I understand how challenging it can be to select a VAT code when your company isn’t VAT-registered. This usually occurs when the VAT feature was accidentally enabled. However, don’t worry, Irene, we can easily set the default tax rate to Out of Scope of Tax to prevent this from happening.

Here’s how:

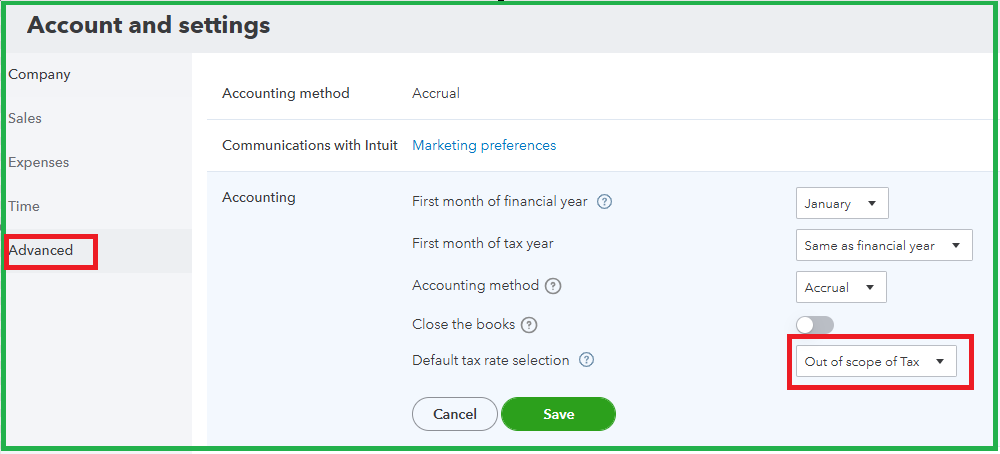

- Choose the Gear icon.

- Tap Accounts and Settings.

- Tick Advanced.

- Go to Accounting.

- Hit the drop-down in Default tax rate selection and choose Out of Scope of Tax.

- Hit Save. Then, Done.

The Out of Scope of Tax is used for non-VAT registered businesses. This means, if you use it then it will not show in any taxes reports in your account.

If you need any help updating your settings or have any other questions, please don’t hesitate to reach out. We’re here to support you and ensure your accounting runs smoothly. Thank you for bringing this to our attention.