understanding the financial position of your company at a specific point in time. Our excel template summarizes assets, liabilities, and equity to easily compare your company’s value over time. The template also provides a sample balance sheet so you can see what a completed balance sheet report looks like.

Get your free Excel balance sheet template

If you’re launching a small business and just getting started, Excel templates can be a useful solution. As your business grows, it gets harder to track everything in Excel. QuickBooks organizes your accounting data so you can easily run up-to-date balance sheet reports whenever you need them. Print the reports you need, or save them as a PDF to send to your accountant. Save time and track your finances in one place—let QuickBooks accounting software do the hard work for you.