Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Buy now and save 90% off today

xyzHello!

We use a separate credit card processing terminal to manage payments. Typically when we issue a refund, the refunded amount comes out of our next batch deposit. For instance, if we ran $1000 worth of charges but also refunded a customer $100, our deposit the following day would be $900.

I'm finding this process is making it challenging for me to properly reconcile a customer's original payment and subsequent refund when I'm matching deposits in the business overview/bank account section. For instance, I received a credit card batch deposit on 1/03 which included the customer's original payment - I am able to match that payment without issue. On 1/05 I received another credit card batch deposit, but it is for $600 less than the charges ran the previous day because of the $600 refund. I can't match this deposit to the charges it was for because it is less than what those charges add up to.

I'm not sure if I'm explaining this clearly enough...hopefully someone can still help me though!!

Solved! Go to Solution.

I appreciate your effort in adding a detailed scenario with your concern, @tmoney5252. Let's work together to make things right so you find a match for the batch deposit in QuickBooks Online (QBO).

To fix this, you'll need to undo first the transaction from the Categorized tab to void the resolve difference and the transaction goes back to the For Review tab. After that, we can follow the process to settle this issue and you'll be able to find a match for the deposit payment.

Firstly, you'll want to Receive payment directly since you've already created an invoice that amounted to $ 1,650. Then, deposit the Undeposited funds or Payments to the deposit account.

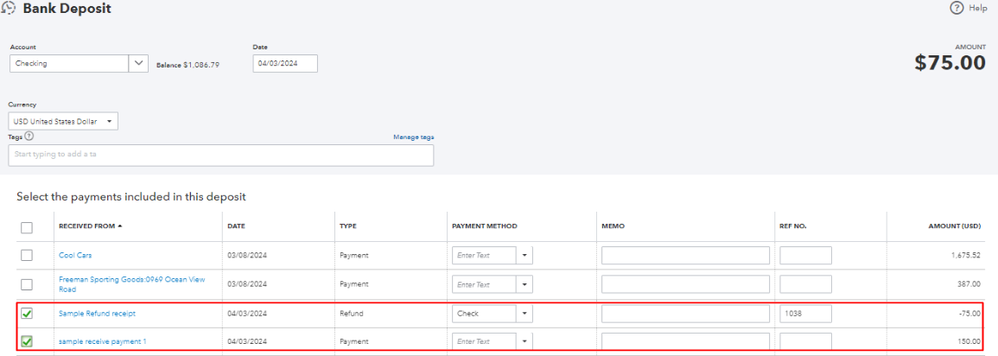

After that, create a Bank Deposit for the invoice payment. On the Add Funds to this deposit section, enters the expense refund for Customer B with an amount of -600. For the accounts to use, I recommend reaching out to your accountant or a QuickBooks Certified ProAdvisor. That way, they can guide you with the appropriate process and ensure the accuracy of your books. Then click Save and close. After this, you can now find a match for the deposit transaction on the For Review tab.

I'll be adding these articles for future reference:

If you need more help matching your bank transactions in QuickBooks Online. I'll be around. Take care!

Welcome back to the Community, @tmoney5252. I'm here to provide additional help so you'll be able to record your customer refund in QuickBooks Online (QBO).

In QBO, there are several ways on how you can record the customer refunds. I'm happy to guide you how.

Yes, you can create a credit memo, if you want to return the payment for a paid invoice. Then, enter an expense transaction to zero out the balance of the customer. Follow along below to get this done right away.

Create credit memo:

After that, create an expense. Then, use the Receive payment option to link it to the credit memo:

If this refund is for product or services that did not satisfy the customer, you can create a Refund receipt. For reference, feel free to check this article: Record a customer refund or supplier refund in QuickBooks Online.

Once everything if fine, you can now proceed in matching the transaction in your Banking page.

Keep me posted if you have any other concerns managing your customer transactions. I'd be happy to lend a hand. Have a good day ahead and stay safe.

