Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

You just have to turn-on the VAT feature, @spkauditors.

We have added three main features into QuickBooks Online to be compliant with the new tax law for UAE. These are set of VAT codes, an option to enter transactions by location, and a form for the VAT return.

Follow the steps below:

Then, when creating a new invoice, you’ll just have to choose the VAT code below the Tax column.

Check this article for more information about VAT Feature Update FAQ.

I'm always here if you need further guidance in setting up your invoices. Just let me know by leaving a comment below. Have a wonderful week!

Suppliers are denying to accept our invoices as they can't claim VAT with our invoice. Tax authority charging fine AED 5,000 for not maintaining the sales invoice as per their regulations. So please amend the sales invoice

I appreciate the screenshots, @anzari25.

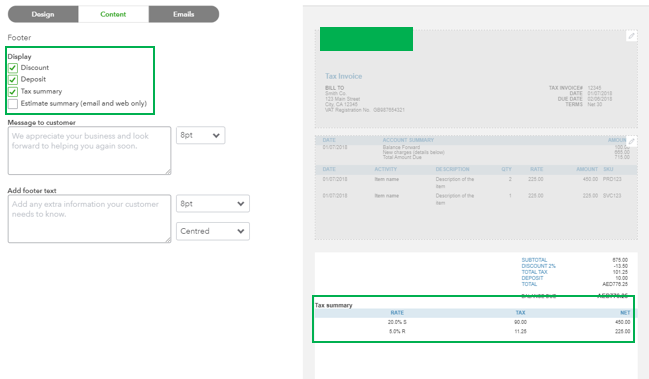

You can customise your sales invoice to show the tax amount. Here's how.

In your QuickBooks Online (QBO):

Here's an article you can read for more details: Customise your invoices, estimates, and sales receipts in QuickBooks Online.

You can also visit our Help articles page for reference in case you want to learn some tips on managing your QBO account.

I'll be around if you have other questions or concerns. Have a great day and take care!

Thanks for your kind responds. You are telling about the tax amount in the summary. But we need the tax amount separately for each item. If we are selling 10 different items and there will be 10 lines for each items in the invoice. As per UAE tax law, we have to show the tax amount in each line separately. So we are requesting you to include tax amount (in each line) option in the customize tab or replace the tax rate with the tax amount.

Hello anzari25,

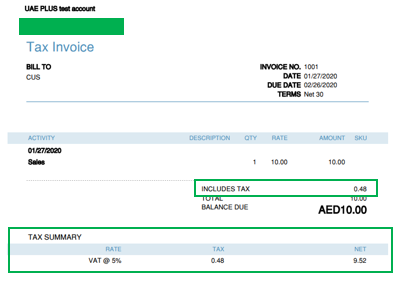

Adding a tax column to see the taxes accumulated per line item is a good idea. I'll let our Product Development Team know about this. They'll put it into consideration for product updates. You can also visit the QuickBooks Blog to see what's new to the program. For now, adding the Tax Summary is our way to see the amounts per sales tax item.

We appreciate you for sharing your feedback and ideas. This would help us improve the program to suit your business needs.

We are facing the same problem....! please help us to get a solution.

Thanks for informing us, @Salmandxb01.

As mention above, the option to add a tax column to view the taxes accumulated per line is unavailable in QuickBooks. Our product developers are already informed about this. We'll make sure to update this thread once they share their insights about this function.

We know the importance of this feature in running your business. Also, your suggestions and ideas are our basis in adding new features in QuickBooks.

Any idea when this will be updated in QBO? As yet another UAE business I am having problems getting paid because the invoices dont allow for VAT (rate AND amount)displayed by line item.

hey any news on this? whne will the option to add a tax column showing tax amount per line item be added to the functionality? Serious problem - I am not getting paid because of this - please help. the covid crisis makes this even more critical

Hello, @sid77. I appreciate your input from every angle.

I definitely see how you would want to have this feature. Right now, it's still unavailable. Rest assured that I'll pass along your suggestion to our Product Developers. They're always looking for ideas to consider on how to improve QuickBooks Online (QBO).

In the meantime, I encourage you to star our blog to keep up with any product updates or improvements on the online version: https://quickbooks.intuit.com/blog/whats-new/.

If there's anything else I can do for you, let me know by commenting below. I'm happy to help. Have a great day!

I too am having the same problem. My customers will not pay until each 'activity' has the tax amount and not just the total tax amount.

Please can this feature be added ASAP?

