Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello Everyone !

Want to record advance payment made to a supplier. I tried by doing a journal but we can only select expense account not supplier (or customer). Kindly advice how to record advance payment.

Kindly note that I am using basic plan to Quick book online.

Regards

Many thanks in advance.

Hello there, @arif hamid.

You can create an expense and select the Accounts Payable (A/P) account from the category section. This will set a credit on the supplier section, which you can use for the future bill.

Once you create the bill, you can apply the credit as a payment. Let me guide you how:

To see more options, you can view this article: Record vendor prepayments or deposits for prepaid parts or services.

In addition, you can run the Transaction List by Vendor report to see all transactions grouped by vendor. Here's an article on how to customize a report in QuickBooks Online.

If you have additional questions, you're always welcome to drop a comment below. Keep safe!

Many thanks for your reply.

I wanted to understand in either of the methods; how the expense account is hit ?

I am looking for the following way:

Dr. Supplier – advance payment

Cr. Cash / Bank

Recording the advance payment to the supplier.

Dr. Prepaid expenses

Cr. Supplier – advance payment

Debiting the prepaid cost as the advance payment details are received and it is spread over the period of 2 years.

Dr. Expense Account

Cr. Prepaid expenses

recording each month's expense

Kindly advice on above.

Hello there, @arif hamid.

I'd be glad to show you the way on how to properly handle prepayments in QuickBooks Online.

First, we are going to create an Accounts Payable account for the transaction. Then, create a journal entry, and input the total amount of the payment. After that, make another journal entry transaction to post the advance payment. When the time comes for your monthly payment, you can also create a journal entry for it. That way, you can track the balance you've owed to your supplier. Please refer to the detailed steps below.

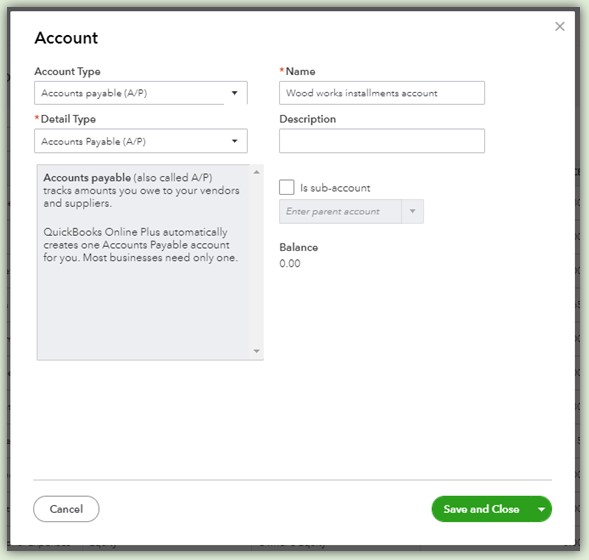

Step 1: Create an Accounts Payable account.