Hello there, tmoney5252.

I appreciate you for providing more details about your concern. Based on your scenario, we can utilise the Find match button and enter an adjustment to resolve the difference to match the deposit to the charges. Here's how:

Let's keep your bank data accurate from time to time. With that, we have to review and reconcile your accounts in QuickBooks. The articles below will serve as your guide.

If you have more concerns about connecting accounts and handling transactions, please know that I'm here to help you. Take care and stay safe.

Hi - Thanks so much for your response!

I think I am making some progress with your suggestion, but still not quite fully there yet. Perhaps if I give you the exact details, it will help.

I have a batch deposit of $1,050 that I am trying to match. This consists of two charges: a $1,650 payment from customer A, and a refund of $600 to customer B. When I select find match, the $1,650 payment does not show up in the list of invoices/transactions - I believe this is because it is greater than the $1,050 deposit amount and is getting filtered out (I see it when I look at other larger deposits). Is there a way to make the $1,650 payment appear? (if so, I believe that would resolve the final issue I mention at the end).

I clicked resolve difference and was able to add a $600 refund for customer B (I entered -600) and then also manually entered the $1,650 payment from customer A. This added up to $1,050 and I was able to save it.

The refund appears as an expense in customer B's home page (where I can see all their invoices/payments) - the only issue with this is that it's not linked to a credit memo, so it appears that there's an open balance.

The other issue is that the $1,650 payment that I manually entered for customer A is not linked to the payment I already had for them (back when I created the invoice and clicked "receive payment"). How can I resolve this issue?

Thank you so much!!

I appreciate your effort in adding a detailed scenario with your concern, @tmoney5252. Let's work together to make things right so you find a match for the batch deposit in QuickBooks Online (QBO).

To fix this, you'll need to undo first the transaction from the Categorized tab to void the resolve difference and the transaction goes back to the For Review tab. After that, we can follow the process to settle this issue and you'll be able to find a match for the deposit payment.

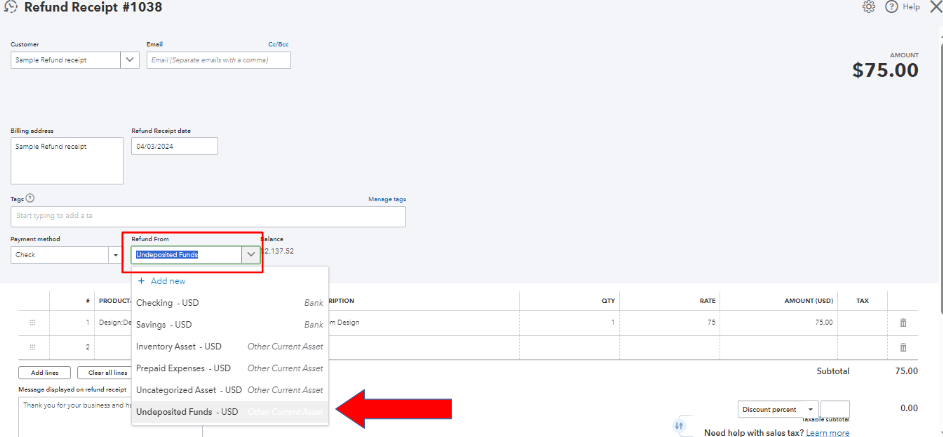

Firstly, you'll want to Receive payment directly since you've already created an invoice that amounted to $ 1,650. Then, deposit the Undeposited funds or Payments to the deposit account.

After that, create a Bank Deposit for the invoice payment. On the Add Funds to this deposit section, enters the expense refund for Customer B with an amount of -600. For the accounts to use, I recommend reaching out to your accountant or a QuickBooks Certified ProAdvisor. That way, they can guide you with the appropriate process and ensure the accuracy of your books. Then click Save and close. After this, you can now find a match for the deposit transaction on the For Review tab.

