Choose your...

Country Language

Take control of your taxes with QuickBooks Online

Kick off the new financial year the right way with your tax information all in one place. Avoid nasty surprises and last-minute panics come tax season with QuickBooks. Whatever your business size and industry, we’ve got everything you need for a successful tax season.

GST in QuickBooks Online

Small businesses in Australia, Canada, Singapore, and the UK already rely on QuickBooks to help them track and report Goods and Services Tax (GST) and Value-Added Tax (VAT). With QuickBooks’ one-click tax reports, small businesses save hours each month.

Automatically track and calculate sales tax in seconds with QuickBooks Online. QuickBooks is pre-filled with common tax rates (VAT/GST/GCT/IVA/ITBIS/TOT) or, you can easily set up your own tax rates. Once set up, QuickBooks automatically tracks sales tax. Every time you create an invoice or expense, QuickBooks will automatically calculate tax for you. When you’re ready at the end of your financial reporting period, QuickBooks prepares an accurate activity statement to assist you with filing your tax return.

QuickBooks is prefilled with tax rates in the following countries: Argentina, Bahamas, Bahrain, Barbados, Cambodia, Colombia, Costa Rica, Dominican Republic, Ecuador, Haiti, Indonesia, Israel, Jamaica, Kenya, Nigeria, Panama, Saudi Arabia, Suriname, Thailand, Trinidad And Tobago, Uganda, Venezuela.

It’s time to swap manual data entry for automatic and accurate calculations and record-keeping. Snap and store business receipts and easily categorize your transactions in one convenient location, so you’re ready for tax time. Log in to your account anytime, anywhere using your smartphone, tablet, or computer.

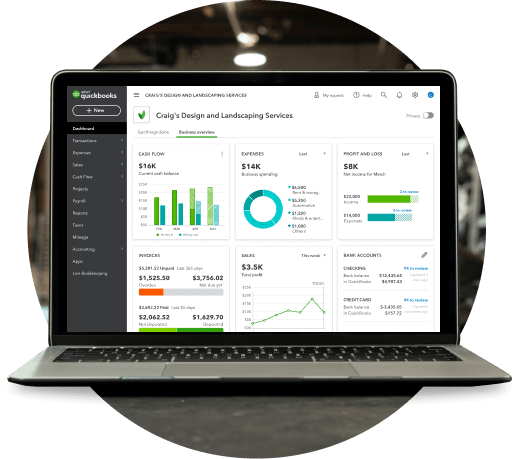

Take control of your cash flow and make smarter business decisions. See exactly how much you owe with our real-time dashboard and calculate your tax-related expenses.

Cut down on activity statement-related stress with QuickBooks’ automatic tax tracking and calculations. Always know how much you owe and when it’s due so you’re ready to file your taxes quickly and easily.

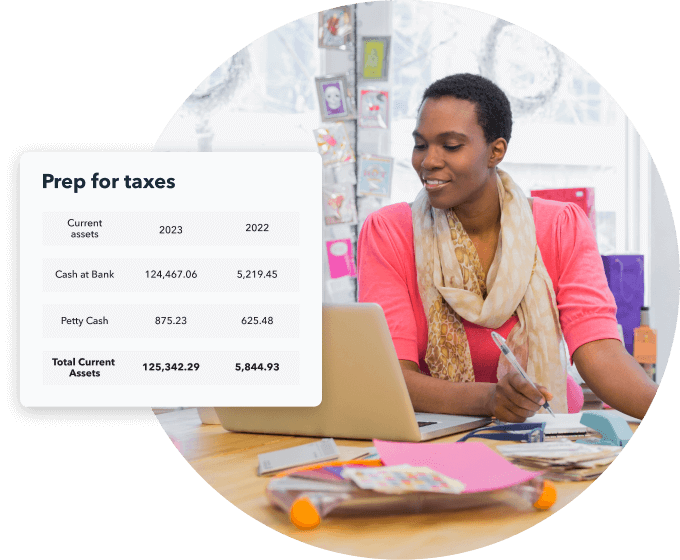

Use QuickBooks reports to create a tax summary for your review before you file your taxes. Use our tax calculator to reconcile your sales tax. You’ll be notified of any changes to old transactions, and they will carry over to your next summary.

How tax affects your sales, expenses and purchases

Invoices

QuickBooks automatically calculates and tracks sales tax within your invoices.

