Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have to do a journal entry for a loan that my boss has had. I have the new account balance and the percentage. How do I go about doing the journal entry and setting up new recurring payments that will account for the principle and the interest? Can quickbooks figure the interest or do I have to figure it each time. I would appreciate anyone's help.

Good day, NeeNee2022.

Let me make it up to you by ensuring you'll be able to record a loan in QuickBooks Online (QBO).

To start tracking loans, we'll have to set up a liability and expense account for the loan and interest payments, respectively.

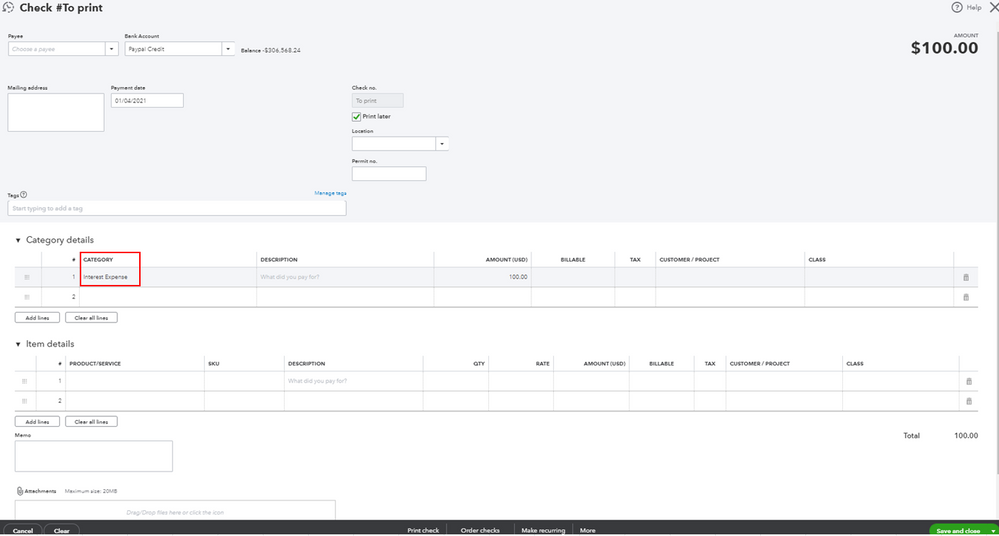

After that, you'll need to create a check for the loan. I'll show you how:

You can check out this article for more detailed steps: Set up a loan in QuickBooks Online.

I also recommend reaching out to your accountant for additional guidance in managing your loans in QBO. Doing so ensures you'll record everything correctly and avoid messing up your books.

Should you need any assistance managing your loan payments in QBO. I'm is always here to help.

Can you put the principal payment and loan payment on same check?

Also is there a way to do a recurring payment and put percentage in so that it accounts for the reduced interest amount each payment or do I need to just do a new check for each one?

Hi there, @NeeNee2022!

Yes, you can enter and put the principal and loan payment amounts in one check as long as the correct names of categories are used.

Kindly read and use this article to learn more about recording a loan payment: Record a Loan Repayment in QuickBooks Online.

Meanwhile, the option to create a recurring transaction using a certain percentage of the loan payment is unavailable. This means we'll have to manually create checks for every payment made to the loan in question.

I'm also adding this reference that'll help you understand your account and its transaction history which breaks down how much money you have or owe: The Chart of Accounts in QuickBooks.

I've got you covered if you have other questions aside from recording a loan in QuickBooks. Use the Reply option below to leave a comment and don't forget to include my name, @JonpriL. Take care always and stay safe!

I'm so sorry but here is my dilemma. My boss has this loan account in his QB, and the bank has been taking automatic withdrawals for a while now. The account has been reconciled with the bank. He says it's not showing up on the reports right and I need to have it paid with the principal and interest. I've only taken one course on QB and am just out of school, so I'm trying to figure out how to rectify this. He says we need to do a journal entry for the current balance and start recording payments from there. To me if payments have already been reconciled, they have been recorded, just not principal and interest. I'm sorry but please any help would be wonderful.

I want to make sure the loan is recorded correctly, NeeNee2022.

The principal and interest were not included in the previous balance. That's why the report isn't showing right.

I suggest consulting your boss again and having them include the principal and interest on the previous reconciled payments. Adding it to the new account balance will no longer match the statement on the real-bank account. And, will mess up the report in QuickBooks.

If not, you can write a check and make sure to add the principal and interest. Please use this article and follow the instruction in Step 3: Record a loan repayment section: Learn how to record a loan in QuickBooks Online. Make sure not to miss any of the steps provided in this link so your loans are tracked properly.

If you aren't sure about this, it's a good idea to ask an accountant’s professional opinion. If you don’t have one, here's how to find a ProAdvisor near you.

Don't hesitate to comment below if you have follow-up questions about this. The Community forum is always open for replies.

This would be all me. He doesn't want to fix past payments. He wants to do journal entry for current balance and start recording the principal and interest payments from now on. Would I have to set up new liability and expense accts and start as a new one?

Hello @NeeNee2022,

Yes, you'll want to create a new set of accounts to track journal entries of the principal and interest payments. If you're still unsure about this, I highly recommend contacting your accountant for guidance. They can also provide the best practices to follow to ensure the accuracy of your accounting books.

Let us know in the comments if you have any other questions. Take care always!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here