Benefits of mobile invoicing

Mobile invoicing can simplify a number of workflows in your business, help you get paid faster, and establish more predictability with your finances.

You’ll also save time and require less people-power to stay on top of your accounting.

1. Central location for client information

Never lose a client’s address or other pertinent details again. By using a mobile interface, you can input client data directly into the invoicing software using a mobile phone or tablet. Some programs will store your information locally on your mobile device, while others will store it in the cloud. But wherever your data is stored, mobile invoicing software enables you to keep all of your pertinent client details with you at all times.

2. Instant billing

While you can automate the sending of invoices using most accounting software programs, one of the best things about mobile invoicing is that you can create an invoice the moment the job is done and send it out for payment, saving you time and the headaches of snail mail or other alternatives.

3. Integration with your accounting software

Most accounting software programs that help manage your business’ financial records can integrate with mobile invoicing. For example, QuickBooks allows you to automatically enter invoices and estimates from its mobile app, eliminating the risk of double entries. This makes for smoother and more accurate expense management.

4. Capture signatures and generate receipts

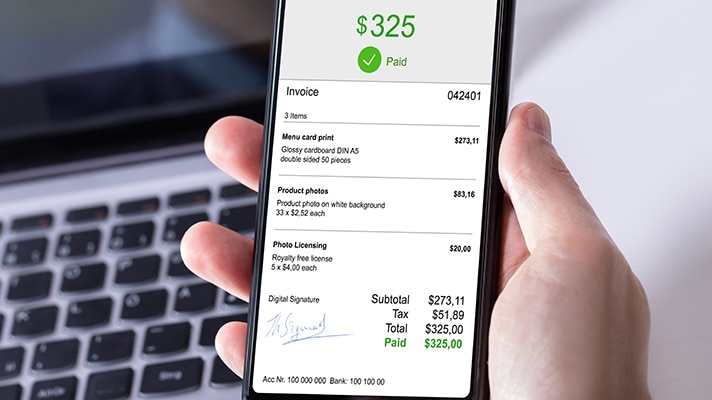

Most mobile invoicing software also enable you to capture signatures by having yourself or clients sign with a finger or stylus on the mobile device. This can be useful for receiving approval on an estimate or for adding your signature to a bill before sending it to the client for payment. Additionally, receipts can be easily generated, making it easier for you to keep up with your accounting paperwork.

5. Centralized, automated invoice tracking

If you choose software that supports cloud storage, then all of your invoices and estimates will be stored remotely, making it easy for you to keep records. Storing records in the cloud also frees up local memory on your own mobile device while ensuring that your information can be accessed from any of your authorized devices.

Other integrated options include adding pictures or notes to different client records, both of which can be especially helpful for tracking progress on a project or keeping track of client meetings. Additionally, programs like QuickBooks can sort your invoices into separate categories (e.g. open, paid, overdue), giving you a quick snapshot of the state of your billing. So at the end of a billing cycle, you can easily note whom you need to reach out to in order to request payment.