Thanks,

Murrindie

Would you please at least let us know an ETA for this feature to be added? Is it considered on your roadmap? If its not then we really need to know to move to another accounting system that complies with UAE VAT law.

Your invoice is reflecting the TRN number in TAX Invoice ??

@ReymondO wrote:Thanks for informing us, @Salmandxb01.

As mention above, the option to add a tax column to view the taxes accumulated per line is unavailable in QuickBooks. Our product developers are already informed about this. We'll make sure to update this thread once they share their insights about this function.

We know the importance of this feature in running your business. Also, your suggestions and ideas are our basis in adding new features in QuickBooks.

This is really disappointing , This small adjustment it takes long time to fix .

I used QB from 12 years back , The QB year after year shown un-flexibility and one day will go out from the competition race .

I too am having this issue. Quickbooks, when will this feature be available? This thread was opened a very long time ago. If it took this long for my business to pivot, i wouldn't have a business anymore!

Hello. @Jason888.

I understand that this feature would be handy to you and your business. Currently, the ability to include a VAT calculation per line item in the invoice is not available. Also, there's no definite turn around time on when this will be added.

In the meantime, you can follow the suggestions shared by my colleague @JasroV. Also, you can import your own invoice template. Just make sure to map the customized invoice field accurately with QuickBooks. You can refer to this article formore detailed instructions: Import custom form styles for invoices or estimates.

Lastly, you can visit our QuickBooks Blog to keep updated on the latest product updates and feature releases.

We appreciate you for sharing your feedback and ideas. This would help us improve the program to suit your business needs.

Dear Admin,

Any news regarding the updating of QBO invoice showing VAT amount per row item? We need to customize our invoice and include the vat amount because our client are not accepting our invoice.

T

@JamesDuanT wrote:Hello anzari25,

Adding a tax column to see the taxes accumulated per line item is a good idea. I'll let our Product Development Team know about this. They'll put it into consideration for product updates. You can also visit the QuickBooks Blog to see what's new to the program. For now, adding the Tax Summary is our way to see the amounts per sales tax item.

We appreciate you for sharing your feedback and ideas. This would help us improve the program to suit your business needs.

This feature is not available till now. It is more than 6 months! I recently followed up again with the development team and still no success. QB online had advertised that it is UAE VAT compliant which is the reason why many small businesses went for it

The regulation states that EACH LINE should show amount before vat, vat amount and then amount after VAT. Tax summary comes only at the end and is a combined total.

I have sent several requests and feedback but still no success. How can you claim to be compliant but not develop this feature for 6 months! Please tell the development team that this is really critical.

hey any news on this? when will the option to add a tax column showing tax amount per line item be added to the functionality?

Hey there, sid77.

I know how important it is to have a column showing the tax amount per line item in the invoice. However, we haven't added this feature yet.

While QuickBooks aims to find new ways to make sure that your product meets your needs, I'll be sure to take note of this idea for future enhancements.

For the time being, you can visit our blog. This way, you’ll be updated about what new changes and features, and hopefully this feature would be one of them.

To get more ideas on how to customise and utilise your sale form templates in QuickBooks Online, you can go through this article: Customise invoices, estimates, and sales receipts in QuickBooks Online. This will give you steps on how to add fields as well as changing the colour scheme.

If I can be of assistance while working in QuickBooks Online, please let me know. I'll be more than willing to lend you a hand.

Hi,

Is there any luck on this? This conversation has been happening fromt the beginning of this year. I cannot imagine that the development team is taking a year to build something like this.

In one of your messages you mentioned about customised templates. I tried that option, but in that, I am unable to get tax amount on each line, only tax rate is appearing.

As mentioned by someone, FTA has already started issuing fines to clients who do not have the right format. Many of my clients have already started exploring other online platforms as quickbooks is not responding to this simple query with a solution. Can you please expedite? Atleast give us some indication on when this is expected to be ready?

Thanks

meena

Hi there, Miyer.

I can see how adding the tax amount per line item in the invoice would be helpful for you and your business.

Since you already sent several requests and feedback to our developer, rest assured, they'll take note of the feedback. They're constantly looking for great ideas from users, like yourself when deciding how to enhance QuickBooks. For now, we aren't able to give a specific time frame on when this tax amount on each line will available in QuickBooks Online.

I suggest visiting our QuickBooks Blog to know about the latest news and updates from QuickBooks Online.

Please refer to this article to see information about temporarily reducing the VAT rate from 23% to 21%: Temporary VAT rate reduction due to Covid-19.

Leave me a comment below if you have additional questions or any other concerns. I’m here to assist further and make sure you’re taken care of.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here