The difference between a profit and loss statement, a balance sheet, and a cash flow statement

A P&L statement, a balance sheet and a cash flow statement are three of the most common financial reports you’ll encounter as a business owner.

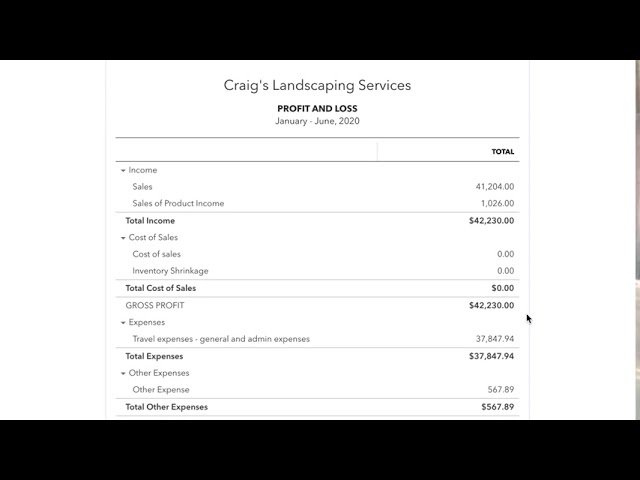

A P&L statement provides an overview of your profits and losses over a specific time period, such as a month, quarter or year.

A balance sheet shows your business’ assets and liabilities at a specific point in time instead of over a certain timeframe. That includes what your business owns and the amount it owes with the amount that has been invested by its shareholders.

A cash flow statement captures how much cash is coming in and out of your business, meaning you can see how much profit is going into your bank account as cash over a certain time period.

All three reports are important for understanding your business' finances and are often used by lenders and investors.

Example:

Let’s say you own a candle making business. Last month you sold $1,000 worth of candles and used $400 worth of materials to make candles. Your P&L statement would show these profits and losses, and that your net income for the month is $600.

You also have $200 in cash on hand and inventory worth $200, as well as a $100 debt owing to a supplier. Your balance sheet would show that you have an equity position of $300.

Your cash flow statement would show your cash position as $900 ($1,000 in cash sales + $200 cash in hand - $100 in debt paid).