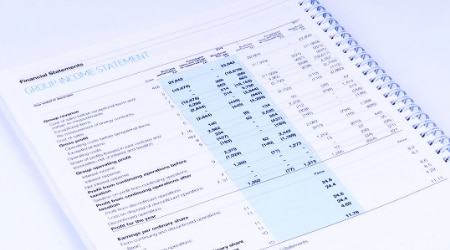

What is a Liability Account?

Liability Account (Definition)

A liability account is used to keep track of all legally-binding debts that must be paid to someone else. They are part of a company's general ledger and balance sheet. A liability account records amounts owed to suppliers for goods and services that were given to you on credit. It also includes the amount owed to banks and other lenders; and amounts owed for wages, interest, taxes. A liability account also includes amounts that customers have paid, including deposits and any taxes a business owes. Some of the most common liabilities accounts include:

- Loans payable

- Accounts payable

- Accrued expenses

- Customer deposits

- Deferred taxes