Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

This cause your sales by customer report to be incorrect as the deposit is also taken as a sale.

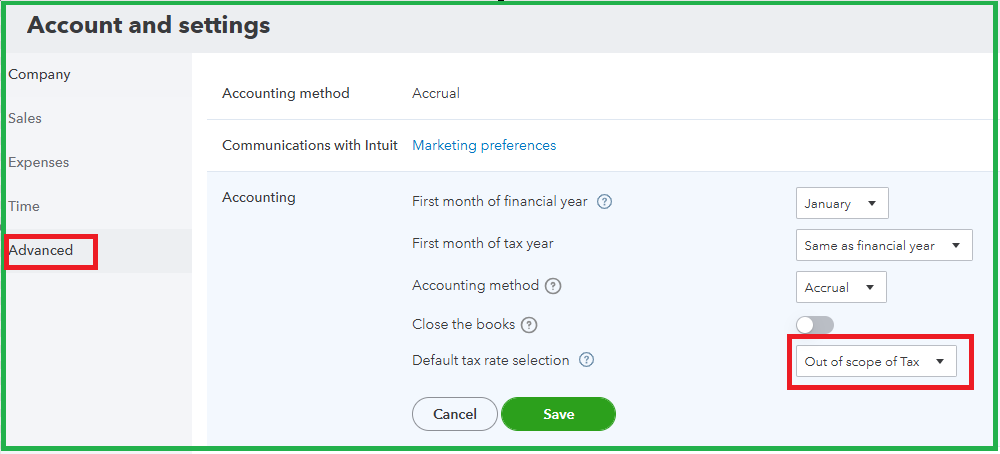

I understand how challenging it can be to select a VAT code when your company isn’t VAT-registered. This usually occurs when the VAT feature was accidentally enabled. However, don’t worry, Irene, we can easily set the default tax rate to Out of Scope of Tax to prevent this from happening.

Here’s how:

The Out of Scope of Tax is used for non-VAT registered businesses. This means, if you use it then it will not show in any taxes reports in your account.

If you need any help updating your settings or have any other questions, please don’t hesitate to reach out. We’re here to support you and ensure your accounting runs smoothly. Thank you for bringing this to our attention.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here