Expenses and Purchase Orders

QuickBooks automatically calculates and tracks tax within your expenses and purchase orders

One-click Forms

QuickBooks allows you to easily view your tax payable/receivable amounts in a few clicks, to help you prepare for lodgment.

Choose a plan to fit your needs.

Try FREE for 30 days!

Try FREE for 30 days!

- QuickBooks reserves the right to change pricing, features, support and service at any time. See our Terms of Service for further information.

- Discount: For new QuickBooks customers, receive a discount off the current monthly price for QuickBooks Online Simple Start, QuickBooks Online Essentials or QuickBooks Online Plus for the first 3 months of service, starting from date of enrolment. From month 4 from the date of enrolment, the price will change to the then current monthly price. See current prices here. Your account will automatically be charged on a monthly basis until you cancel. You may cancel at any time. There is no limit on the number of subscriptions ordered under this offer. This offer cannot be combined with any other QuickBooks Online promotion or offers.

- Trial: First thirty (30) days of subscription to QuickBooks Online, starting from the date of enrolment, is free. During the free trial. To continue using QuickBooks after your 30-day trial, you'll be asked to present a valid credit card for authorisation and you'll be charged monthly at the then-current fee for the service(s) you've selected.

- Devices: QuickBooks Online requires a computer with Internet Explorer 10, Firefox, Chrome, or Safari 6 and an Internet connection (a high-speed connection is recommended). The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. QuickBooks Online is accessible on mobile browsers on iOS, Android, and Blackberry mobile devices. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

- Cloud storage: Data access is subject to Internet or cellular provider network availability and occasional downtime due to events beyond our control.

- Annual Billing: You may pay for your QuickBooks Online subscription on an annual, upfront basis to enjoy a discount on the current fees. If you cancel your QuickBooks Online subscription within the pre-paid 12 month period, you will not be eligible for a refund, but will retain full access to your QuickBooks Online subscription for the remainder of the 12-month period. Unless cancelled by you prior, your annual subscription will auto-renew on the 12 month anniversary of your sign-up date using the billing details you have given us. Discounts, prices, terms and conditions are subject to change.

- Our Terms of Service apply to all QuickBooks Online subscriptions. Please review them carefully.

- Saasant Managed Migration: Offer is limited to the first 250 small businesses or Accountants who purchase any QuickBooks Online subscription from 5 March 2024, and within 14 days of their purchase date, sign up for a SaasAnt Managed Accounting Migration at https://www.saasant.com/quickbooks-migration/. Offer not available in the USA, UK, Australia and Canada. Data migration is provided by SaasAnt Inc and you acknowledge that to the maximum extent permitted by law, Intuit disclaims all responsibility and any liability for services provided by third parties, including migration services provided by SaasAnt Inc.. The terms of SaaSant Inc govern the use of its services and you agree to review, and be subject to those terms. Offer is for a one-off migration of data from Excel to QuickBooks. All migrations are to be completed within 3 months from the date of acceptance of your QuickBooks subscription purchase, or by 5 July 2024, whichever is earlier. Any entitlement to a free migration not completed within this time will expire.

- QuickBooks se reserva el derecho de cambiar los precios, las funciones, el soporte y el servicio en cualquier momento. Para obtener más información, consulta nuestras Condiciones de servicio.

- Descuento: Los nuevos clientes de QuickBooks reciben un descuento del precio mensual vigente para QuickBooks Online Simple Start, QuickBooks Online Essentials o QuickBooks Online Plus durante los primeros 3 meses de servicio, a partir de la fecha de inscripción. A partir del cuarto mes luego de la fecha de inscripción, el precio cambiará al precio mensual vigente en ese momento. Consulta los precios vigentes aquí. Se cobrará automáticamente a tu cuenta de forma mensual hasta que canceles la suscripción. Puedes cancelarla en cualquier momento. No hay límite para la cantidad de suscripciones que se pueden solicitar con esta oferta. Esta oferta no se puede combinar con ninguna otra promoción u oferta de QuickBooks Online.

- Prueba: Los primeros treinta (30) días de suscripción a QuickBooks Online, a partir de la fecha de inscripción, son gratis (durante el período de prueba gratuita). Para seguir usando QuickBooks después de los 30 días de prueba, se te solicitará que presentes una tarjeta de crédito válida para autorizar el pago y se te cobrará la tarifa mensual vigente en ese momento por los servicios que hayas seleccionado.

