Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Obviously lots of people have requested this feature but the development team, contrary to your and your colleagues' claims, doesn't seem interested in taking the feedback into account and implementing it. It is utmost frustrating to have to tell my clients that they need to manually set the due date because QBO doesn't offer it natively, effectively telling them that QBO is more a SOHO accounting solution with lots of limitations that will never get addressed.

@nortsandcrosses Your suggestion makes a lot of sense to me! It did make me question whether a bill that comes in on, say, the 13th and is due the 6th of the following month would have an incorrect due date, but it looks like QBO calculates it correctly (in case anyone else is concerned).

For example:

bill date: 13 Nov 2022

due date: 6 Dec 2022

I was worried QBO would make the due date 6 Nov (wanting to keep everything in the same month, given the "Due the next month..." option), but fortunately it does not. I've had to do a lot of experimenting with how to get the right due dates for vendors that have odd terms (I'm seeing this a lot with US insurance companies), like the 23 days in the above example. It's a different issue, but I wish we could simply type the due date into the recurring transaction rather than having to choose from a drop-down. If I have bills due every day of the month and terms ranging from upon receipt to 30 days, that's a lot of scrolling. I do understand that free-form fields make reporting very difficult, but in terms of due dates it would certainly make my life easier to just type it in. OK, off my soap box. Thanks for your solution!

Hello Michael,

I totally agree with you, I am at present using Sage and have taken Quickbooks for 3 months to trial it as an alternative but this issue may be a game changer. We have always used 30 days EOM and this is what most companies use here in the UK. I cannot understand how the producers of Quickbooks would not have known this and included it as an option from the beginning.

Our company will have to see if there is a work around but at present, I cannot see how.

We can but wait to see if the developers listen and give an update option soon to incorporate this.

Hi there, PSElec.

The option to set 30 days from the end of the month isn't available in QuickBooks Online (QBO). I can see how this functionality would be beneficial to your business.

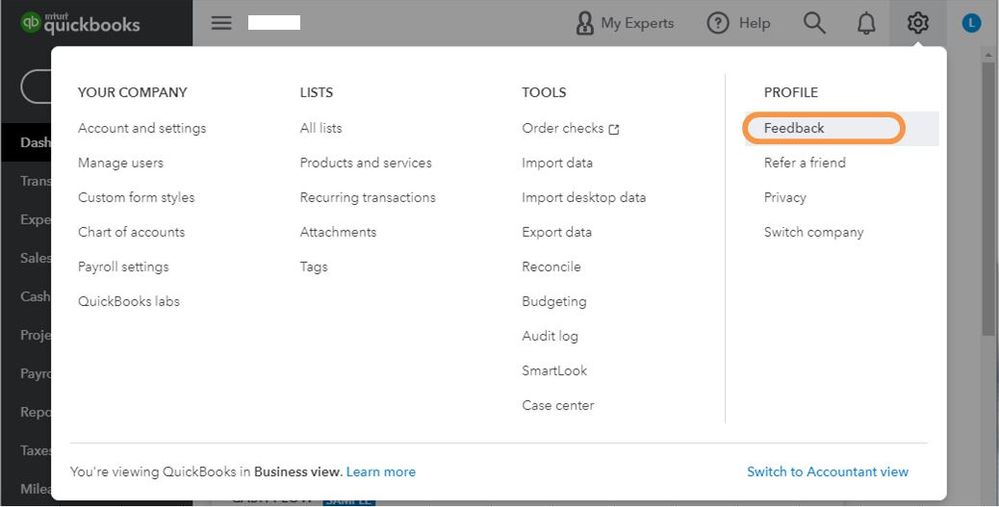

I encourage you to add your vote by sending a feature request in the Feedback section within QuickBooks. Our product development team reviews the suggestions they receive to ensure we’re meeting the needs of our customers.

