6 Steps To Create An Expense Report: A Guide For Small Businesses

Follow the these six steps to create an expense report for your small business:

1. Select a Template or Use an Accounting Software

You can choose between using an expense report template or expense tracking software to create an expense report.

Download QuickBooks Free Excel Expense Report Template

Preparing an expense report from scratch takes a lot of effort, but QuickBooks has you covered with our free Excel expense report.

With our Excel expense report template you can easily enter data items in their designated columns and add more columns for additional expense categories. Your calculations will be fast and accurate as our Excel template is set up to automatically calculate amounts in the corresponding columns.

Download QuickBooks Free Excel Expense Report Template

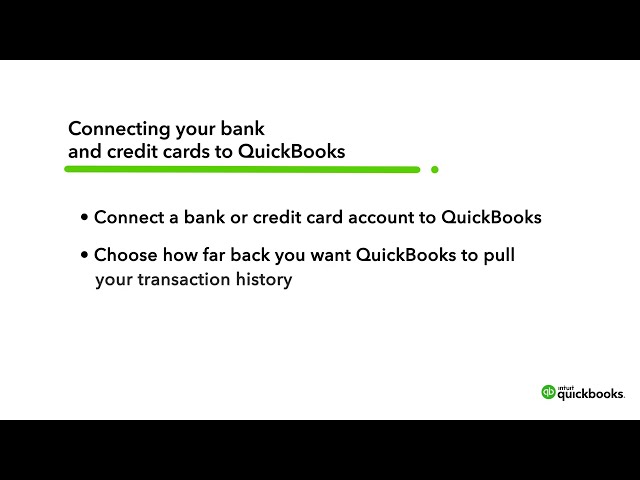

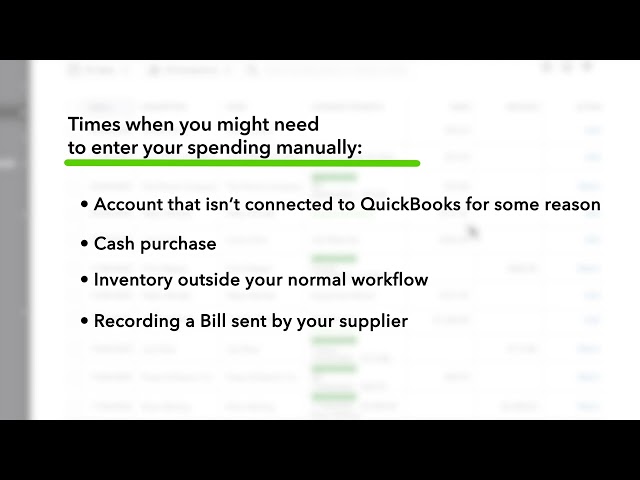

Using an Expense Tracking Software to Generate Expense Reports

As a small business, preparing expense reports in Microsoft Excel is easy, but as your business grows you may need to shift to an expense tracking software.

Expense tracking software allows you to easily connect your bank account to the software, download transactions, and categorise and add expenses, so you can get time on your side. You can also often capture receipt images through third-party app integrations that are available with the expense tracking software. This automates the process of creating an expense report.

2. Add or Delete Columns

The Microsoft Excel template comes with standard expense categories, which you can edit based on the type of expenses that your business incurs. For example, if you have employees that travel frequently for business needs, you'll need the ‘Travel and Meals’ column.

As a result, expense reports help you itemise expenses by tax categories, fast tracking your taxes as there are certain expense categories on which deductions can be claimed by you as a business.

3. Report Expenses as a Different Line Item

You'll need to report each expense separately in a different line and provide as much detail as possible. Make sure to provide information, like the client for which specific expenses were incurred, so that you can track expenses effectively.

Additionally, you'll need to report expenses in the order they were incurred, with the most recent towards the end. Once all expenses have been reported, add each expense amount including the tax amount.

4. Calculate the Total

Various expense categories will have a subtotal along with the total of all the expenses. Adding subtotals and the grand totals to your expense report will make expense tracking easy so you can see how much money is being spent.

5. Attach Associated Receipts

Expense reports are used by employees who have incurred an expense on the behalf of a business and who wish to be reimbursed. As such, they'll need to provide proof of the incurred expenses by attaching the corresponding receipts.

They can submit a scanned copy or a photocopy of the receipts depending on whether they are submitting reports electronically or in a printed format.

6. Print or Send the Report

Before you print and send the expense report, be sure to check the totals and subtotals listed.

Using expense tracking software will allow you to export the expense reports to Excel and as a PDF so you can send the reports via email.