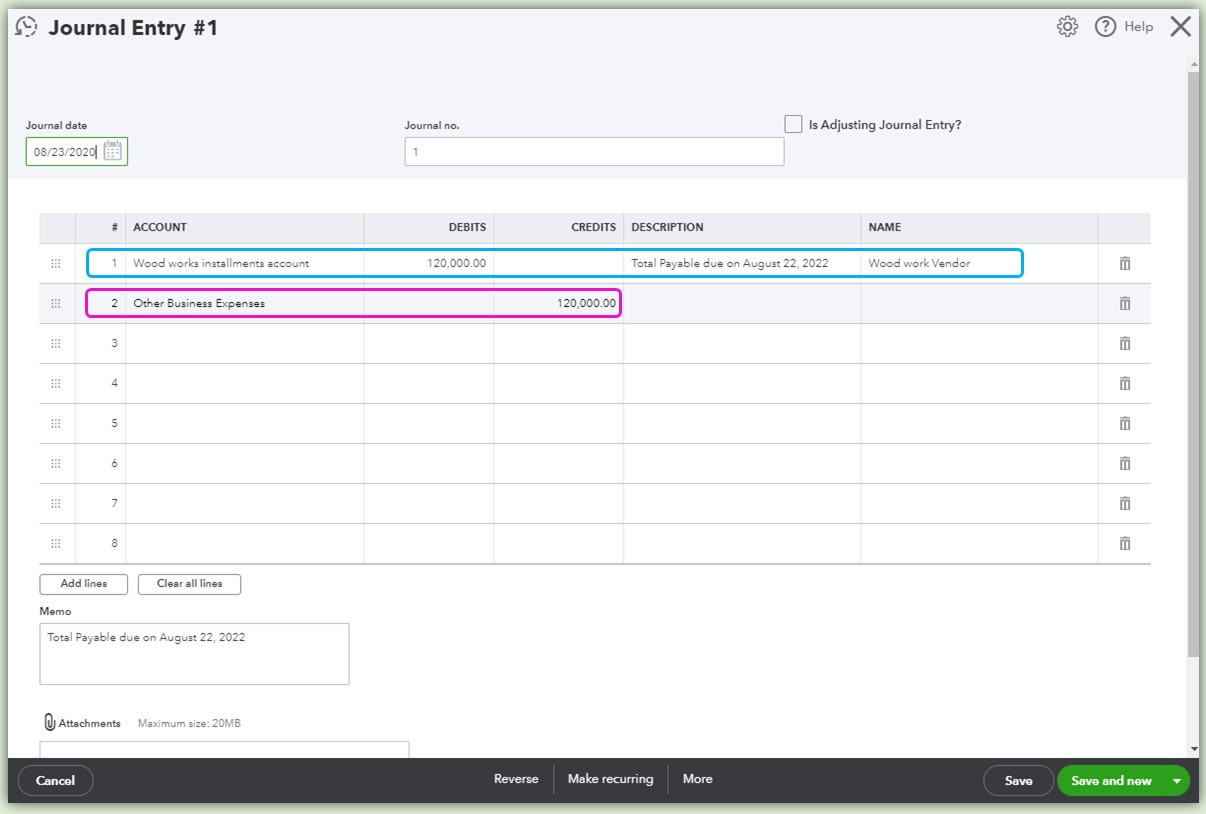

Step 2: Post the total payable amount in the account you've just made.

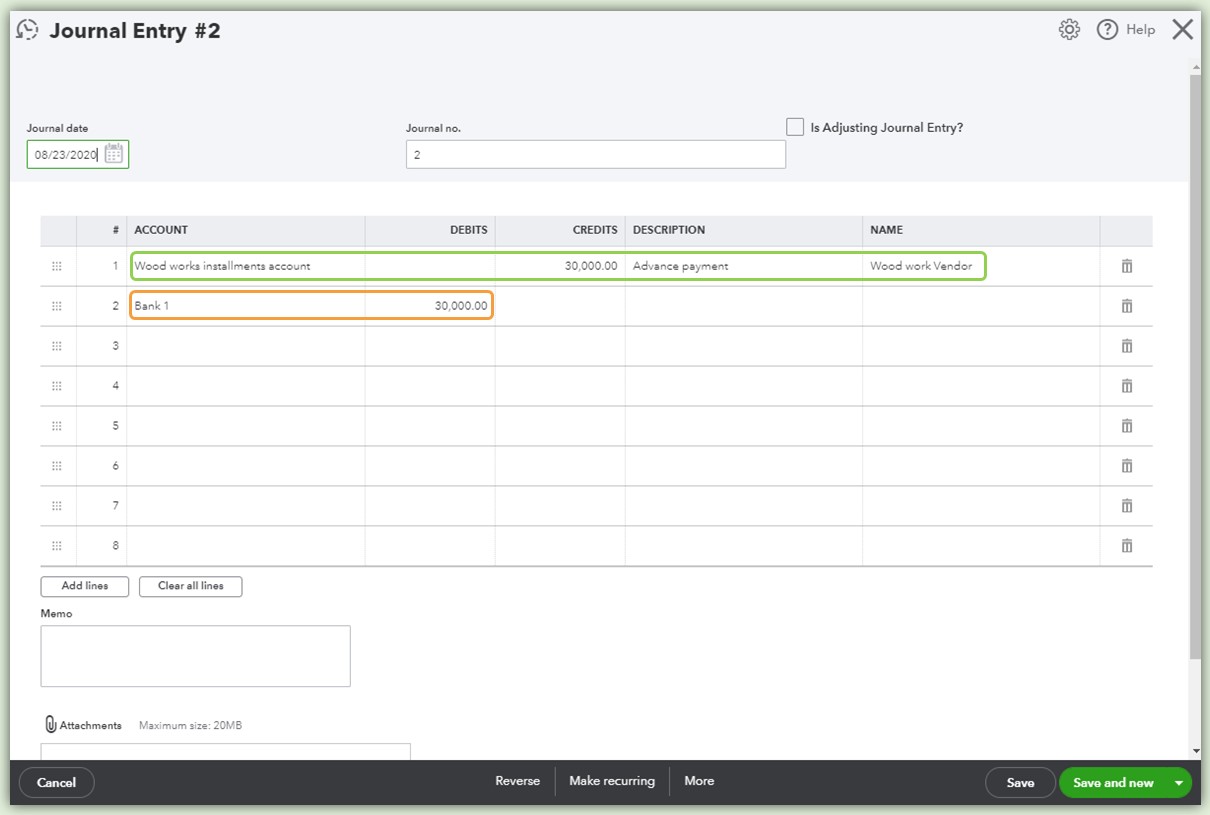

Step 3: Record the Advance payment on the Accounts payable.