- Dispositivos: QuickBooks Online requiere una computadora con Internet Explorer 10, Firefox, Chrome o Safari 6 y conexión a Internet (se recomienda conexión de alta velocidad). La aplicación móvil de QuickBooks Online funciona con iPhone, iPad, teléfonos Android y tabletas. Se puede acceder a QuickBooks Online con navegadores móviles en dispositivos móviles iOS, Android y BlackBerry. Los dispositivos se venden por separado; se requiere un plan de datos. No todas las funciones están disponibles en las aplicaciones móviles y en el navegador móvil. El acceso para móviles a QuickBooks Online está incluido con la suscripción a QuickBooks Online sin costo adicional. El acceso a los datos está sujeto a la disponibilidad de la red del proveedor de servicio de telefonía celular o Internet, a ocasionales cortes de servicio debido a mantenimiento del servidor y el sistema, y a eventos fortuitos que no podemos controlar. Es obligatorio registrar el producto.

- Almacenamiento en la nube: El acceso a los datos está sujeto a la disponibilidad de la red del proveedor de servicio de telefonía celular o Internet, así como a ocasionales cortes de servicio debido a eventos fuera de nuestro control.

- Facturación anual: Puedes pagar la suscripción a QuickBooks Online de forma anual y por adelantado para disfrutar de un descuento sobre las tarifas vigentes. Si cancelas tu suscripción a QuickBooks Online en el transcurso del periodo prepagado de 12 meses, no podrás recibir un reembolso, pero conservarás el acceso completo a tu suscripción de QuickBooks Online durante el periodo restante de los 12 meses. A menos que canceles con anticipación, la suscripción anual se renovará automáticamente al cumplirse los 12 meses posteriores a la fecha de registro y se cobrará conforme a los detalles de facturación que nos hayas proporcionado. Los descuentos, precios y términos y condiciones están sujetos a modificaciones.

- Nuestras Condiciones de servicio se aplican a todas las suscripciones de QuickBooks Online. Léelas detenidamente.

- QuickBooks se reserva el derecho de hacer cambios en los precios, las características, el servicio y el soporte en cualquier momento. Consulta nuestras condiciones de servicio para obtener más información.

- Descuento: Los clientes nuevos de QuickBooks recibirán un descuento sobre el precio mensual de QuickBooks Online Simple Start, QuickBooks Online Essentials o QuickBooks Online Plus durante los tres primeros meses del servicio, a partir de la fecha de inscripción. A partir del cuarto mes desde la fecha de inscripción, el precio cambiará a la tarifa mensual vigente. Consulta los precios actuales aquí. El importe se cargará en tu cuenta automáticamente todos los meses hasta la cancelación del servicio. Puedes cancelar el servicio en cualquier momento. Esta oferta no lleva asociado un límite de suscripciones solicitadas. Esta oferta no puede combinarse con otras promociones u ofertas de QuickBooks Online.

- Prueba: Los primeros treinta (30) días de suscripción a QuickBooks Online, a partir de la fecha de inscripción, son gratis. Durante la prueba gratuita. Para continuar usando QuickBooks después de la prueba de 30 días, se te pedirá que presentes una tarjeta de crédito válida para la autorización y se te cobrará la tarifa mensual vigente por los servicios seleccionados hasta que los canceles.

- Dispositivos: Para utilizar QuickBooks Online se necesita un ordenador con Internet Explorer 10, Firefox, Chrome o Safari 6 y conexión a Internet (se recomienda una conexión de alta velocidad). La aplicación móvil de QuickBooks Online es compatible con los dispositivos iPhone, iPad, así como con móviles y tabletas Android. Se puede acceder a QuickBooks Online desde los navegadores móviles de dispositivos iOS, Android y Blackberry. Los dispositivos se venden por separado; se requiere un plan de datos. No todas las características están disponibles en las aplicaciones y navegadores móviles. El acceso móvil a QuickBooks Online está incluido con tu suscripción a este servicio sin coste adicional. El acceso a los datos está sujeto a la disponibilidad de la red del proveedor de telefonía móvil o Internet, a estados de inactividad ocasionales por mantenimiento del sistema y del servidor, así como a acontecimientos de fuerza mayor. El registro del producto es obligatorio.

- Almacenamiento en la nube: El acceso a los datos está sujeto a la disponibilidad de la red del proveedor de telefonía móvil o Internet y a estados de inactividad ocasionales por acontecimientos que se escapan de nuestro control.

