Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Let's figure this out, @M K1.

Let me share some insights about the expenses not showing up in your VAT Detail report in QuickBooks Online. This way, I can guide you accordingly.

Here are some things you need to make sure to isolate the missing expenses transaction in the report:

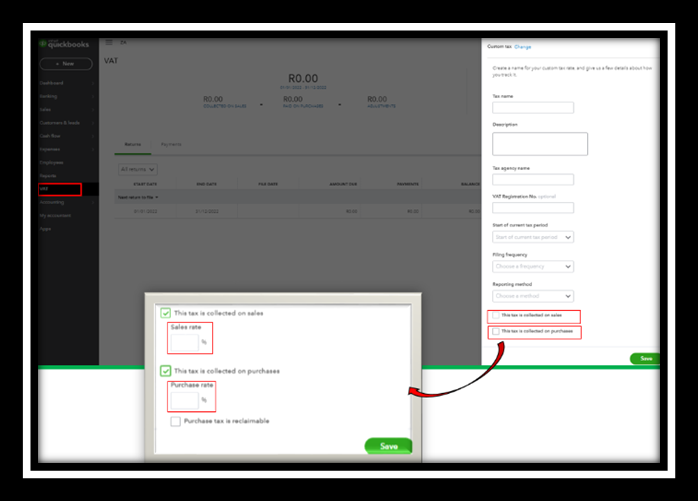

1. Go to the Taxes tab and select your appropriate VAT in the drop-down.

2. Click the small drop-down arrow beside Add tax and pick Edit rates.

3. Hit the Edit hyperlink and review the details.

2. Choose the appropriate Accounting Method, Report Period, VAT Agency, Distribution Account, and other necessary filters.

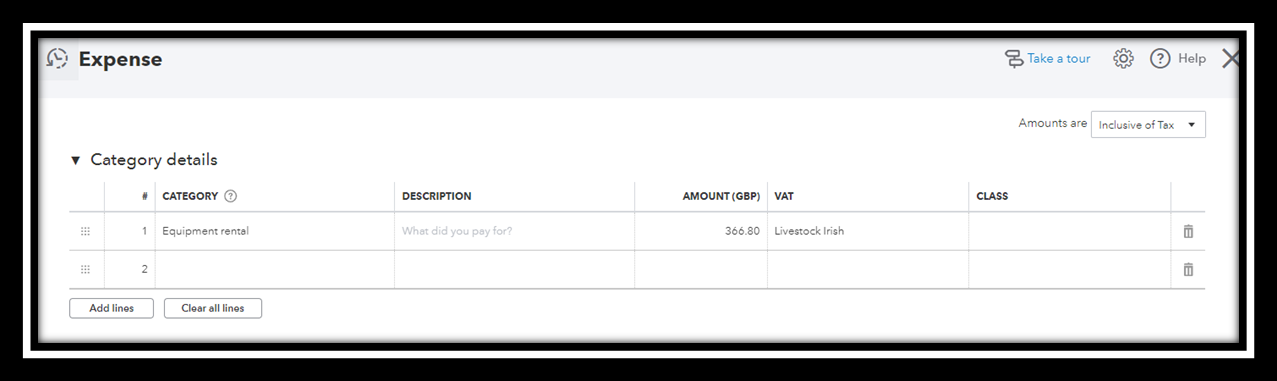

3. Make sure you select accurate tax in the expense form, and it's not zero-rated.

If you're still getting the same data on your report, let's start accessing your QuickBooks account using a private browser. This way, we can isolate this unexpected behavior for the possible browser-related issue.

From there, run the VAT Detail report again to verify if it's already performing well. If you're to see the expenses, please go back to your regular browser to clear the cache.

To learn more about the VAT rates and reports, feel free to check out these articles:

If you have further questions, feel free to post questions in this thread. We're happy to help out where we can. Keep safe.

I have done all those things to no avail. The tax agency is Revenue, all vat rates are listed under this and there are no other tax agencys. No matter what tax rate I add if it is not in the existing default rates it will not show up in the vat detail expense report. It will show up in the sales list within the vat detailed report.

when I hit the edit button for the vat rate. the rate is listed as 4.8% under sales and account type "liabilty" and listed under purchases as 4.8% and account "type expense". If i change the vat rate in the expense form to any other default vat rate or even 0% it will show up in the VAT detail Report. I cannot see anything else to change or try. Is this just a glitch and should QB not have all the standard vat rates of a country as default within its program.

I appreciate your update on the results after following the steps provided by my colleague above, @M K1.

Sometimes too much cache stored in a browser can cause the issues when using QuickBooks. It might also be the reason why the VAT expenses isn't showing on the VAT Detail report.

To verify, let's run some basic troubleshooting steps. Let's start by accessing your account using a private window. It doesn't save your browser's history and will help us check the issue. Here are the following shortcut keys to access this mode:

Once a private browser is open, pull up the VAT Detail report again and check if expenses are now showing up.

To know the recent VAT features update, see this article: VAT Update FAQ.

Keep me posted if you still have questions or concerns about taxes in QBO. I'll be around for you. Have a great day!

Mirriam thanks for your help, tried what you said but still not working tried in chrome after (cleared cache), then with incognito page and then in Firefox. expenses with (4.8% manually added non default rate) do not show up in purchases.

Thank you for coming back to the Community and letting us know the result of the solution shared by my peer, M K1. I’m here to help ensure the expenses will show on the VAT Detail report.

To determine the source of the issue, we’ll need to thoroughly check the category type used for the transactions and the tax set up. The process requires special handling because I need to collect personal data to pull up an account.

That said, I recommend you get in touch with our QuickBooks Online (QBO) Care Team. They can perform in-depth troubleshooting in a secure space. Then guide you on how to apply the resolution steps from there.

Here’s how to reach them:

You can go over this article for detailed information about the support hours and types: How and when can I contact Support?

For additional resources, the Tax link contains a breakdown of articles about VAT, GST, and general tax FAQs. In addition, you can browse the following reference to learn more about different reports available in the online program as well as ways to tailor each one: QBO self-help guide.

The information I provided should help make running your business more simple, M K1.

Let me know how it goes after contacting our support team. I want to make sure you’re taken care of and help you the best that I can.

I had contacted the support team last Wednesday and they said that they needed to send it to the back room team to sort out. I have heard nothing since.

I appreciate you for contacting us to get this resolved, M K1.

I'd recommend contacting us again so we can pull up your recent case and check its updates. Please make sure to reach out to us during support hours to get assistance on time.

Also, I've added these resources that'll help you learn more about how QuickBooks Online handles VAT:

Please keep us posted on your progress in getting this issue fixed. It's always our pleasure to help you out.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here