I'll be adding these articles for future reference:

If you need more help matching your bank transactions in QuickBooks Online. I'll be around. Take care!

THANK YOU!! That worked!

The one final step I would like to take to fully close the loop on this is regarding the $600 refund for Customer B. I was able to add this to the Bank Deposit in the "Add funds to this deposit" section. The only issue is that this refund doesn't show up anywhere in Customer B's account history. I only see the original invoice and payment. Should I create a Credit Memo and link it to the refund I created in the Bank Deposit? Or is there some other method to demonstrate that we refunded this customer?

Thanks!!

Tad

Welcome back to the Community, @tmoney5252. I'm here to provide additional help so you'll be able to record your customer refund in QuickBooks Online (QBO).

In QBO, there are several ways on how you can record the customer refunds. I'm happy to guide you how.

Yes, you can create a credit memo, if you want to return the payment for a paid invoice. Then, enter an expense transaction to zero out the balance of the customer. Follow along below to get this done right away.

Create credit memo:

After that, create an expense. Then, use the Receive payment option to link it to the credit memo:

If this refund is for product or services that did not satisfy the customer, you can create a Refund receipt. For reference, feel free to check this article: Record a customer refund or supplier refund in QuickBooks Online.

Once everything if fine, you can now proceed in matching the transaction in your Banking page.

Keep me posted if you have any other concerns managing your customer transactions. I'd be happy to lend a hand. Have a good day ahead and stay safe.

Hi!

I am experiencing the same issue and I was able to match our received payments when the deposit hits our bank transaction feed. However, it looks like there is no way to match a refund receipt. So I created an expense with the resolve difference feature. But like you mentioned, the expense is not hitting the customer's account. Did you ever get a response to your question?

The system seems to work great except for this detail not showing up in the customer's profile.

I'm here to assist you in matching your refund receipts, MBL-S_H.

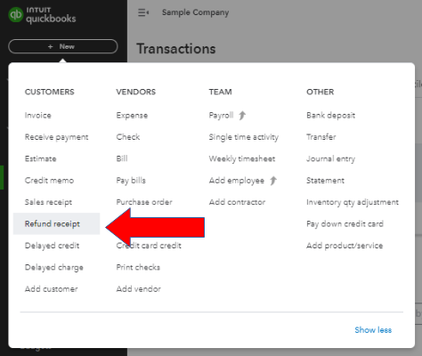

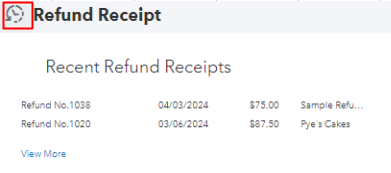

You can match your received payments and refund receipts if they're under one bank deposit. You don't need to use the resolve the difference function. Please refer to the steps below to guide you through the process:

Moreover, I'll add these articles to help keep your bank data accurate:

I'll keep the thread open so you can post a reply if you have further questions about matching your bank transactions in QBO. Stay safe!

Have this same issue only it's with credit card customer payments so it affects sales receipts, not invoices. How does the correct process change in this scenario? Sales receipts will not accept a negative number line item, so simply adding a negative quantity of the sales item to a sales receipt will not do the trick. Please advise.

I appreciate you for sharing this concern in the Community, @Workafrolic1. Let me provide you with the right way to add a negative number to your sales receipt.

Let's start with editing your sales receipt, you can follow these steps:

Once the transaction is assigned to undeposited funds, you can proceed with the bank deposit and manually add a negative line item. Please refer to the steps provided by my colleague above.

Additionally, customising your sales form contents is a breeze in QBO. For a detailed guide, please refer to this article: Customise invoices, estimates, and sales receipts in QuickBooks Online.

If you have any further questions or need additional assistance with managing sales receipts in QuickBooks Online, please do not hesitate to click the Reply button. We are here to support you and will respond as promptly as possible.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here