Here's how:

In the meantime, we can create a new payment term and set it to 30 days. I'll show you how:

I've added this article to learn more about payment terms and personalising sales forms in QuickBooks:

Please let me know if you have any other issues or concerns. I want to make sure everything is taken care of for you. Have a great weekend!

It's embarrassing that this issue hasn't been resolved since 2020.

Why is this not available on Quickbooks yet. Recently set up and have discovered this, makes the system almost useless... any suggestions of other software providers that actually has this commonly required function?

Hi there, @Steve337.

I completely understand the importance of calculating invoice terms from the send date for you and your business. Please rest assured that all suggestions are carefully evaluated by our product engineers. Their implementation depends on the volume of requests and how they influence the user interface.

To ensure your suggestion receives proper consideration, I recommend submitting your feedback directly to our product engineers. Here's how you can do it:

While we actively work on integrating this feature, you can check the workaround shared by nortsandcrosses in the other thread to achieve similar results.

Although we cannot recommend specific software or apps offering this feature, you are free to explore alternative solutions outside our program that may suit your needs.

To stay informed about the latest updates and developments in QuickBooks Online, I recommend visiting our QuickBooks Blog.

You can also check this article about payment terms in QuickBooks: Fix inconsistencies in due date and invoice date in QuickBooks Online.

Thank you for your valuable feedback, and we strive to continuously improve your QuickBooks experience based on user insights like yours. Should you have any further questions or concerns, feel free to reach out anytime. We're here to assist you!

Hi I want too set a new term on 1 vendor days is from 09/11/23 untill 10/11/23 due date must be 11/03/23.How must I set the terms

Thank you

Hi there, maris.

Currently, the option to set a specific term to only one supplier in QuickBooks Online (QBO) is unavailable. Rather, you can set the terms available from the application or create a new one and manually add the Bill date and the Due date. Please take note that setting a new term applies to all vendors for whom you will create a bill.

To manually set a specific term of a particular bill, here are the steps you can take:

Moreover, if you need help about setting up new terms, you can follow the steps below:

Furthermore, you can take a look and access each supplier’s records, and edit and view the status of their transaction. I also included a resource where you can refer to complete guidelines on customizing reports:

If you need an extra pair of hands to help you with managing your bills, please don’t hesitate to come by the Community. We’re available 24/7 to help you. Have a good one!

We use desktop version QB, not QB online, but I guess the setup is similar.

I had that question of EOM term set up in QB as well. Here's how it works:

TO Set up EOM in Terms List:

Lists - Customer & Vendor Profile Lists - Terms List,

Edit terms, or add New:

Choose Date Driven, & input 2 days in the 2 lines:

Net due before the ___ th day of the month (A day)

Due the next month if issued within ___ days of due date (B day)

(A day) is the day of the month that you'd like to the 'due date' to show in the moth for the cheque date

(B day) is the due day

So, I use A day to schedule the cheque day, as it's good to batch the cheque issuing (payment) days to 2 (or more) times a month. I use end of the month and mi-month for cheque days that are 30th and 15 of the month for A day.

For example,

EOM 15.60: I input 15 for A day & 60 for B day. With Jan 9, 2024 invoice date, the Due date on QB is 2024-03-15.

EOM 60: I input 30 for A day & 60 for B day. With Jan 9, 2024 invoice date, the Due date on QB is 2024-03-29.

Hope this helps.

Hi Annie W,

I wanted to make sure you'll get the right support for your QuickBooks account. At the moment you've posted your question in the QuickBooks Online Community. In Australia, QuickBooks Desktop accounts are called Reckon accounts. I'd recommend reaching out to the QuickBooks Desktop support team for Australian region through this link https://www.reckon.com/au/contact-us/ they're the best support that can provide more information about your query.

If you're using the QuickBooks Enterprise version, please reach out to the US support team through this link https://quickbooks.intuit.com/learn-support/en-us/contact.

Drop by again in the Community if you have further concerns about QuickBooks Online version.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here