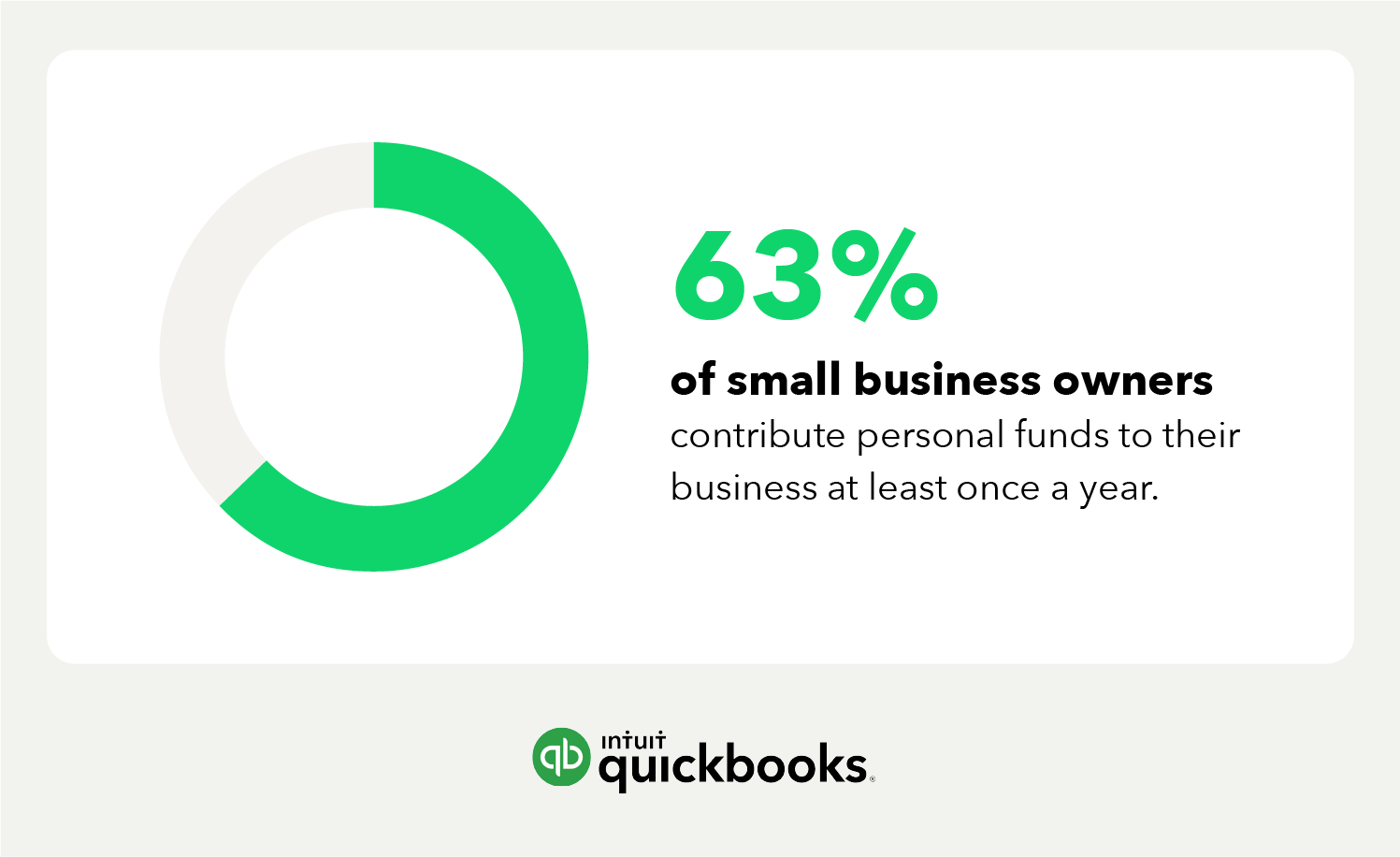

Starting a business is an exciting adventure that gives you the chance to be your own boss, bring your entrepreneurial vision to life, and control your financial future. However, to avoid being one of the 20% of small businesses that fail within their first year, you’ll want to take every precaution to ensure that your business is sustainable for the long term.

Budgeting is a process that allows you to see how your business will perform into the future and will help you to make better capital budgeting decisions in relation to a future investment project. Knowing how your business is managing its cash flow allows you to easily see if your returns on invested capital or your initial investment are going to give you the internal rate of return (IRR) that you are hoping for.

Therefore, creating a business budget is an excellent first step for any new business owner. By taking a closer look at your assets, expenses, capital invested, and financial goals, you can craft a better plan for the future of your booming business, and so you can reap some of the monetary benefits.