- Facturación anual: Puedes efectuar el pago de tu suscripción a QuickBooks Online de forma anual y por adelantado para disfrutar de un descuento sobre las tarifas vigentes. Si cancelas tu suscripción a QuickBooks Online dentro del periodo de 12 meses que has pagado por adelantado, no podrás obtener un reembolso del importe, pero podrás conservar el acceso a todas las características de QuickBooks Online durante el resto del período de 12 meses. A menos que la canceles con antelación, tu suscripción anual se renovará automáticamente cuando se cumplan los 12 meses de la fecha de registro con los datos de facturación que nos has proporcionado. Los descuentos, los precios, así como los términos y condiciones están sujetos a cambios.

- Nuestras condiciones de servicio se aplican a todas las suscripciones de QuickBooks Online. Léelas con atención.

- QuickBooks si riserva il diritto di modificare i prezzi, le funzionalità, l’assistenza e i servizi in qualsiasi momento. Per ulteriori informazioni, consultare i nostri Termini di servizio.

- Sconto: i nuovi clienti QuickBooks ricevono uno sconto sul prezzo mensile corrente di QuickBooks Online Simple Start, QuickBooks Online Essentials oppure QuickBooks Online Plus per i primi 3 mesi di utilizzo, a partire dalla data di registrazione. A partire dal quarto mese dalla data di registrazione, verrà applicato il prezzo mensile corrente. Consultare i prezzi correnti qui. L’addebito mensile verrà eseguito automaticamente sul conto dell’utente fino a quando l’utente non deciderà di annullare l’abbonamento. L’utente può annullare l’abbonamento in qualsiasi momento. Non è previsto un numero massimo di abbonamenti ordinabili con quest’offerta. Quest’offerta non è cumulabile con altre promozioni o offerte QuickBooks Online.

- Periodo di prova: i primi trenta (30) giorni di abbonamento a QuickBooks Online a partire dalla data di registrazione sono gratuiti. Nel corso del periodo di prova. Per continuare a utilizzare QuickBooks al termine del periodo di prova di 30 giorni, chiederemo all’utente di presentare una carta di credito valida ai fini dell’autorizzazione e verrà addebitata la tariffa mensile in vigore in quel momento per i servizi selezionati.

- Dispositivi: QuickBooks Online richiede un computer con Internet Explorer 10, Firefox, Chrome o Safari 6 e una connessione Internet (si consiglia una connessione ad alta velocità). L’app mobile QuickBooks Online funziona su iPhone, iPad e smartphone e tablet Android. QuickBooks Online è accessibile dai browser per dispositivi mobili su iOS, Android e Blackberry. I dispositivi sono venduti separatamente ed è necessario un piano dati. Non tutte le funzionalità sono disponibili su app e browser per dispositivi mobili. L’accesso a QuickBooks Online da dispositivi mobili è incluso nell’abbonamento a QuickBooks Online senza costi aggiuntivi. L’accesso ai dati è soggetto alla disponibilità di rete del gestore telefonico/Internet provider e a interruzioni occasionali a causa di interventi di manutenzione ai sistemi e ai server e di eventi di forza maggiore. È richiesta la registrazione del prodotto.

- Archiviazione nel cloud: l’accesso ai dati è soggetto alla disponibilità di rete dell’Internet provider o gestore telefonico e a interruzioni occasionali a causa di eventi di forza maggiore.

- Fatturazione annuale: effettuando il pagamento anticipato dell’abbonamento annuale a QuickBooks Online, è possibile accedere a uno sconto sulle tariffe correnti. Qualora l’utente decida di annullare l’abbonamento a QuickBooks Online prima del termine del periodo di 12 mesi prepagato, non verrà emesso alcun rimborso. L’utente potrà continuare a usufruire dell’abbonamento a QuickBooks Online per il periodo restante. Fatta salva la facoltà dell’utente di annullare l’abbonamento, l’abbonamento annuale si rinnoverà automaticamente alla data di scadenza annuale utilizzando i dettagli di fatturazione forniti dall’utente. Sconti, prezzi, termini e condizioni sono soggetti a modifiche.

- I nostri Termini di servizio si applicano a tutti gli abbonamenti a QuickBooks Online. Invitiamo l’utente a consultarli con attenzione.

Non-USD Pricing: Prices displayed in local currency are estimated based on current exchange rates from United States Dollars (USD). Exact amount charged in local currency will vary according to the USD exchange rate at the time of payment processing. Prices displayed exclude any applicable taxes and fees, which will be added to the cost of all services purchased. For exact base pricing please refer to prices listed in USD.

