Starting a small business is a great way to achieve a work-life balance while pursuing your passions, but it can be challenging. The first year is often the most difficult, but if you're prepared and diligent, you'll be well on your way to success.

QuickBooks surveyed 965 experienced small business owners and solicited their insights for individuals embarking on their first business venture. To summarise, they recommended three steps to starting a business:

- Write a business plan

- Research the competition

- Find a mentor

Current small business owners say these three things can increase your chances of success. And yet, according to the survey, not all prospective business owners plan to follow this advice. Download the full report to find out what current business owners recommend for new business owners and what they wish they would have done differently.

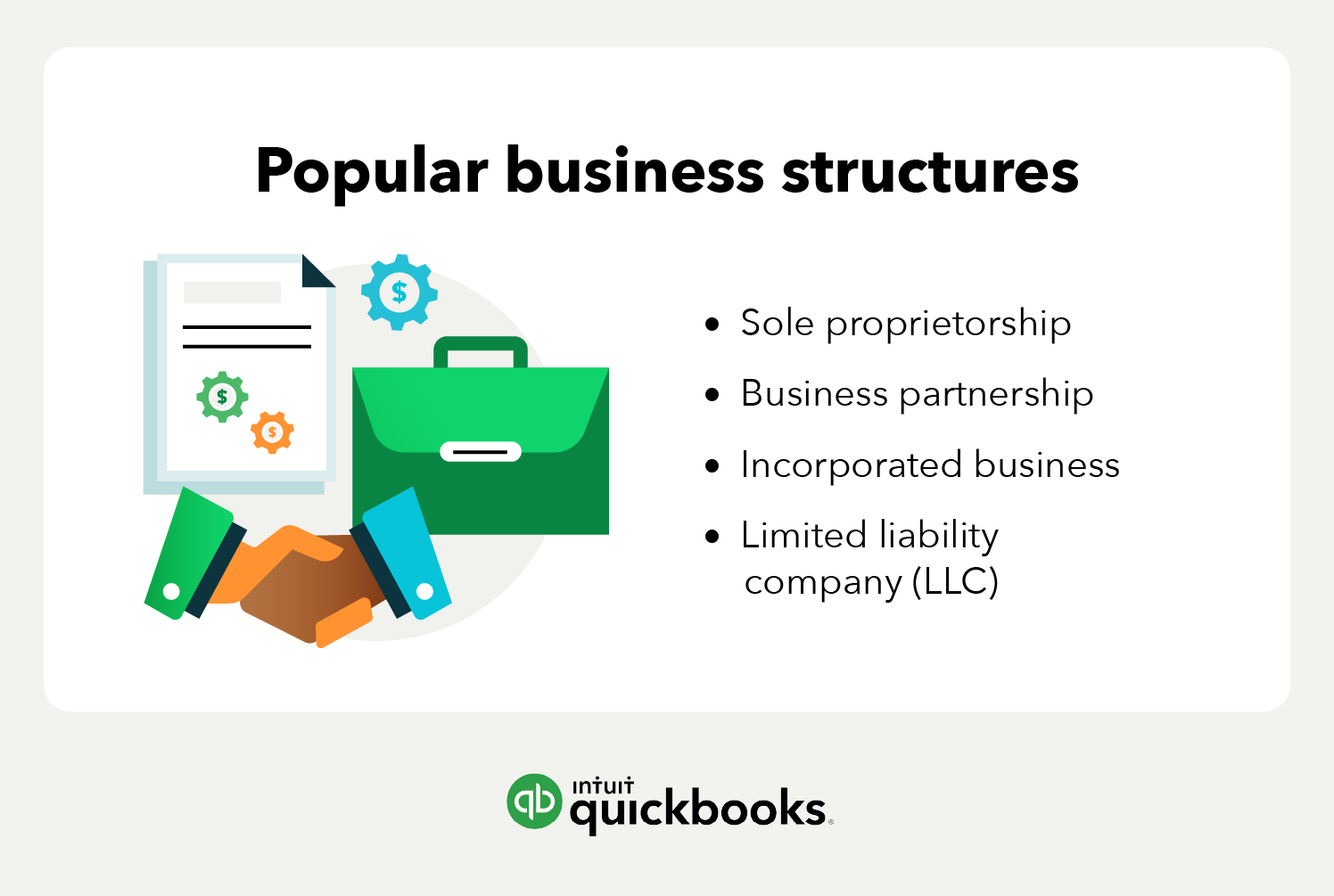

We’re giving you a comprehensive starting a business checklist, which includes all the prep work you need to do before you register and the actions you need to take when registering.