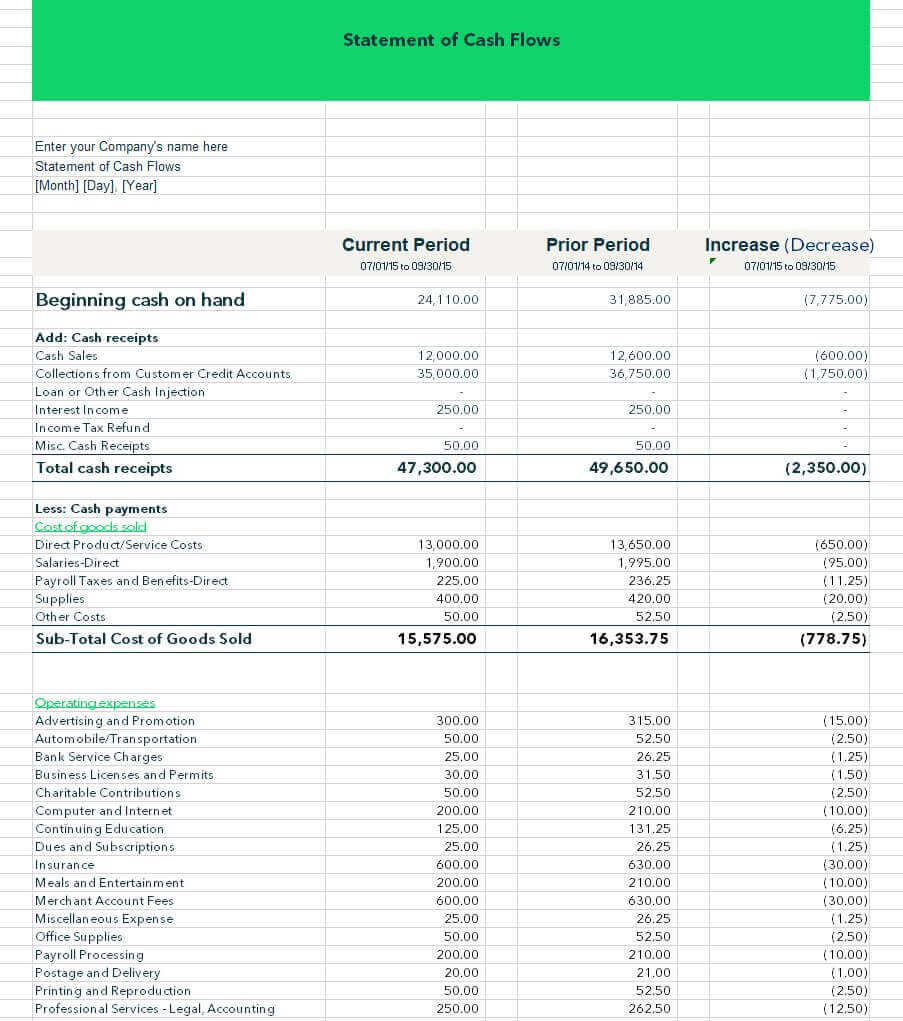

A cash flow statement, along with the balance sheet and income statement, is one of the primary financial statements used to measure your company’s financial position. It tracks the cash inflow and cash outflow of cash from operating, investing, and financing activities during a given time period.

The term 'cash' refers to both cash and cash equivalents, which are assets readily convertible to cash. This financial statement provides relevant information to assess a business’s liquidity, quality of earnings, and solvency.

In this article you will learn:

- What is a Cash Flow Statement?

- Why Do Businesses Need Cash Flow Statements?

- What Does a Cash Flow Statement Show?

- How to Create a Cash Flow Statement

- What are Cash Equivalents?

- Direct vs. Indirect Cash Flow Methods

- Cash Flow Statement Formulas