Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi info-smuccivapes,

Greetings and thank you for joining the QuickBooks Community! We appreciate your interest in learning how to include duty or excise taxes on your inventory purchases. Allow me to guide you through the process of inputting these taxes on your transactions.

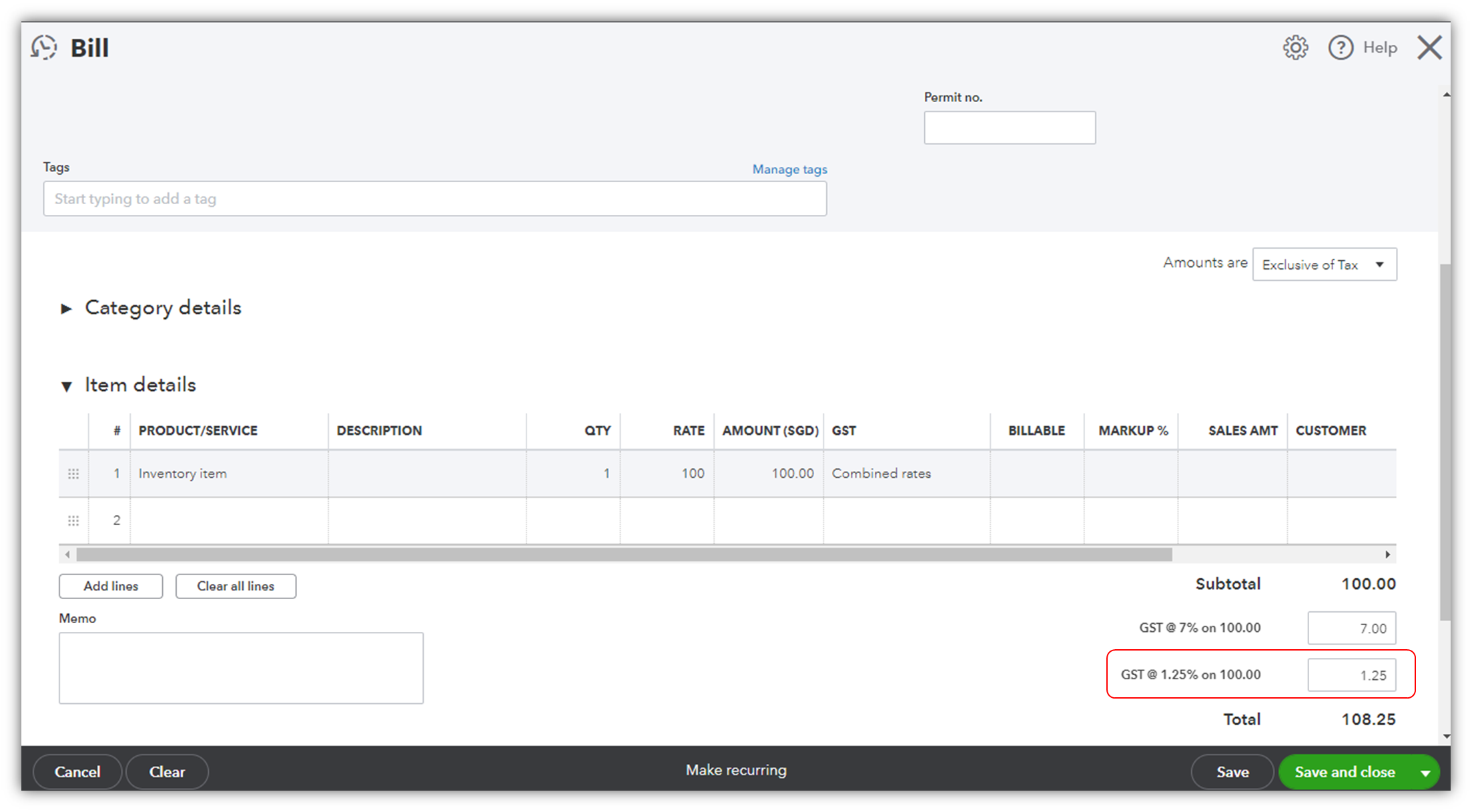

In order to add the mentioned taxes into your inventory purchases, you have the option to combine it to the main tax of your purchases. Basically, you will add a new tax rate for the duty/excise, and then create group tax composed of the original sales tax and the newly created duty/excise tax.