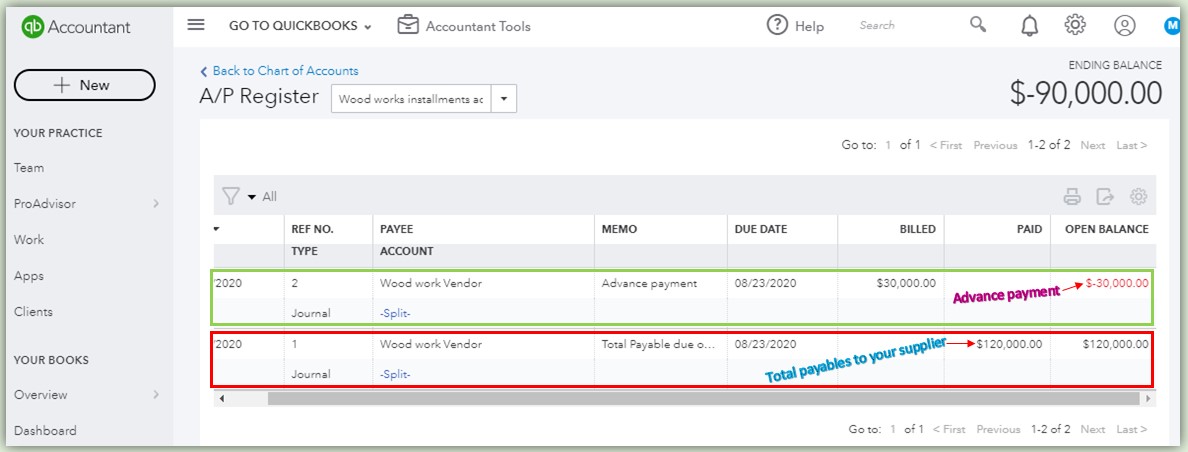

After those steps, you can check out the register of the Accounts payable you've created to track the payment. This is how it looks like:

For the monthly payment, you can follow Step 3 when recording. To learn more on how to enter details in Journal entry, you can check out this article: Create a journal entry in QuickBooks Online.

I've also added this article to help you categorize and match your transactions in QuickBooks: Categorise and match online bank transactions in QuickBooks Online. This also contains troubleshooting steps just in case you've matched the wrong transaction.

Please don't hesitate to tag my name in the comment section below if you need further assistance or questions. I'd be happy to answer them for you. Have a beautiful day.

Good Morning MarsStephanieL:

Are you able to provide steps for this same procedure in QuickBooks Desktop please?

Thank you!

Good to see you in this thread, Blackrete.

I'd be happy to show you how to handle vendor prepayments in QuickBooks Desktop (QBDT). You can either use Accounts Payable or an Asset account.

To use the Accounts Payable to record the prepayment, here's what you'll need to do:

To use an Asset account to track the prepayment, here's how:

To know which best suites for you, I recommend contacting your accounting professional since every business structure is unique, they can help determine the correct recording.

Keep in touch if you need any more assistance with this, or there's something else I can do for you. I've got your back. Have a great day.

Because its a prepayment which mean unless you will receive the services or good it will be your asset technically..

one way of doing it is ....

Dr Prepayment Account: xxx

Cr: Bank xxx

once you received the services or goods

Dr: Expense account xxx (P&L)

Cr: Prepayment Account xxx (B.s)

We have solved this issue by following this process:

1. Create a balance sheet asset account titled something like Downpayments to Suppliers (or something descriptive for your company)

2. Create a purchase order to the supplier in QB for the full order.

3. Create a bill for the amount of the downpayment you are about to make. Do not use the purchase order to create this bill; you will do that later. Select your new "Downpayments to Suppliers" account as your category.

4. Pay the bill to your supplier for the downpayment.

5. Later when you have received your purchase from the supplier and you have a bill of lading and an invoice for your complete order, create a new bill using the purchase order you created in the beginning.

6. Create a Vendor Credit to apply to the new invoice; again select your "Downpayments to Suppliers" as the source of your credit.

7. Any remaining open balance on your Invoice can now be paid. The Purchase Order and the Invoice will be closed out in full and all Downpayments will be applied, leaving a balance of $0 zero in your Downpayments to Suppliers balance sheet account.

This process works perfectly for us.

thank you so much! loving this system!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here