50% 24 Month Bulk SMB Offer Terms and Conditions

Eligibility: Starting 15 Apr 2024 and for a limited time, eligible customers will be entitled to a 50% discount for the first 24 months on QuickBooks Online Simple Start, Essentials, and Plus (“QBO”) when they sign up for a minimum of two (2) QBO subscriptions using a single email account. This offer is eligible for new and trial QBO customers only. Excluding customers based in the US, UK, Canada & Australia. Customers must purchase two (2) or more subscriptions. To take advantage of this offer you must call one of the phone numbers below, sign up through the assigned sales account manager, and/or or chat with an expert at: quickbooks.intuit.com/global/.

- - South Africa +27 800 990 331

- - Hong Kong +852 800 903 418

- - UAE +971 8000 35703102

- - Philippines +63 2271 1565 (PLDT Smart) or 1800 8902 0401 (Globe)

- - Singapore +65 8001 204 517

- - Malaysia 1800 818 232

- - Ireland 1800 80 71 32

Pricing: Eligible customers will be entitled to apply 50% off the monthly price for QBO for the first 24 months of the service starting from the date of enrollment, followed by the then-current list price for the service as long as two (2) or more QBO subscriptions are purchased. Sales tax may be applied where applicable. List price subject to change at any time at Intuit’s sole discretion. If you add or remove services, your service fees will be adjusted accordingly.

Term of Offer: All QBO subscriptions must be activated within 180 days. If the subscriptions are not activated within the time period, the price will change to the then-current list price. Offer is non-transferable and non-refundable. The discount is valid only for the QBO customer that registered the QBO subscriptions and cannot be transferred to another client, individual, or company. The promotion requires active subscriptions for the entire duration of the 24 month discount period. This offer can't be combined with any other QuickBooks offers. Offer ends 31 July 2026.

Billing & Cancellation: The QBO account will be automatically charged on a monthly basis. To cancel your subscription at any time go to Account & Settings in QBO and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period. You will not receive a prorated refund; your access and subscription benefits will continue for the remainder of the billing period. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

30% 12 Month Bulk SMB Offer - QBO Advanced Terms and Conditions

Eligibility: Starting 11 Nov 2024 and for a limited time, eligible customers will be entitled to a 30% discount for the first 12 months on QuickBooks Advanced (“QBO Advanced”) when they sign up for a minimum of two (2) QBO Advanced subscriptions using a single email account. This offer is eligible for new and trial QBO Advanced customers only. Excluding customers based in the US, UK, Canada & Australia. Customers must purchase two (2) or more subscriptions. To take advantage of this offer you must call one of the phone numbers below, sign up through the assigned sales account manager, and/or or chat with an expert at: quickbooks.intuit.com/global/.

- - South Africa +27 800 990 331

- - Hong Kong +852 800 903 418

- - UAE +971 8000 35703102

- - Philippines +63 2271 1565 (PLDT Smart) or 1800 8902 0401 (Globe)

- - Singapore +65 8001 204 517

- - Malaysia 1800 818 232

- - Ireland 1800 80 71 32

Pricing: Eligible customers will be entitled to apply 30% off the monthly price for QBO for the first 12 months of the service starting from the date of enrollment, followed by the then-current list price for the service as long as two (2) or more QBO subscriptions are purchased. Sales tax may be applied where applicable. List price subject to change at any time at Intuit’s sole discretion. If you add or remove services, your service fees will be adjusted accordingly.

Term of Offer: All QBO subscriptions must be activated within 180 days. If the subscriptions are not activated within the time period, the price will change to the then-current list price. Offer is non-transferable and non-refundable. The discount is valid only for the QBO customer that registered the QBO subscriptions and cannot be transferred to another client, individual, or company. The promotion requires active subscriptions for the entire duration of the 12 month discount period. This offer can't be combined with any other QuickBooks offers. Offer ends 31 Dec 2025.

Billing & Cancellation: The QBO account will be automatically charged on a monthly basis. To cancel your subscription at any time go to Account & Settings in QBO and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period. You will not receive a prorated refund; your access and subscription benefits will continue for the remainder of the billing period. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

See what customers and accountants have to say about QuickBooks Online.

Wai Hong Fong

CEO of Storehub Sdn Bhd

Stella

Chartered Accountant at QB Services Sdn Bhd

CT Chee

Chartered Accountant at AccPro Group

Anfaal Saari

CEO of Brotherhood Arts

© 2022 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice.

By accessing and using this page you agree to the Terms and Conditions.