Create a new tax rate for the duty or excise tax.

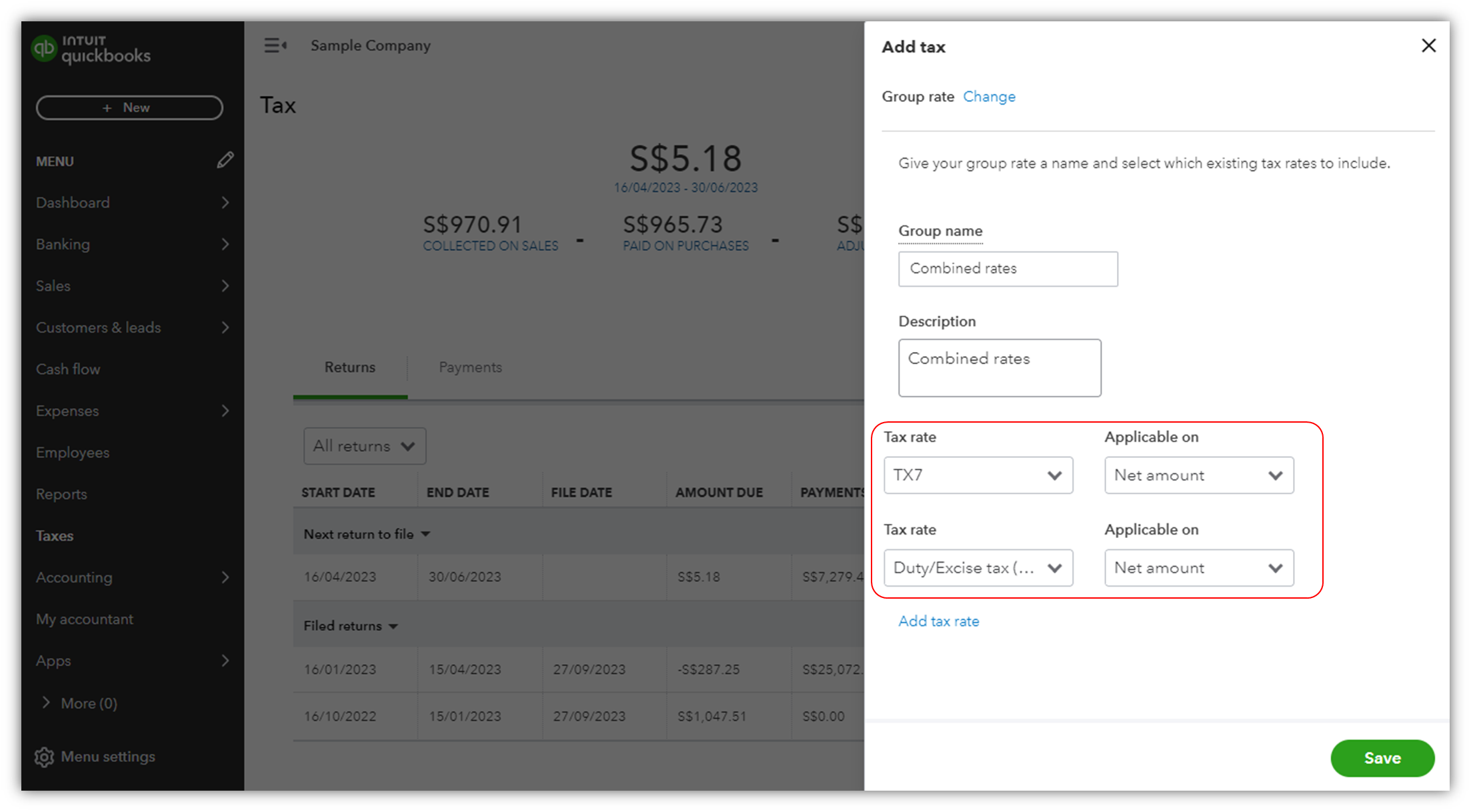

Next, create a group tax that combines the original sales tax and the newly created duty or excise tax.

In the group tax settings, add both the original sales tax and the newly created duty or excise tax. This will merge them into a single tax rate. Save the group tax and apply it to your inventory purchases. When recording a transaction, choose the group tax you created instead of the individual taxes.

If you have any other concerns, please don't hesitate to reach back out. I'm just around to help.

Consider having a 3rd party inventory management app with that feature to integrate with QBO.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here